Download the 2.16.24 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

What Recession?

Happy Valentine’s Day! As a special treat, the S&P 500 has crossed over 5,000 for the first time ever. While this is just a number, it signifies the strength we have exhibited in the stock market over the past few months (up close to 20% since the start of last November). The S&P 500 has now been up 14 of the past 15 weeks. One of the primary reasons for this rally is the evolving economic situation, which includes improvement in both growth figures as well as inflation.

Here’s recent data from the U.S. Bureau of Labor Statistics that supports market strength:

- Employment Growth. The U.S. economy added 353,000 jobs in January 2024, as measured by Non-Farm Payrolls, well above the market forecast of 180,000. This is the largest increase in employment that we’ve seen in a year, reinforcing the stability of the labor market. Additionally, the unemployment rate held steady at 3.7%, lower than expectations.

- Inflation Growth. The U.S. inflation rate dropped to 3.1% in January, as measured by the Consumer Price Index (CPI), below last month’s reading of 3.4%. Core CPI, which doesn’t include the more volatile food and energy prices, held steady at 3.9%, which is a two and a half year low.

The resilience of the economy in the face of higher interest rates, as well as moderating inflation, is making investors re-think the concept of a definitive recession, at least a strong one. While a recession may still happen, the data points to an environment of continued growth for the economy and financial markets.

Why Can’t We Be Friends?

With all the love in the air, let’s talk about politics!

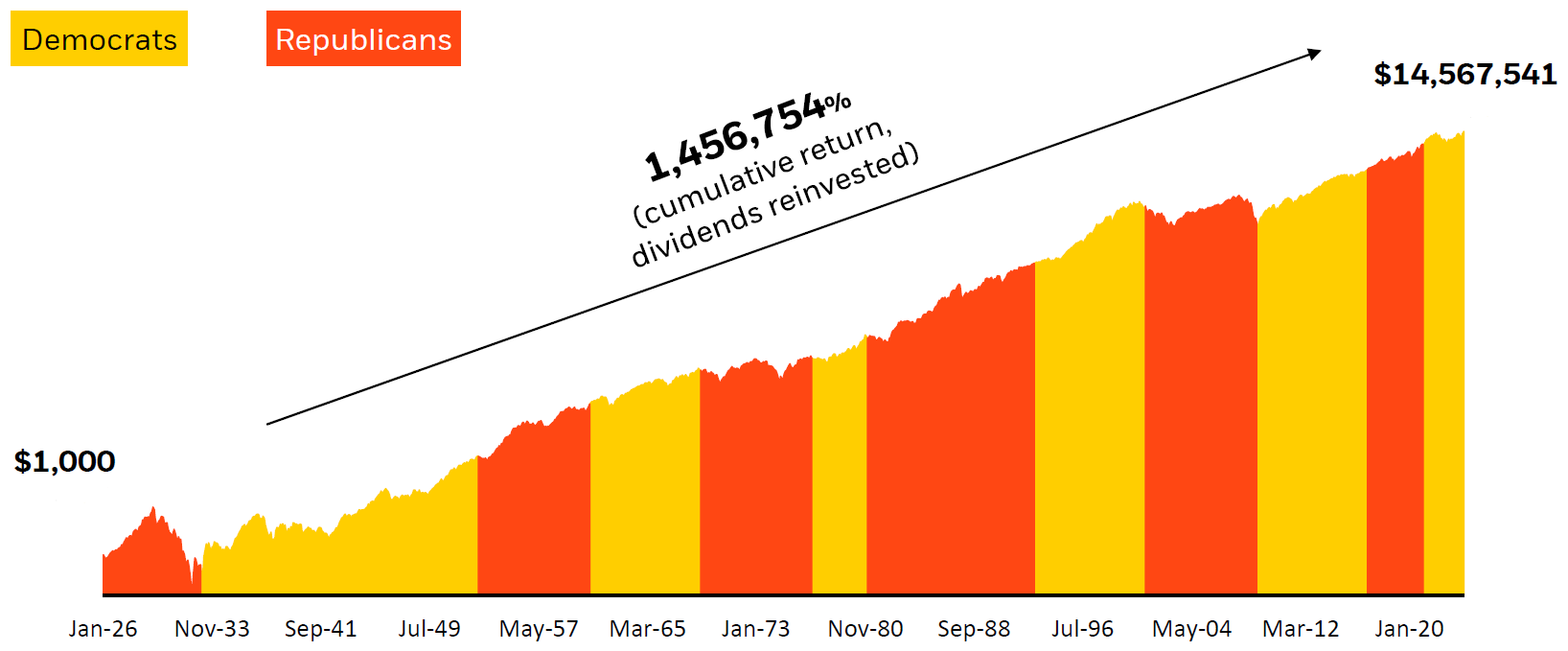

Given it’s an election year, there’s a lot of focus on which party may be better for the economy or the markets. So, the question emerges: Does it matter which party holds the presidency as it relates to market growth? The chart below, “Long-Term U.S. Stock Returns and Elections,” helps with the answer:

- Democrats Win – Market Goes Up: Election results can have an impact on government policy, laws and foreign relations, but they have less impact on the direction and strength of the market. As investors, it may be more important to focus on the things we can control such as staying invested for the long-term.

- Republicans Win – Market Goes Up: As a reminder, while presidential elections often control the news headlines, they don’t control the financial markets. Market returns are often more dependent on the economy and inflation, which are little impacted by elections.

- Long-Term Investors Win: It turns out the time invested in the market is really the most important factor to growth, not which political party holds the presidency. If you weren’t invested over the yellow-shaded time periods or the orange ones, you would’ve missed out on significant gains.

Stay diversified, my friends.

Long-Term U.S. Stock Returns and Elections

Growth of $1,000 Since 1926, Cumulative Returns from Jan. 1, 1926 to Dec. 31, 2023

Source: BlackRock. Morningstar as of 12/31/2023. Stock market represented by the S&P 500 Index from 1/1/1970 to 9/30/2023 and IA SBBI U.S. large cap stocks index from 1/1/1926 to 1/1/1970. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock