High-performing advisory firms don’t just ride market tailwinds. They build systems that compound growth: better client experiences, clearer messaging, sharper focus and stronger partnerships. On a recent Dynamic Resource Call webinar, Stephen de Man, regional director and vice president at Dimensional Fund Advisors and valued Dynamic partner, shared research-backed takeaways with actionable items you can put to work now.

The Big Theme: Practice Management that Scales Your Growth

De Man frames the journey with three timeless disciplines (think “Lewis & Clark expedition” for modern firms):

- Adaptability. Your terrain is changing (technology, client expectations, etc.). Keep evolving your processes and client experience.

- Gather Unconventional Intelligence. Don’t rely on gut alone. Use client feedback, behavioral cues, internal metrics and partner resources to guide decisions.

- Partnerships. Step off the island. Strategic partners, such as centers of influence (COIs) and platform partners, multiply your reach and remove bottlenecks.

What the Data Says about Growth (and What Really Drives It)

- Headlines vs. organic growth: Median firm growth over the last five years had a compound annual growth rate (CAGR) of about 14%; that shifts to approximately 6% when you strip out market effects. Know your true organic growth so you can manage what’s in your control.

- Where top firms struggle: High performers cite capacity constraints as the No. 1 challenge (other firms cite prospecting). Translation: Your time is your scarcest asset. Optimize your schedule for client-facing work and growth activities.

- How clients define value: The top response year after year: “Sense of security/ peace of mind.” Returns and balances matter, but clients ultimately stay for confidence and clarity.

Define Your ‘Who’ (Then Speak Their Language)

Most firms say they have a target client profile, but it’s often limited to demographics only. De Man urges a 2.0 version:

- Behavioral needs: What do they need? When and how do they need it?

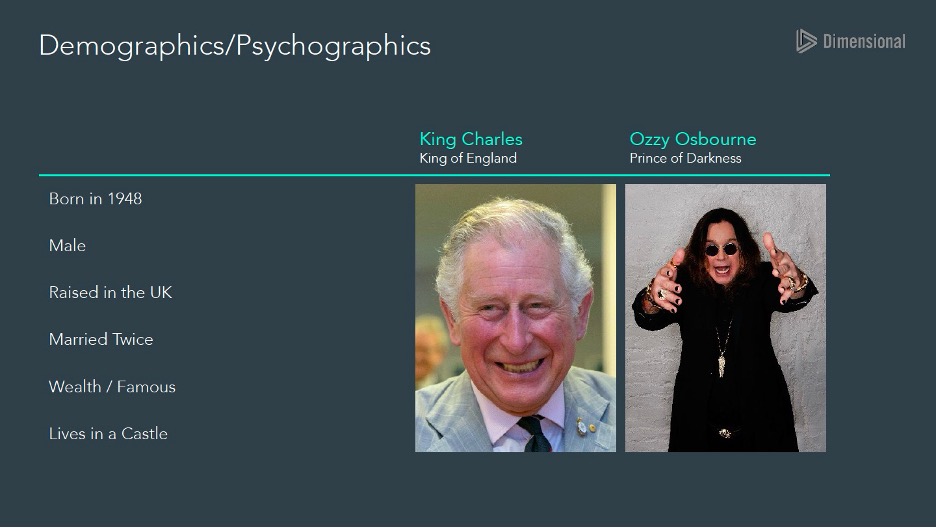

- Psychographics: Values, interests, attitudes, lifestyle. His memorable example: The same demographics can yield both King Charles, the King of England, and Ozzy Osbourne, the Prince of Darkness — each requiring very different messages and experiences!

- Show it, don’t just say it: Personal examples with a “people like you” approach help prospects see themselves in your process and outcomes.

Quick win: At the start of meetings, when clients ask, “How’s it going?” answer with a brief story that spotlights a recent win with a client like them. It builds relevance and naturally seeds referrals.

Referrals: The Flywheel of Compounding Growth

Across three years of data, the primary growth channel remains:

- Referrals from Existing Clients.

Referrals from existing clients remain the most reliable driver of growth, flowing naturally from an exceptional client experience. When clients feel truly supported, they’re more likely to connect friends or family who could benefit from the same care.

See “Grow Your Practice: Unlock the Power of Referrals”

- Referrals from COIs.

COI referrals tend to convert at higher rates and with larger client sizes, making them an efficient growth channel. But these relationships must be balanced. If a COI partnership starts to feel one-sided, it’s worth re-engaging or reassessing to keep it mutually valuable.

- Advisor-led Outreach.

Advisor-led outreach also plays a role. By identifying target prospects and approaching them with clarity, firms can intentionally shape their book of business. While not as high-volume as client referrals, this proactive strategy often brings in clients who closely match the firm’s ideal profile.

Promoters, Passives, Detractors: Where to Spend Time

When using a net promoter-style lens, de Man suggests:

- Promoters: Identify your top three to 10 champions today and double down on them.

- Passives: Neutral; move them up when time allows.

- Detractors: Don’t spin cycles trying to convert; seek greener pastures.

He explained, what drives promoters most is “experience with clients like me.” For detractors, the driver skews to investment returns — a reminder to anchor your messaging and service model in relevance and relationship, not just performance.

Articulating Value: The Four Cs

Most firms lead with competence (planning, portfolio, tech), but Dimensional’s research shows advisors win and retain more when they balance all four Cs:

Competence

De Man noted that most advisors default to leading with competence. While their financial planning or portfolio construction skills are essential, they’re also what nearly every advisor highlights, which can make it hard to stand out if you stop there.

Coaching

The real differentiator often lies in coaching: helping clients manage emotions, bias and stress while educating them along the way. This is the “squishier stuff,” as de Man put it, but it’s where advisors create deeper, more lasting relationships.

Convenience

Convenience is another critical driver of client value, especially for busy people who don’t want to tinker with portfolios or make complex decisions on their own. By saving clients time and providing high-touch, secure access to resources, advisors show they respect clients’ bandwidth as much as their balance sheets.

Continuity

Finally, de Man described continuity as “transcendent,” extending beyond the individual client to encompass family, legacy and philanthropy. Advisors who engage in these conversations aren’t just managing wealth; they’re aligning multigenerational goals and helping clients define the impact they’ll leave behind.

Defining Your Roadmap

Ultimately, building a high-performing advisory practice isn’t about mastering a single tactic. It’s about weaving together adaptability, client focus, strong partnerships and a clear articulation of value — the four Cs.

As de Man reminded us, when firms stay grounded in their purpose and connect with clients beyond just competence, they create a culture of growth that compounds over time. With the right strategies and the right partners, advisors can write their own roadmap to sustainable success.

For more resources and insights, watch the Dynamic webinar with Dimensional, “Growth Strategies for High-Performing Firms.”

Want to discuss more ways to scale for success? Contact Dynamic for a complimentary, objective consultation at (888) 997-4212, joinus@dynamicadvisorsolutions.com or schedule your consultation here.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock