Download the 11.21.25 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Asset Management

Congratulations on the end of the U.S. government shutdown! We get to kick the can down the road for a couple months until the end of January 2026. This 43-day shutdown, which ended on November 14, was the longest the U.S. has seen. The end of the shutdown means roughly 1.4 million federal workers are eligible for backpay, restoration of critical federal programs such as the Supplemental Nutrition Assistance Program (SNAP), and airlines should be back to full capacity ahead of the holidays.

The bad news: The Congressional Budget Office (CBO) is estimating a 1.5% reduction in fourth quarter Growth Domestic Product (GDP) growth due to the shutdown. Given economist estimates were in the range of 2.5% to 3.0%, economic growth should remain in the green, but a slowdown nonetheless. A rebound could be expected in the first couple quarters of 2026, however, it may be gradual as consumer spending picks back up.

In other bad news: The shutdown has also created delays in important economic data, such as employment and inflation figures. This information is critical for the Federal Reserve (Fed) to make sound interest rate decisions. As a reminder, their next meeting and decision is scheduled for December 11. Given the lack of data, investors are left in the dark, trying to decipher what the Fed may be thinking. Without data we have uncertainty, which leads to volatility — and ultimately, market weakness.

Case in point, the stock market has been trending downward since its peak on Oct. 28, 2025. That said, the S&P 500 is only down about 4% through Nov. 18, 2025. Notably, the darlings of the technology sector seem to be taking the biggest hit, perhaps showing signs of fatigue after such a strong run. Meanwhile, more value-oriented sectors have fared considerably better, perhaps hinting at yet another rotation on the horizon to accompany recent small-cap and international market outperformance.

Taking a step back and cutting through the noise, I will remind everyone the S&P 500 is still up close to 14% on the year (through Nov. 18, 2025). International markets are up more than 26%. And the bond market is up close to 7%. This spells good news overall for investors in diversified portfolios who are not concentrated in a handful of “magnificent” stocks but instead allocated to a variety of asset classes, staying disciplined and invested for the long-term.

Rates and Recessions

The Fed has recently gifted investors an interest rate cut with expectations for more to come. Interest rate cuts are a way to stimulate the economy by enticing consumers and companies to spend/borrow more.

At the same time, economic growth has been resilient. While we have seen some cracks in the employment payroll numbers, unemployment has been at historically low levels. Furthermore, inflation appears to be stable, albeit somewhat elevated.

This translates to a potential scenario of rate cuts without a recession. How have stock and bond markets performed in such a Goldilocks scenario, you may be wondering?

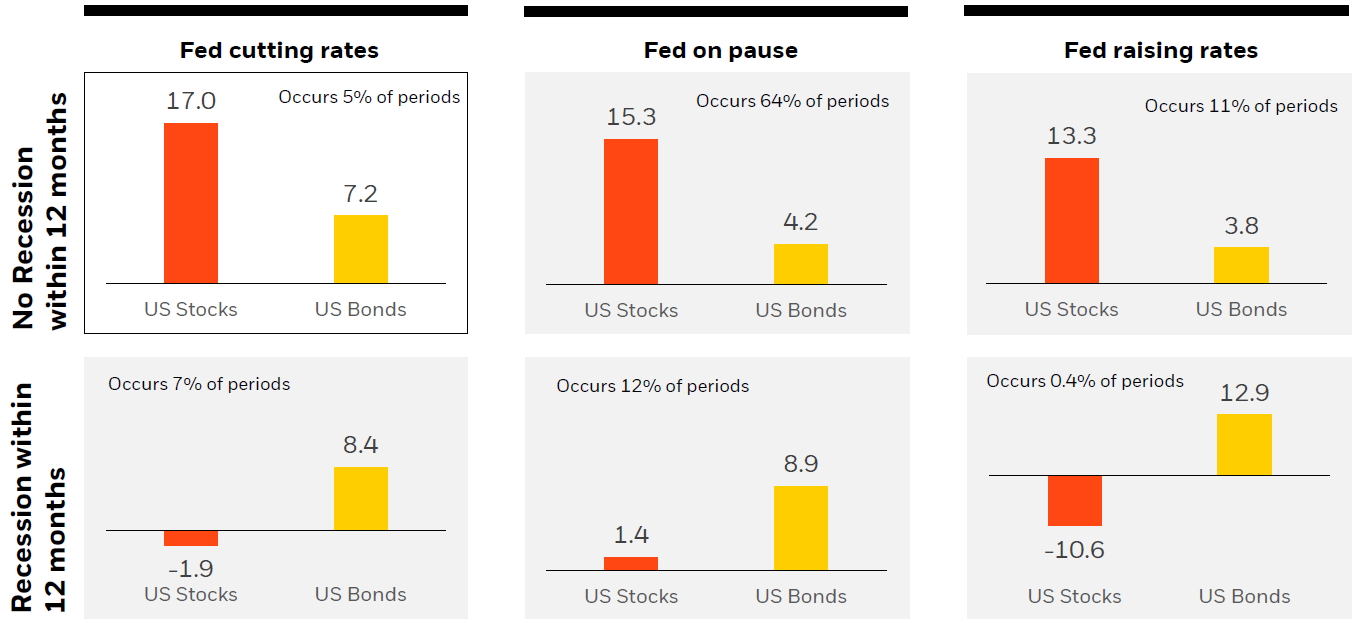

The graph below breaks down time periods over the past 35 years into scenarios of Fed rate cycles and adds whether a recession happens within a year of each rate decision. Here’s a look at the data to learn more about our current potential scenario:

- Best for Stocks. The top left box highlights the scenario described above: a Fed cutting rate cycle with potentially no recession on the horizon. This is a rare occurrence, happening only 5% of the time, but if the Fed is able to thread this needle, stock investors are in for a treat. Historically it has resulted in an average 17% growth in the stock market over the following year, the highest of any other quadrant. Note, in every scenario without a recession, there is a double-digit stock market return, regardless of rate decisions.

- Best for Bonds. This top left box is relatively strong for bonds; after all, falling rates typically translate to a rise in bond prices. But bonds care a lot more about recessions. Note, there is generally an inverse relationship between stocks and bonds, meaning the more stocks fall, the better bonds perform. This is why all periods with a recession tend to have strong bond returns.

- Diversification is Best. Regardless of the scenarios, if you had an even split of stocks and bonds, there would be no periods of negative returns on average. Nobody knows the future, we don’t know when the Fed will cut rates and by how much, and we certainly don’t know when or if a recession will hit, or how impactful it will be. However, we can control how diversified our portfolios are and how much risk we take on. Staying diversified, risk-balanced and invested through a wide range of scenarios is the best way to achieve long-term investment goals.

Stay diversified, my friends.

Stock and Bond Market Returns in Various Rate and Recession Backdrops

One-Year Average Forward Returns (Jan.1, 1990 – Sept. 30, 2025)

Source: Blackrock October 2025 “Student of the Market.” Data from Morningstar as of 9/30/25. U.S. stocks are represented by the S&P 500 Index, U.S. bonds represented by the Bloomberg U.S. aggregate bond index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Asset Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock