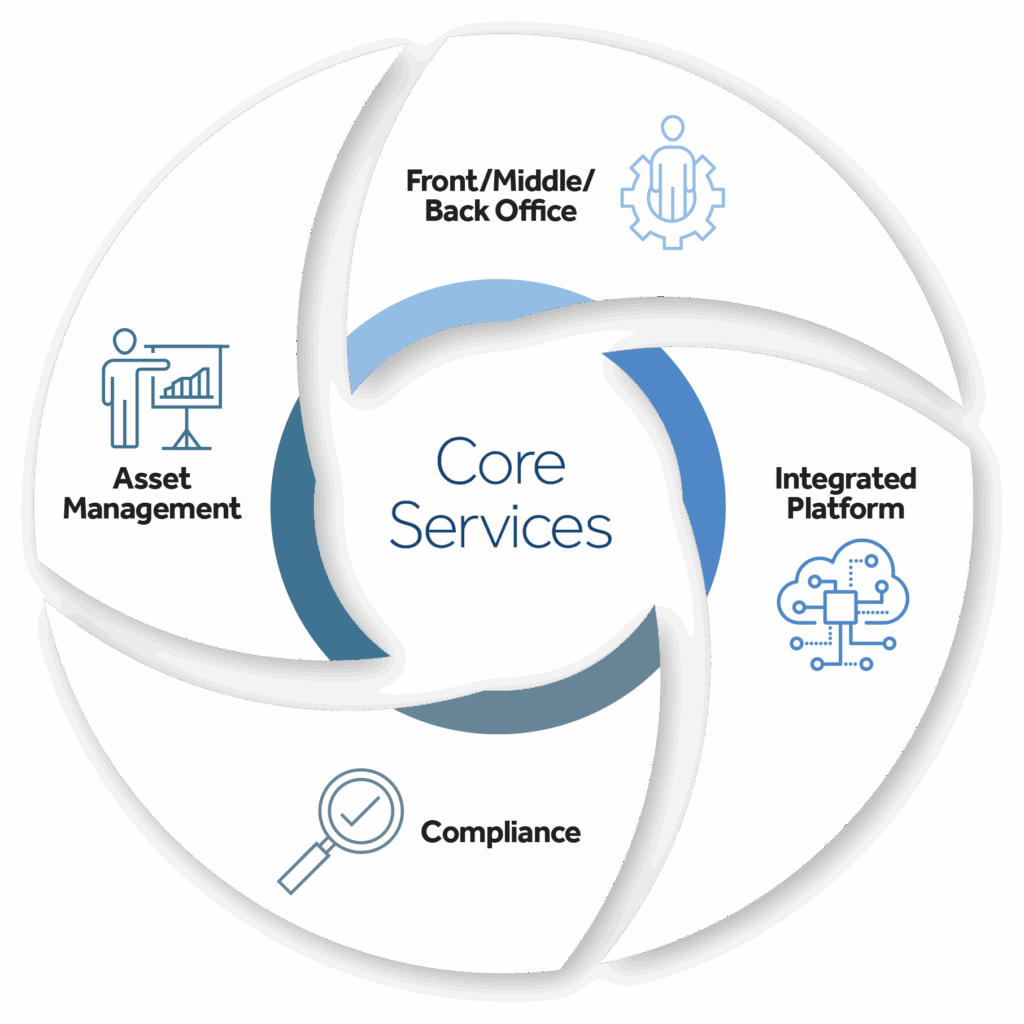

Core Services

Let Us Handle the Heavy Lifting

At Dynamic, we place your clients at the center of everything we do. Our people-first service model ensures you have experienced, knowledgeable professionals handling the heavy lifting across every area of financial services, so you can focus on building deeper client relationships without the strain of additional staffing.

We Help You Go Beyond

Our extensive resources cover front, middle and back-office support and extend beyond operational needs. Benefit from our longstanding industry relationships, offering access to top-tier partners in fintech, M&A, artificial intelligence, marketing, portfolio management and more — everything you need to elevate your practice, including our fully integrated technology platform.

The operational side of your business can pull you away from building client relationships. With Dynamic, you partner with experienced professionals who handle essential tasks and best practices to support your growth:

- Account opening processing

- Electronic document prep

- Advisory fee billing

- Generation and delivery of client performance reports

- Custodian relationship management for best pricing

- Data and account aggregation, and more.

We also manage seamless fintech integration and take care of your firm’s critical IT needs, including cybersecurity and client data security.

Wealth360®, Dynamic’s 100% integrated platform is a “best of” fintech with a single sign-in for you. A closer look at the platform:

- Account aggregation

- CRM/Secure Email/Archiving

- Cyber security application and password manager

- Digital onboarding application

- Documents/Workflow/Client Portal

- Financial planning and portfolio management

- Unified managed household and more.

Managing regulatory compliance can be time-consuming and stressful. Let Dynamic’s experienced Compliance team handle it for you, ensuring your firm stays compliant now and in the future. We assist with:

- Maintenance of client contracts

- Form ADV updates

- Cybersecurity preparedness

- Compliance testing and system checks

- Books and records requirements

- Ongoing education and training

- Trade blotter and administration.

With Dynamic Asset Management, outsource investment management while retaining control of your clients’ portfolios. Our disciplined, rules-based approach focuses on asset allocation and risk-adjusted returns to enhance client outcomes.

Our services include:

- Rebalancing and trading

- Handling investment due diligence and regulatory documentation

- Ongoing monitoring for deposits, withdrawals, and fee billing

- Managing position exclusions for legacy or tax considerations

- Researching and implementing customized investment solutions

- Providing ERISA tools and administration for retirement plans.

Streamlined & Efficient Core Services

Our integrated platform brings you best-in-class fintech solutions to modernize your business. Seamlessly manage CRM, client portals, mobile apps, accounting, cybersecurity and more, creating a streamlined and efficient model for a 21st-century wealth advisory practice.

Premium, Personalized Service with Dynamic Concierge

Concierge is designed to elevate the client experience and streamline your advisory practice. This service helps wealth advisors enhance productivity, engage clients virtually and offload administrative tasks.

Whether it’s scheduling review meetings, preparing reports or managing client outreach, Concierge provides the support you need to focus on what matters most — growing your practice and nurturing client relationships.

White Glove Service

Let us handle your client onboarding and ongoing account services with a dedicated Concierge team member. Our team provides full-service support for everything from service requests to client follow-up to Salesforce reporting.

Dedicated Dynamic Professionals

With deep knowledge of Dynamic’s systems and processes, we’re equipped to manage and escalate operational challenges, ensuring smooth service for both advisors and clients.

Enhanced Communication

We ensure transparent and efficient communication through weekly calls, a personalized Slack channel, a dedicated Concierge email address and an Open Item Tracking Tool.

Held-Away Assets Service Options

Dynamic offers flexible solutions for managing held-away assets, providing wealth advisors with the tools and support needed to integrate these assets into their clients’ comprehensive financial plans.

Services | Snapshot | Basic | Indirect | Direct | Premium |

|---|---|---|---|---|---|

Trading (Comprehensive Management) | |||||

Ability to View Plan Investment Options, Performance, & Expenses | |||||

Allows for Advice on Asset Allocation & Security Selection | |||||

Ability to Bill Held-Away Accounts via Custodian Account | |||||

Data & Connectivity (Include Two-Factor Authentication) | Poor | Poor | Good | Good | Excellent |

Position & Value Reporting via Wealth360® | Via Orion Planning | ||||

Performance Reporting via Wealth360® | |||||

Consolidated Reporting via Wealth360® | |||||

Client Access via Portal | |||||

Typical Advisory Fee | None | 0 – .5% | 0 – .5% | 0 – .5% | .8% – 1.5% |

Cost* | $2/month/client | $6.50/month/account | $0 | $0 | .3% or .45%** |

Common Use Case Scenarios | Enables 360o view of client’s net worth and all holdings (not billable) | When data feeds are not available, client login is used to scrape data for reporting and billing | Accurate performance reporting of billable assets | Accurate performance reporting of billable assets | Full management, trading and performance reporting of billable account (typically at full advisory fee) |

Examples | Checking, savings, loans | Participant level 401(k) account, VAs, billable without trading | Mutual funds, 529s, VAs without trading | Limited trading with custodians, trust companies, some mutual funds and VAs | Participant level retirement accounts such as 401(k), 403(b) and HSA, as well as VAs and 529s with billing and trading |

Tech Provider | Orion Planning | ByAllAccounts | DST | Direct Feed | Pontera (Formerly FeeX) |

*Plus normal Dynamic service fees

**Dynamic Managed

Together, We’re Ready

for What’s Next

Dynamic was designed for advisors at pivotal career moments. Allow us to bring together the people, resources and technology to customize a solution for you.