By Kostya Etus, CFA®, Head of Strategy, Portfolio Services Team at Dynamic Advisor Solutions

The strong performance for the stock market continues. However, volatility is elevated and there are some investor concerns for the future. Here, we review taxes, inflation and crypto.

Key Takeaways

- Proposed tax hikes could potentially weaken earnings growth and personal spending. However, history shows the stock market is resilient to tax increases and there are investment strategies which can be utilized to help support a rising capital gains rate.

- Inflation is another factor impacting markets, but the Fed believes it to be transitory and is maintaining accommodative policies. To combat the wealth erosion that can come from high inflation, there are strategies and portfolio tilts which can help defend against inflation.

- Cryptocurrencies and other market excesses over the past year have given concern to an overheated market. Looking at investor sentiment suggests that there is potentially room to grow, albeit with more volatility. The best course of action in volatile environments is to stay invested and diversified.

Tax hikes may be on the horizon – What does this mean for the stock market?

While nothing is set in stone, the proposed tax plan includes a hat-trick of hikes for personal, corporate and capital gains taxes. This has led to some concern among investors as intuitively, paying higher taxes would mean less money for people to save and spend, less earnings for companies to make and lower after-tax returns for investment accounts.

In fact, according to estimates from the Tax Foundation, the proposed hikes could reduce economic growth (long-run GDP) by close to -1%, as well as a meaningful reduction in jobs.

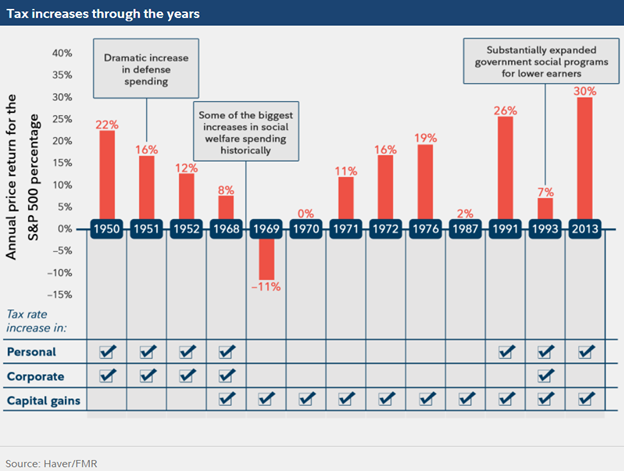

But, what has history taught us about the connection between tax hikes and market returns? As you can see in the graph below, the last 13 years of tax increases post 1950 have resulted in positive, and generally above-average market returns. One way to explain this: Often times the revenue from tax hikes is used on fiscal stimulus (such as the proposed infrastructure spending), which can strengthen the economy.

While there doesn’t seem to be a strong relationship between tax hikes and market returns, an increase in the capital gains rate will certainly be felt in taxable investment accounts. But there are ways to help address some of those issues. Here at Dynamic we pride ourselves on building tax efficient portfolios and offering custom solutions – from direct indexing to active tax-loss harvesting – to help all our clients reach their long-term goals.

Inflation is the highest in decades – What are the implications for investors?

Inflation isn’t always a bad thing. Moderate levels help boost consumer demand and consumption, which drives economic growth. But when inflation gets too low (slow economy) or too high (economy overheated) it may create issues. That’s why the Federal Reserve targets maintaining inflation near 2% to help meet its goals: maximum employment and price stability.

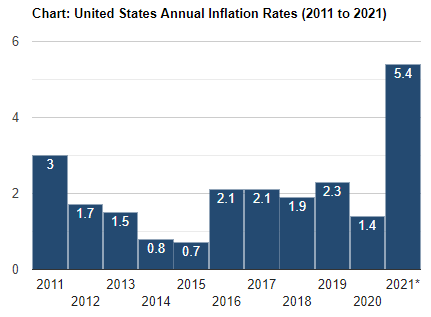

For the past decade, inflation has averaged under 2% per year. Recently, as seen in the graph below, inflation readings have spiked (near doubled). This is primarily due to the reopening of the economy post COVID. Pent-up demand in areas like airlines and hotels has sent prices higher. Another factor distorting the number is that it’s typically a year-over-year change. Consider where we were last year, essentially a full lockdown without travel.

The reason this is so impactful for the markets? The main defense from the Fed to combat high inflation is to raise interest rates (or taper bond purchases). This could effectively signal an end to the accommodative monetary policies the market has grown to love (cheap money).

But despite the high readings, the Fed believes that current inflation is “transitory” and not permanent. Meaning that as the pent-up demand dissipates and the economy gets into a “normal” cycle, inflation will get back to a more moderate range. This is why the Fed is holding steady on their policies, which should continue to bode well for the markets.

That said, higher prices and inflation do erode wealth, as well as investment returns, but there are some ways to curb those effects. Certain asset classes tend to do better in periods of higher inflation and a strengthening economy:

- Value Stocks: Value companies, such as those in the financials and energy sectors, tend to perform better during periods of higher inflation and economic recoveries.

- Small Cap Stocks: Smaller companies tend to do better during periods of strong economic growth as they are more closely tied to the resurgence of consumer spending.

- Real Assets: Asset classes such as real estate can provide an inflation hedge as they are closely tied to rising prices for materials as well as benefitting from commercial re-openings.

These asset classes and portfolio tilts can be found in many Dynamic portfolios, particularly the DFA models, which have generally benefitted from the outperformance of value and small cap stocks in the first half of 2021.

Crypto asset prices have spiked, and other excesses are present – Are we at a market peak?

Bitcoin, the most well-known cryptocurrency, has had quite a wild ride over the last year. In October 2020, it was trading around $10,000; by February 2021, it shot up to $40,000; by mid-April, it was close to $60,000; in July it settled down to $30,000; and now in September, it’s trading close to $50,000 (although the current price may be drastically different based on the day you’re reading this).

That type of volatility and surge in prices has given some caution to investors. There is certainly some FOMO (fear-of-missing-out) from investors, but generally it’s the idea of fear-of-excesses.

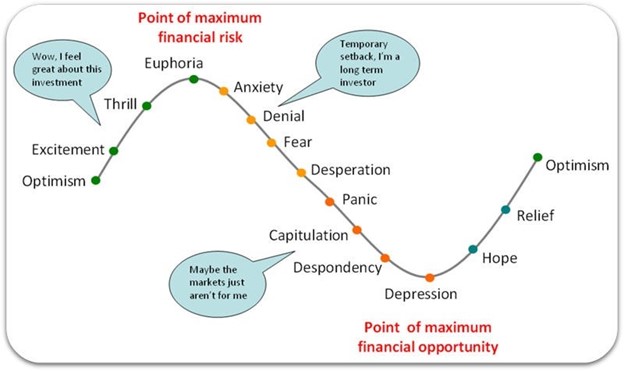

Excesses tend to happen when markets may be reaching a peak because investors are flocking to similar investments in a state of euphoria (see graphic below). Think about the technology bubble in the early 2000s or the housing market in 2008. And cryptocurrencies aren’t the only place we are seeing it.

We had the “stay-at-home” stocks rocketing last year. We have the “Reddit meme stocks” trading out of control this year. And the housing market, along with lumber prices, have been at extremes. Could this be the culmination of a potential market peak?

This may not necessarily be the case. A good exercise to gauge the status of market health is to evaluate investor sentiment. A great resource is the American Association of Individual Investors (AAII) survey which asks investors a simple question: Where do you feel the stock market will be in the next six months? Excessive bullish readings would suggest a potential topping of the market.

As you can see from the Sentiment chart below, the bullish reading is close to the historic average at the start of September—it’s not an extreme. (For reference, the bullish reading in the first week of 2000 was 75%.) The large percentage of neutral and bearish voters suggests that a “wall of worry” may still be in place.

While excesses in the market could increase volatility and potentially cause short-term market weakness, sentiment surveys highlight that the market could continue to see more gains moving forward.

That said, given expectations for above average volatility and potentially below average returns, it’s important to continue to stay invested in globally diversified and balanced allocations among various asset classes—something that Dynamic strongly believes in within our portfolios.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.