We put risk management first in strategically designing global, well diversified, balanced portfolios that are focused on the long-term.

All strategies range from 100% to 30% equity in 10% increments.

Investment Objective

The primary objective of Dynamic Core is to maximize long-term risk-adjusted returns while allocating to a broadly diversified variety of asset classes utilizing ETFs.

Investment Approach

Utilize non-proprietary ETFs to invest in low-cost, passive, market-cap weighted equity and fixed income exposures with lighter portfolio tilts and broader asset class exposures.

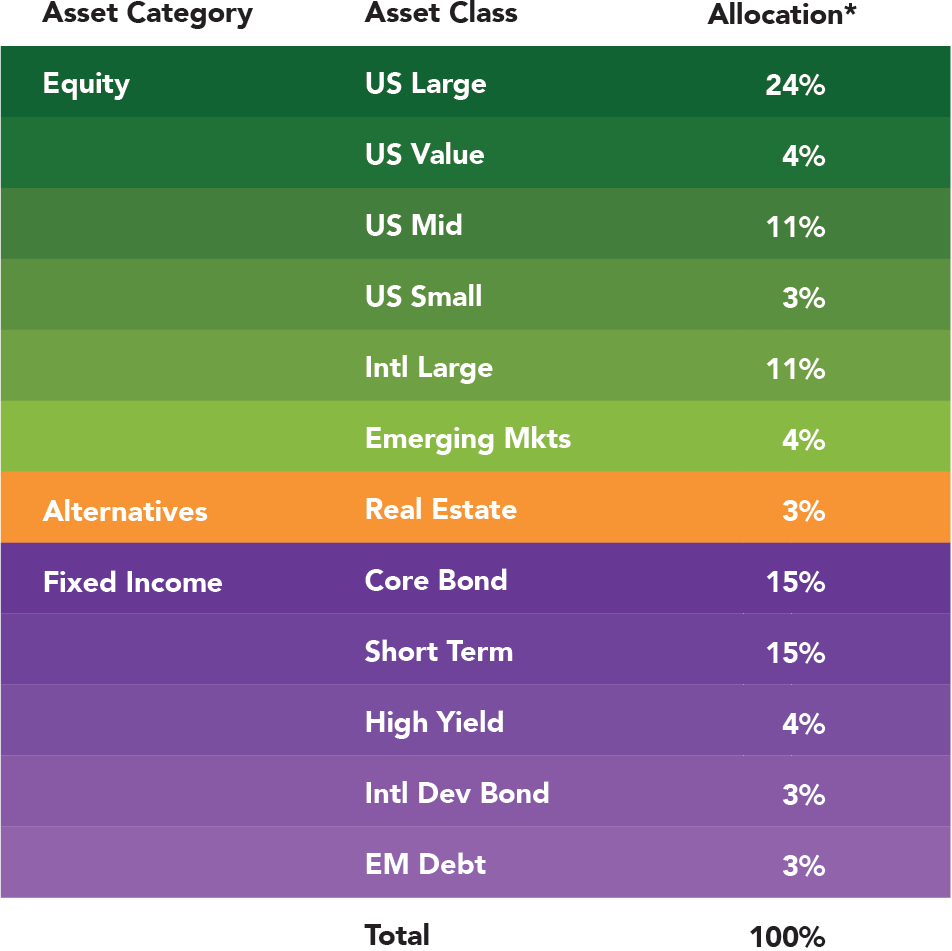

Asset Class Breakdown 60/40

*For illustrative purposes only. Allocations are subject to change.

Why ETFs?

- Lower cost: ETFs typically offer a significant cost savings relative to mutual funds.

- Tax efficiency: ETFs typically distribute fewer capital gains than mutual funds.

- Transparency: ETFs typically report their holdings daily and track an index, providing stability in exposure and risk.

Why Low Cost?

- Less Expense: Lower expense ratios are one of the few indicators that have consistently proven to correlate with stronger long-term investment performance.

- Less Turnover: Low portfolio turnover is often considered a sign of a disciplined investment process. Lower turnover also suggests more investment conviction in addition to lower transaction costs.

- Less Taxes: Utilizing ETFs enhances after-tax returns given that ETFs generally have lower tax costs than mutual funds.

Why Open Architecture (Non-Proprietary Investments)?

- Diversify Risk: An open architecture platform helps diversify portfolio risk through issuer diversification. Management teams at different fund companies may have different styles and mandates that will perform differently in various market environments, allowing for investors to take advantage of their strengths.

- Control Expenses: Having the entire universe of investments to choose from provides the ability to better control expenses and the potential to boost returns for an asset class exposure given a wider variety of options available with competitive expense ratios.

- Eliminate Conflicts: Using non-proprietary products eliminates conflicts of interest and risk of bias that an allocation manager would face if they were put in a position to choose between a proprietary or a third-party fund.

There is no guarantee that the model portfolios or any investment strategies will work under all or any market conditions. They may not be appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of a downturn in the market. Past performance is not a guarantee of future returns.