We put risk management first in strategically designing global, well diversified, balanced portfolios that are focused on the long-term.

About Dynamic HNW Solutions

Dynamic specializes in evaluating complex client situations and finding simple solutions for High-Net-Worth (HNW) clients. We build custom strategies that include a variety of unique products to meet specific client situations.

Investment Objective

The primary objective of Dynamic Custom HNW can vary greatly based on the investor’s desire to focus on total return, income, defensiveness, tax awareness or a combination thereof.

Investment Approach

Allocate to a broadly diversified variety of asset classes utilizing various non-proprietary investment vehicles including, but not limited to, ETFs, individual stocks, individual bonds and alternative investments

Optimizing the Client Experience

- Understand Client Needs

- Design a Custom Portfolio

- Deliver a Professional Proposal

- Implement and Manage

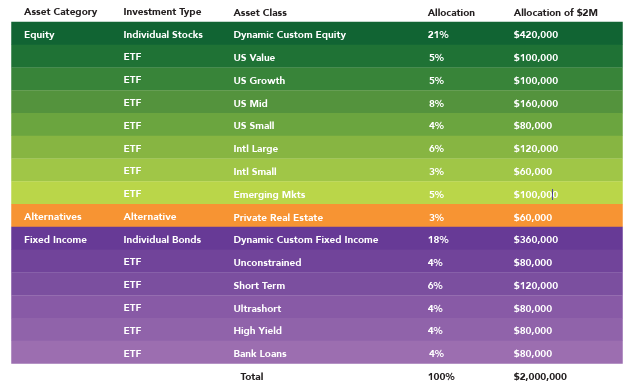

Sample Asset Class Breakdown 60/40

*For illustrative purposes only. Allocations are subject to change.

Dynamic ETF Strategies — Start with a stable core strategy to support overall portfolio diversification.

- Total Return: Core, Smart

- Objective: Income, Defensive, Tax Aware

Individual Stocks — Invest in a portfolio of stocks to enhance tax efficiencies and potentially boost returns.

- Dynamic Direct Indexing

- Dynamic Custom Equity

Individual Bonds — Increase portfolio customization and potential tax benefits through active bond management.

- Dynamic Custom Fixed Income

- Dynamic Municipal Fixed Income

Alternatives — Diversify equity and fixed income holdings with uncorrelated alternative investments.

- Dynamic Liquid Alternatives

- Dynamic Private Investments

Why ETFs?

- Lower Cost: ETFs typically come at a significant cost savings relative to mutual funds (no minimums, front-end loads, redemption fees, etc.)

- Tax Efficiency: ETFs typically distribute fewer capital gains than mutual funds due to their unique enhanced structure.

- Transparency and Consistency: ETFs typically report their holdings daily and track an index giving stability in exposure and risk.

Dynamic Core — Low-cost passive exposures with lighter portfolio tilts.

- 7-12 Holdings

- S25k Minimum

- 5-6 BPS Fund expenses

Dynamic Smart — Multi-factor (Smart Beta) equity exposures combined and actively managed fixed income with higher conviction portfolio tilts.

- 11-18 Holdings

- $150k Minimum

- 32-41 BPS Fund expenses

Dynamic Income — Higher-yielding equities and fixed income to help clients with higher income needs. Generally, these strategies have the objective of yielding approximately double the income of broad-based benchmarks and Dynamic’s other models.

Dynamic Defensive — Buffered and lower risk holdings designed to hold up better in down markets for risk averse clients. Generally, these models have the objective of achieving approximately 15% to 20% lower risk than broad based benchmarks and Dynamic’s other models.

Dynamic Tax Aware — Tax Aware strategies have an intentional focus on reducing the tax burden for tax sensitive clients through Dynamic’s management. This includes allocations to tax-advantaged investments such as municipal bonds.

Why Individual Stocks?

- Alpha Generation: Potential for added gains as compared to diversified ETFs or mutual funds in advantageous market environments.

- Customization: Allow for portfolio modification based on client preference, such as incorporating existing stocks into the allocation to avoid sector overexposure or exclude specific sectors altogether.

- Tax Awareness: Provide opportunities to harvest losses throughout the year.

Why Concentrated Stocks?

- Customization: Portfolios can be built around a client’s existing positions and unique tastes and preferences.

- Control the Timing of Taxes: Capital gains can be realized or deferred depending on each client’s tax situation.

- Ownership Transparency: By concentrating investments in a small number of businesses, investors can better understand what they own.

Dynamic Custom Equity | Summary

Actively managed, concentrated stock portfolios of about 30 stocks focused on either U.S. Large-Cap Core exposure or Dividend Income. Stocks are selected using both quantitative and qualitative analysis based on a “Quality Value” philosophy with the belief that competitive long-term returns can be achieved by investing in high quality companies trading at attractive valuations.

Strategy Highlights

Core Equity:

- Quality Focused: High Returns on Capital

- Value Driven: High Earnings and FCF Yield

- Growth Minded: Attractive Earnings Growth Elevate your investment strategy.

Dividend Equity:

- Quality Focused: High Returns on Capital

- Income Driven: High Dividend Yield

- Growth Minded: Emphasis on Dividend Growth

Why Direct Indexing?

- Tax Optimization: Utilize the power of daily tax-loss harvesting (TLH) to potentially improve clients’ after-tax returns over time.

- Strategic Preferences: Proprietary algorithms and risk modeling allow you to tailor clients’ investments according to their unique preferences, values, and outlook.

- Scalability: This technology-driven solution offers clients personalized, professionally managed portfolios at scale.

Dynamic Custom Direct Indexing | Summary

Direct indexing allows you to track a stock index, such as the S&P 500, by investing in an optimized portfolio of stocks. The primary benefit is the ability to review for tax loss harvesting opportunities daily and achieve tax alpha (potentially higher after-tax returns) relative to mutual funds as well as ETF investments.

Strategy Highlights

- Wide Range of Investments: Various indices available for tracking from Large Cap U.S. Stocks to All World All Cap.

- High Level of Customization Control: Select variety of constraints (number of holdings, regional restrictions, investment factors (quality, volatility, etc.) and ESG screens (carbon emissions, exclude tobacco, etc.)

- Detailed Transition Analysis: Tax-efficient transition analysis and reporting to meet clients’ specific tax situations.

Why Individual Bonds?

- Stability: Bonds offer a finite maturity date for the full return of your principal investment, providing investors more certainty in bond returns as well as portfolio stability with better control of purchase and sale prices, while avoiding potential negative impacts of activity from other investors.

- Enhance Returns: Active bond management provides opportunities to take advantage of bond market inefficiencies which could result in higher yields and lower costs in various market environments.

- Flexibility: Provide the ability to customize portfolio to address client specific considerations including yield or income targets, cash flow timing, taxes, duration, and credit risk concerns.

Why Taxable Individual Bonds?

- Cash Replacement Solution: Take advantage of the interest rate environment to offer superior yields beyond bank accounts.

- Consistent Income with Capital Preservation: Provide a stable ballast for your portfolio with reliable cash flows.

- Matching Distributions: Target bond maturity and cash flows with various future cash needs (college tuition, tax bills, etc.).

Dynamic Custom Fixed Income | Summary

Utilizing an active SMA manager within taxable fixed income (treasuries, agency bonds, investment grade corporates, certificates of deposit) provides the opportunity to increase portfolio customization to help clients meet desired outcomes. Additionally, an active bond manager can adjust duration exposure and look for higher yielding opportunities to increase overall portfolio returns.

Strategy Highlights:

- Treasuries: These investments offer the security and liquidity of the U.S. government without commission fees and are exempt from state and local taxes. Elevate your investment strategy.

- Bond Ladders: Generally, more interest rate neutral with exposure across duration and more consistent cash flows given fixed maturities with reliable return of principal for reinvestment.

- Customization: Target various levels of duration, cash needs, and investment types (treasuries, CDs, investment grade corporate bonds, etc.) based on client preferences.

Why Tax-Aware Individual Bonds?

- Tax Efficiency: Municipal bond income is exempt from federal taxes and potentially state taxes if an investor resides in the state that issued the bond.

- High-Quality Investments: While municipal bonds may be higher risk than Treasuries, they offer relatively low default rates.

- Diversification: A wide variety of municipal bonds exists which may have unique characteristics and are diversified by sector, issuer, maturity and geography.

Dynamic Custom Tax-Aware Fixed Income | Summary

Utilizing an active SMA manager within municipal bonds provides the opportunity to increase the tax efficiency of the portfolio with an added benefit of potentially investing in state specific municipal bonds.

Strategy Highlights:

- Boutique Firm: Adapt quickly to clients’ needs and economic shifts while providing a higher level of availability and superior service.

- Active Management: Seek to benefit from taking advantage of inefficiencies in the market as well as harvesting of losses where appropriate.

- Customization: Fully customizable portfolios for each individual client including security selection, duration target, risk preference and state specific considerations.

Why Alternatives?

- Diversification: Alternative investments tend to be less correlated with traditional asset classes, such as stocks and bonds, helping to diversify portfolio returns and offer a smoother ride for investors.

- Risk Reduction: Less reliance on broad market movements reduces uncertainty and a focus on each specific investment lowers volatility, resulting in potentially reduced overall risk of a portfolio.

- Unique Sources of Returns: A broader universe of investment types and strategies allows for additional sources of income as well as potential to enhance total returns.

Why Private Alternatives?

- Variety of Investments: CAIS allows advisors to access a variety of hedge funds and private investments, including private equity, credit and real estate.

- Independent Due Diligence: Mercer, a global leader in private investment oversight, provides independent due diligence and research on the platform’s investments.

- Simplicity and Automation: The often-complex private investment onboarding process is simplified through the CAIS website and generally offers lower minimum investments for accredited investors, some as low as $25,000.

CAIS Platform Private Alternatives | Summary

CAIS is an alternatives platform designed to make the private investing world less complicated by allowing advisors to access a variety of private investments at relatively low minimums, as well as providing education and fund resources.

Strategy Highlights:

- Private Equity: Fund managers seek to drive returns by gaining control of private companies and actively building value by making operational improvements.

- Private Credit: Skilled private debt fund managers generally aim to negotiate strategic positioning within a company’s capital structure and define loan terms that support investors. Elevate your investment strategy.

- Private Real Estate: Portfolios of tangible properties designed to deliver enhanced income, portfolio diversification, and inflation hedging, often through tax advantaged structures.

- Hedge Funds: Actively managed, pooled investment vehicles designed to react quickly to changes in the market and have fewer regulatory limitations, allowing access to unique asset classes and strategies.

Why Liquid Alternatives?

- Liquidity: Unlike private investments, ETF issuers do not impose gated redemptions or require lock-up periods and are traded on public exchanges.

- Transparency: Investors can better understand what they are holding through the daily disclosures required from ETFs, while private investments may be less transparent.

- Lower Fees: ETFs typically come at a significant cost savings relative to private investment, particularly because performance fees are not allowed to be charged through the traditional fund structure.

Dynamic Liquid Alternatives | Summary

A portfolio of alternative investment strategies utilizing liquid ETFs to provide diversification when combined with an otherwise diversified portfolio through risk reduction and lower correlation with traditional asset classes.

Strategy Highlights:

- Different Strategies: Gain exposure to unique alternative categories, including multi-strategy, long-short equity, merger arbitrage, hedged equity and managed futures.

- Low Correlation: The strategies utilized are not only uncorrelated with each other, but they tend to be less correlated with traditional asset classes such as stocks and bonds.

- Low Risk: Most of the funds utilized exhibit less price volatility and can help dampen overall portfolio risk, making them a great supplement for fixed income allocations.

Custom Sub-Advisor Strategies

Dynamic Custom Direct Indexing: Sub-advised by Vanguard

Direct indexing allows you to track a stock index, such as the S&P 500, by investing in an optimized portfolio of stocks. The primary benefit is the ability to review for tax loss harvesting opportunities daily and achieve tax alpha (potentially higher after-tax returns) relative to mutual funds and even ETF investments.

- Minimum: $250,000 ($500,000 Preferred)

- Fee: 0.18% (charged quarterly in arrears)

Dynamic Custom Equity: Sub-advised by Ironwood Investment Counsel

Actively managed, concentrated stock portfolios of about 30 stocks focused on either U.S. Large-Cap Core exposure or Dividend Income. Stocks are selected using both quantitative and qualitative analysis based on a “Quality Value” philosophy with the belief that competitive long-term returns can be achieved by investing in high quality companies trading at attractive valuations.

- Minimum: $100,000 ($250,000 Preferred)

- Fee: 0.35% (charged quarterly in arrears)

Dynamic Custom Fixed Income: Sub-advised by Harmont Fixed Income

Utilizing an active SMA manager within taxable fixed income (treasuries, agency bonds, investment grade corporates, certificates of deposit) gives the opportunity to increase portfolio customization to help clients meet desired outcomes. Additionally, an active bond manager can adjust duration exposure and look for higher yielding opportunities to increase overall portfolio returns.

- Minimum: $100,000

- Fee: 0.12% (charged quarterly in arrears)

Dynamic Custom Tax Aware Fixed Income: Sub-advised by Templeton Financial Services

Utilizing an active SMA manager within municipal bonds gives the opportunity to increase the tax efficiency of the portfolio, with an added benefit of potentially investing in state specific municipal bonds.

- Minimum: $250,000

- Fee: 0.18% (charged quarterly in arrears)

Please contact Dynamic’s Asset Management team for more information about sub-advisors at advisorsupport@dynamicadvisorsolutions.com or by phone at 877-257-3840.

All portfolios using any sub-advisors are managed by Dynamic and subject to Dynamic Managed Account Fees.

All pricing is subject to change by sub-advisors.

Sub-advisory Fees are paid by Dynamic and charged to advisor. It is important to consider the sub-advisory fee when determining the client fee schedule (i.e. pass fees on to client or reduce advisor fee).

In certain large client account situations, Dynamic may be able to negotiate a lower fee.

Disclosure:

This presentation is provided for informational and educational purposes only and should not be considered as a recommendation to purchase any security or pursue a particular strategy. The information, analysis and opinions expressed herein reflect our judgment as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Certain information contained herein are based upon proprietary or third -party research or analysis and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

The model portfolios presented are designed to assist advisors and clients in evaluating investment strategies. Investing in stocks, bonds, and other assets present various forms of risk to investors and could result in losses. Exchange Traded Funds (ETFs) and mutual are sold by prospectus. Please consider the specific ETF or mutual fund’s investment objectives, risk, charges and expenses carefully before investing. The prospectus, which contains this and other information, can be obtained by contacting your Advisor. Read the prospectus carefully before investing; positive returns are not guaranteed. There is no guarantee that the model portfolios or any investment strategies will work under all or any market conditions. They may not be appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of a downturn in the market. Past performance is not a guarantee of future returns.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Dynamic makes no implied or expressed recommendations regarding the manner in which clients’ accounts should be invested. The appropriate strategy depends on the client’s specific investment objectives and financial situation. This is not intended to be used as guide to investing, or source of any specific recommendation. It does not constitute an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it would be unlawful to make such an offer or solicitation. No part of this presentation may be reproduced in any form, or referred to in any other publication, without express written permission. Dynamic Advisor Solutions, LLC dba Dynamic Wealth Advisors is an SEC registered investment advisor. SEC registration does not imply any level of skill or Iearning. Investment advisory services are offered through Dynamic. For additional risk disclosures and information regarding our services, fees and business practices, please refer to Dynamic’s Form CRS (Client Relationship Summary) and Form ADV Part 2A Brochure filed with SEC and available by contacting us, or at the SEC’s website under CRD Number: 151367 ( www.adviserinfo.sec.gov).