We put risk management first in strategically designing global, well diversified, balanced portfolios that are focused on the long-term.

All strategies range from 100% to 30% equity in 10% increments.

Investment Objective

The primary objective of Dynamic Defensive is to achieve approximately 15% to 20% lower risk than broad-based benchmarks and Dynamic’s other models, with a secondary objective to maximize long-term risk-adjusted returns while allocating to a broadly diversified variety of asset classes utilizing ETFs.

Investment Approach

Utilize non-proprietary ETFs to invest in lower risk holdings designed to hold up better in down markets with higher conviction portfolio tilts and more granular asset class exposures.

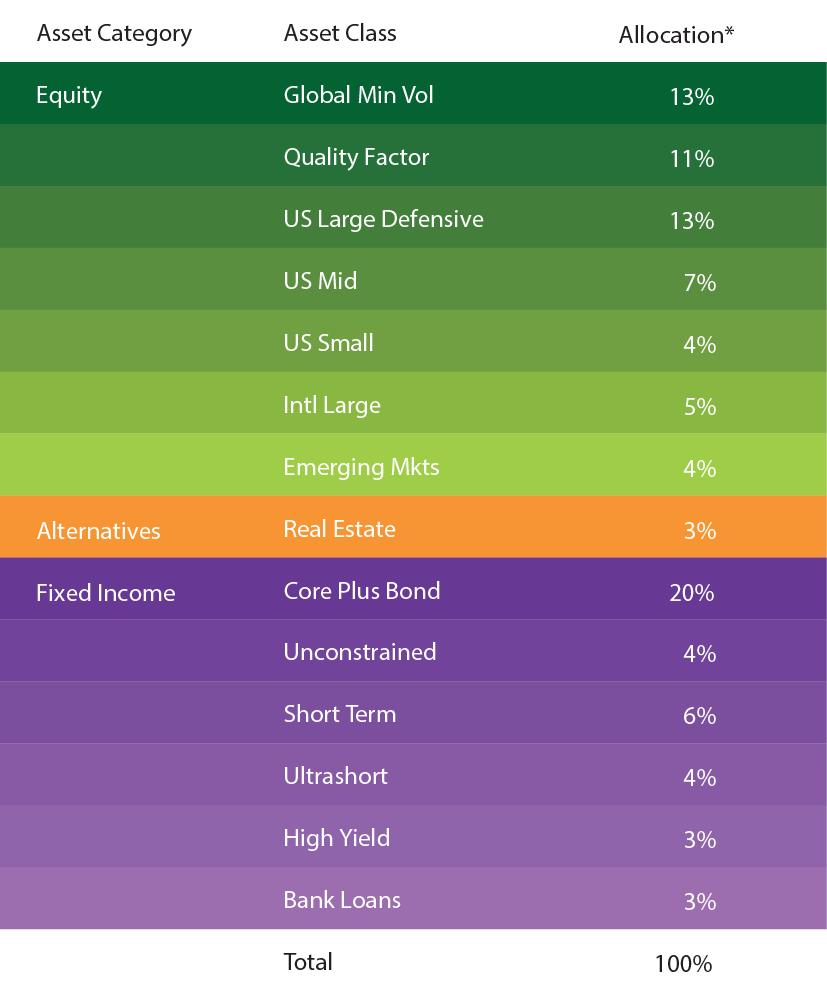

Asset Class Breakdown 60/40

*For illustrative purposes only. Allocations are subject to change.

Why ETFs?

- Lower cost: ETFs typically offer a significant cost savings relative to mutual funds.

- Tax efficiency: ETFs typically distribute fewer capital gains than mutual funds.

- Transparency: ETFs typically report their holdings daily and track an index, providing stability in exposure and risk.

Why Defensive Factors?

- Minimum Volatility Factor: Often categorized as a defensive factor, minimum volatility allows you win by losing less over the long-term. The strategy involves buying a portfolio of stocks which are less correlated with each other and thus produce a lower overall volatility, resulting in lower drawdowns during market downturns.

- Quality Factor: High quality companies are typically those with long lasting business models and competitive advantages. They are often characterized as having high return-on-equity (ROE), high profit margins, and low debt. They have confident management teams who are better able to weather the storm during market downturns.

- Aggregated Factors: While all investment factors tend to deliver superior risk-adjusted returns over the longterm, over shorter time periods their results are cyclical in nature. Combining various factors together adds diversification and provides smoother returns over time, typically with lower risk.

Why Defensive Funds?

- Buffered Funds: A buffered fund will generally provide protection in a 0 to 10% market drop. This strategy utilizes an options collar (sell calls and buy puts) to effectively protect the first 10% of a market drop at the cost of limiting market upside.

- Tactical Funds: A tactical fund will generally provide protection in a 10 to 20% market drop. A rules-based tactical fund will shift its allocation from equities to cash after a market drop of 10% and move back into stocks after a market rebound or if the market drops beyond 20%.

- Tail Risk Funds: A tail risk fund will generally provide protection for a 20% or more market drop. Tail risk is the chance of loss occurring due to a black swan (rare event). This strategy writes deep out-of-the-money options which significantly appreciate when the market falls below 20%.

There is no guarantee that the model portfolios or any investment strategies will work under all or any market conditions. They may not be appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of a downturn in the market. Past performance is not a guarantee of future returns.