Looking to grow your firm without cold calls or costly billboards? In our new series, Grow Your Practice, Director of Advisor Integration Brian Bowen will share practical, proven strategies to deepen relationships and build trust — the building blocks of steady growth—with easy-to-implement tips you can use right away. In this installment, the answer to growing your firm could be sitting right in front of you — your current clients. Unlock the power of referrals!

Grow Your Practice: Unlock the Power of Referrals

By Brian Bowen, Director of Advisor Integration

The best way to grow your practice? Referrals.

Let’s acknowledge that for some, the referral ask is natural, seamless and authentic. And for others it is forced, corny and too salesy. Let’s find a middle ground that works for you.

In this first installment of Dynamic’s Grow Your Practice, we’ll explore some background information on referrals, discuss brief ways to kickstart creating a culture of referrals for your clients, and look at a way to introduce referral opportunities for those that struggle with the ask or have clients that haven’t shown a tendency to refer.

If you prefer, skip directly to some actionable items.

First, let’s get straight to what we know about referrals, why they’re made and the thought process behind those clients that can help your practice the most.

Source: Nielsen

Bear with me on this analogy, as I know it might make some eyes roll. I think money and love are the two most emotionally draining, stimulating and driving forces of human behavior. There are certain people that feel so strongly about this, whether overtly, or subconsciously, that they welcome opportunities to ease the experiences of others. This is the person that makes introductions, arranges blind dates acts as the proverbial wingman and… refers business.

I read this as 84% of us welcome the stress relief of having potential partners (in love and wealth management) pre-vetted. They don’t posses nearly the same amount of skepticism or doubt. They don’t need convincing that a financial plan is needed. Or that the spouse should be present in the discussions. Nor convinced that the hot stock tip from the guy at the 19th hole should be part of the plan. It translates directly into more trusted leads, higher conversion rates, lower marketing costs and ultimately, more profitable and sustainable business growth.

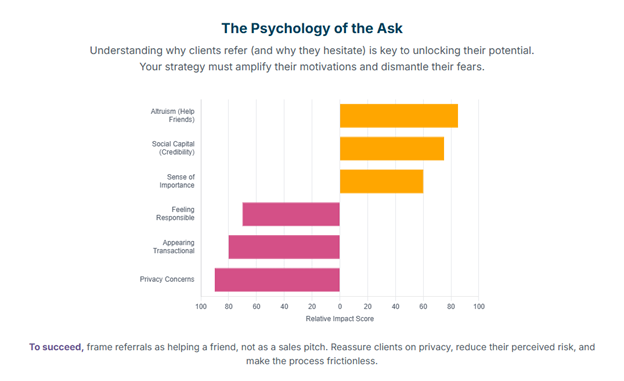

I asked AI to analyze and rank why people do or do not make referrals. The six items in the graph below are the strongest motivators and detractors: Altruism (Help Friends), Social Capital (Credibility), Sense of Importance, Feeling Responsible, Appearing Transactional and Privacy Concerns. In your conversations with clients, you’ll notice some of these traits. The referrer likely looks out for the widow up the street. Or takes the greatest pride in winning the annual club team invitational. While those that are hesitant to refer might be extremely sensitive to privacy, delay action and obsess about any potentially negative impact.

Source: AI

While I probably don’t pay enough attention to the reasons people don’t refer, I strongly encourage you to identify the top three traits and make note of them. Segment those clients appropriately in your practice and look to leverage them as referrers in the future.

Finally, let’s get to some actionable items to kickstart a referrable culture in your practice. Here are a few ideas — easiest to advanced — to get started:

Actionable Ideas – Easiest

Include a signature line in your emails. A few examples:

“The greatest compliment I can receive is a referral. If someone you care about needs financial guidance, I’m here to help.”

“Know someone who could benefit from financial clarity? I offer complimentary consultations for friends, family and colleagues of my clients.”

“I am growing my practice and would prefer to work with the friends and family of my current clients. Let me know if you have a loved one, I can help.”

Actionable Ideas – Moderate

Ask your favorite clients.

I’m not talking about the client that pays you the most. Or the client that’s the easiest to work with. When your phone rings, you recognize the number and you smile. You look forward to catching up with this client. They know you and your family and probably even ask about them, the same way you ask about their family.

If you haven’t already, then please share your interest in working with clients like them. It might sound something like this:

“Mr. Client, if I haven’t said it already, I want to share with you that I love what I do because of clients like you and your family. If you have any friends that you think I would hit it off with, I would love to meet them. It would make my life a whole lot better to have a series of clients just as enjoyable to work with as you are.”

If this doesn’t feel right to you, then maybe you put it in a card. Drop it in the mail and see what happens.

The review.

While you probably have a defined cadence of interacting with your clients, it’s common to have at least one meeting throughout the year that is a deeper dive. After tackling the cash flow, debts, taxes, estate planning, family dynamics and the other things that make you great as a wealth manager, it’s time to set up the ask. An example:

“How do you feel our relationship is evolving, and are you satisfied with the progress we’ve made?”

If the answer is the affirmative, ask for a referral.

“Your trust and partnership are incredibly important to me, and as I look to help more individuals and families achieve similar financial peace of mind, I’m always grateful for introductions to others who might benefit from the same dedicated guidance we’ve provided you.”

Want to discuss more ways to encourage a culture of referrals to grow your practice? Let’s talk! We’re available for a complimentary, objective conversation. Contact us at joinus@dynamicadvisorsolutions.com or (888) 997-4212.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.