Download the 11.29.23 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

What are Markets Thankful For?

As you sat around the Thanksgiving table with friends and family, what were you most thankful for? Well, if you’re anything like me, it was for the market rebound we experienced in November! In fact, most asset classes were up on the month: large, small, value, growth, international, and even bonds and real estate. This has been a welcome respite after the poor performance experienced in the third quarter.

Market strength could potentially continue through year end due to three key reasons:

- Inflation Coming Down. After increases in the third quarter, inflation resumed its downward trajectory for October with the U.S. Bureau of Labor Statistics reporting Consumer Price Index (CPI) of 3.2%, below expectations. Lower inflation helps support the outlook for lower interest rates in the future.

- A Goldilocks Economy. We are living in a “not too hot, not too cold” economy in which consumption and labor are moderating but still maintaining healthy levels. The moderation helps to cool inflation and help promote lower interest rates, while an overall healthy consumer and labor market may help the economy avoid a recession.

- Federal Reserve Hikes Ending. Lower inflation and a normalizing economy are spelling out expectations for the Fed to remain on hold with rate hikes (in fact, the market probability of a December rate hike has fallen close to zero). Markets are recovering in part because they have accepted the idea that stable and potentially lower rates may be on the horizon.

Last but not least, we have had early indications of another record-breaking Black Friday and Cyber Monday sales events which could provide additional tailwinds for companies reporting strong earnings expectations as well as remind us of the continued strength in consumer spending.

Lessons for Life

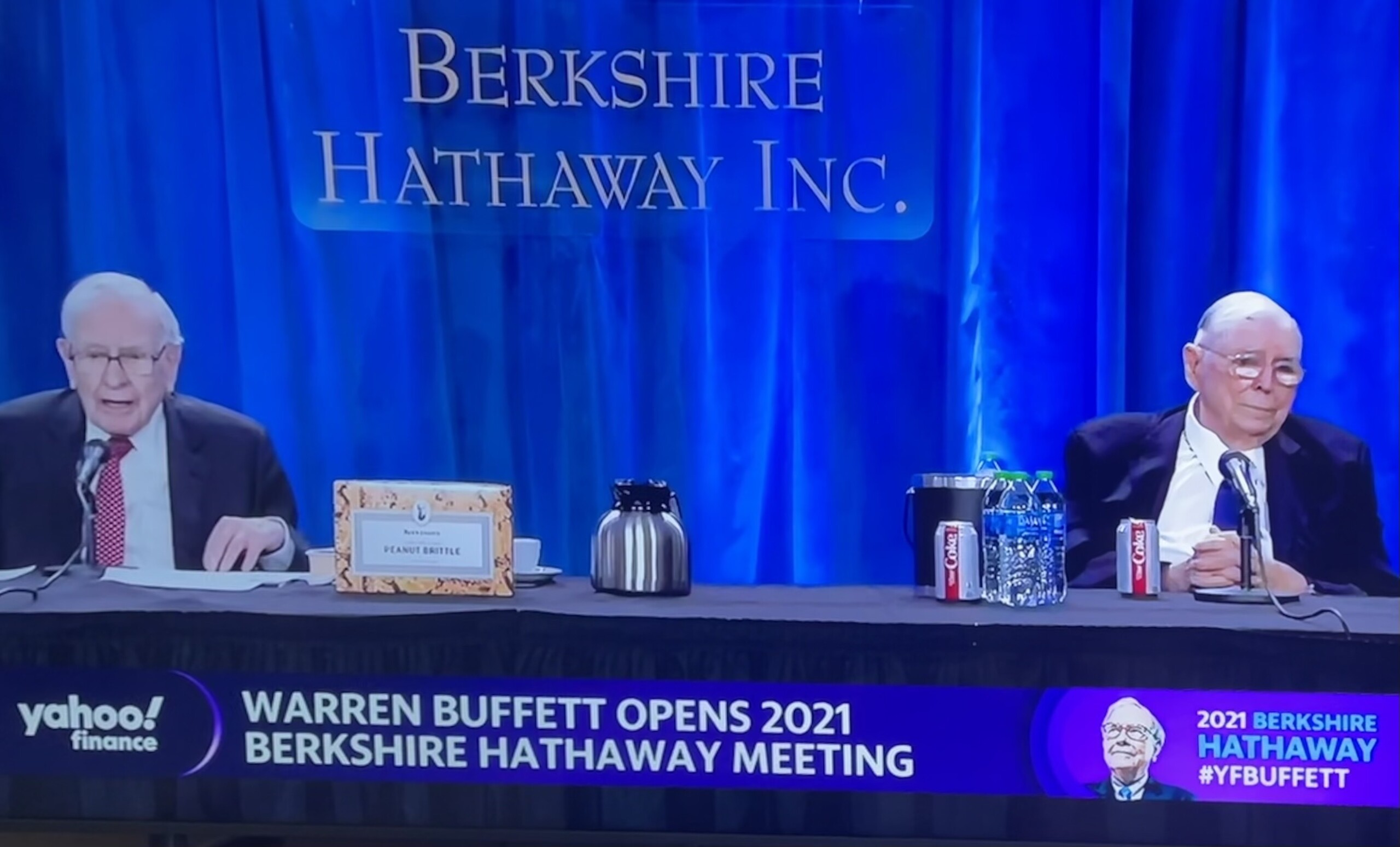

It is truly a sad day. On Tuesday, Nov. 28, 2023, Charlie Munger passed away at the age of 99. He would have turned 100 on New Year’s Day. He was the vice chairman, second in command and closest friend to Berkshire Hathaway’s Chairman and CEO Warren Buffett. He was truly one of the greatest investors of our lifetime.

My most memorable investment and life lessons have always come from Berkshire’s annual shareholder meeting where Warren and Charlie would captivate thousands of investors gathering in Omaha, Neb., for what has come to be known as “Woodstock for Capitalists.”

See Q2 2023 Investing Insights: Top 3 Lessons from Warren Buffett

Below are my personal Top 10 quotes from Charlie which have always stayed with me and will continue to do so as I can only hope to have a long and absolutely grand life as he did:

- “Lifelong learning is paramount to long-term success.”

- “You’re not learning anything if you’re not making mistakes.”

- “Knowing what you don’t know is more useful than being brilliant.”

- “Always take the high road, it’s far less crowded.”

- “The best thing a human being can do is to help another human being know more.”

- “I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart.”

- “You’re not going to get very far in life on the basis of what you already know. You’re going to advance in life by what you’re going to learn.”

- “The best armor of old age is a well spent life preceding it.”

- “It’s so simple to spend less than you earn, and invest shrewdly, and avoid toxic people and toxic activities, and try and keep learning all your life, and do a lot of deferred gratification. If you do all those things, you are almost certain to succeed. If you don’t, you’re going to need a lot of luck.”

- “When you borrow a man’s car, always return it with a tank of gas.”

Stay diversified, my friends.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photos: Omaha sunset, Adobe Stock; Berkshire Hathaway Annual Shareholders Meeting, May 2023, Kostya Etus, CFA®