Download the 10.03.25 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Asset Management

Investors have largely shrugged off the government shutdown this week and the stock market, as measured by the S&P 500, continues to soar, now up more than 14% for the year (through Sept. 29, 2025). Meanwhile, international markets continue to outperform with close to a 26% return and the bond market is up over 6% year to date. This translates to strong returns for well-diversified and balanced portfolios.

The continued market strength has primarily been driven by a slew of favorable economic reports which have generally exceeded expectations, reinvigorating investor views on the strength and momentum of economic activity. Recent key data points:

- GDP Growth. The final estimate for Gross Domestic Product (GDP) growth, the primary gauge of the health of the U.S. economy, was revised higher to a strong 3.8% annualized, well above estimates of 3.3%. After stalling in the first quarter, it appears the economy is back on track — and then some. Early expectations for third quarter indicate the economy has continued to grow by more than 3% annualized.

- Consumer Spending. Real consumer spending (adjusted for inflation) increased by an annualized 2.5% in the second quarter, well above estimates of 1.6%. Given that consumption drives about 70% of economic growth, it’s not surprising the economy remains strong and is a good signal to maintain above trend growth going into the holiday months.

- Inflation Rate. Personal Consumption Expenditures (PCE), the Federal Reserve’s (Fed) preferred inflation gauge, was 2.7% for August, in line with expectations. Likewise, core PCE, which excludes the more volatile food and energy prices, rose by 2.9%, also matching expectations. While this remains elevated relative to the Fed’s 2% target, it remains below their recent estimates, and the impact of tariffs appears to have been exaggerated.

A strong economy combined with a resilient consumer and stable inflation provides a great runway for the market to continue its upward trajectory through year end. And don’t forget the Fed remains accommodative with more potential rate cuts on the horizon, providing even more tailwinds for the market to prosper.

Los Angeles Lakers vs. Stock Market Returns

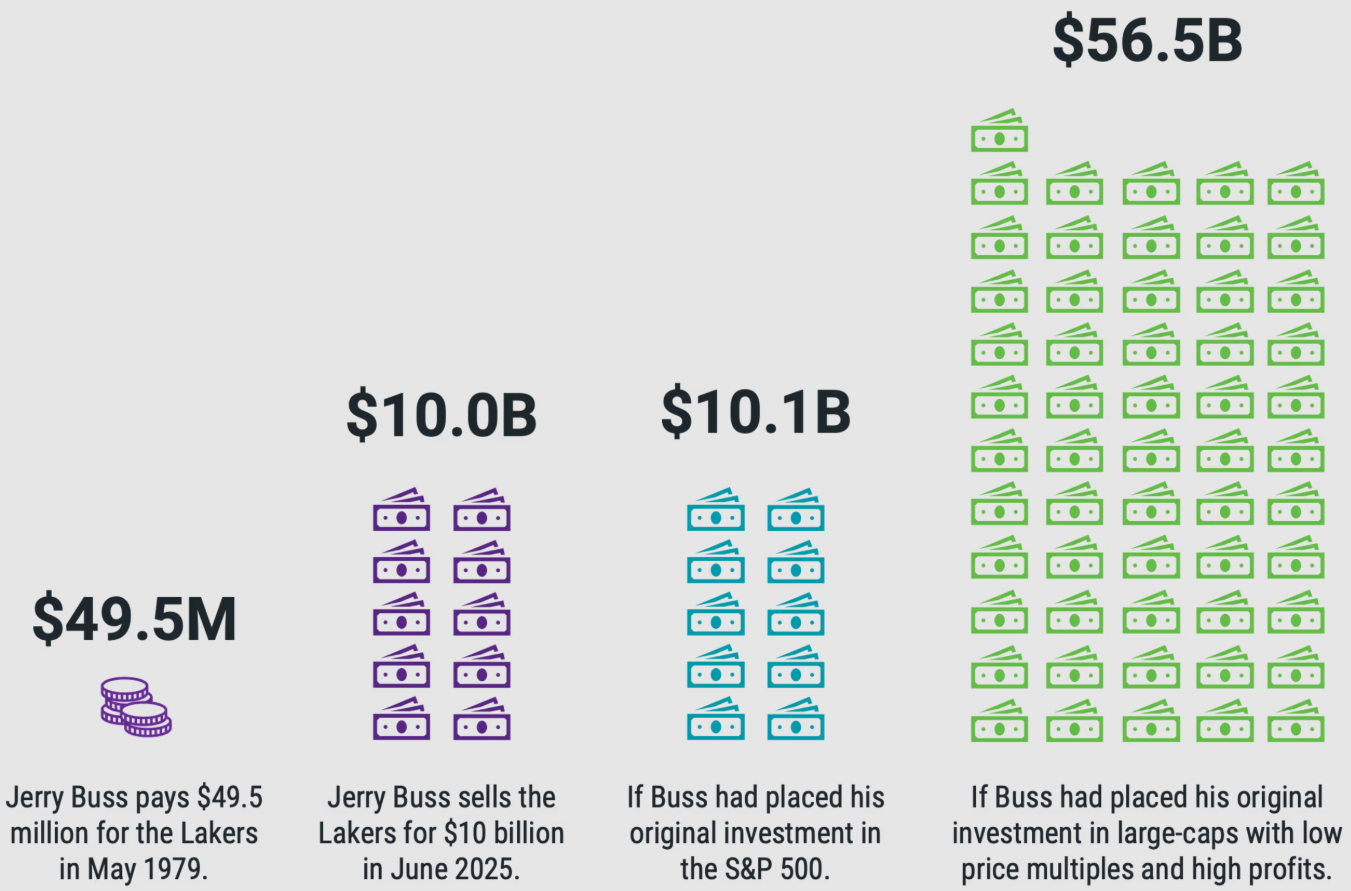

One of the big headlines this year was the sale of the Los Angeles Lakers NBA team in June 2025. It was sold by the Buss family for a staggering $10 billion, making it the largest sales price of any professional sports franchise. Even more astounding, the team was purchased in 1979 by Jerry Buss for a meager $49.5 million. That is quite the return on investment!

Not everyone has millions of dollars laying around to buy sports teams, but anyone can invest in the stock market. How would the gain on the Lakers’ sale compare to investing simply in the S&P 500? Let’s take a look:

- Tie Game. If you annualize the return for the Lakers’ sale between 1979 to 2025, it comes to 12.21%. That’s certainly a strong return, but when you compare the performance of the S&P 500 over the same time, it’s about the same at 12.24% — slightly higher, if we’re keeping score. So, it turns out you don’t have to be a multi-millionaire or buy sports teams to have strong, long-term investment returns.

- Factor Game. While the S&P 500 may be the simplest and most efficient way to access the U.S. large-cap market, academic research has proven that factor investing tends to outperform over the long-term. Two of the more popular factors are value (investing in companies with low valuations) and quality (investing in companies with high quality metrics such as return on equity and low debt). These two factors also tend to work well together. Case and point, investing in large low price and high profitability over the evaluation period would have resulted in a whopping 16.50% annualized return! Making it the winner of the game.

- Long-Term Game. The most important consideration of this study is that regardless of what you invest in, staying invested for the long-term is the best way to grow and compound your wealth. But I would also argue that owning a diversified portfolio of investments most likely offers less risk than owning a professional sports team! So as always, a reminder that the best way to winning the investment game is to stay diversified and invested for the long-term.

Stay diversified, my friends.

Pro Sports Teams vs. Public Stocks: Which Has Provided Better Returns?

Return on the Sale of LA Lakers vs. Return of the S&P 500 Over the Same Period

May 1979-June 2025

Sources: Avantis Investors “Pro Sports Teams vs. Public Stocks: Which Has Provided Better Returns?” Aug. 29, 2025. Data from 6/1/1979 – 6/30/2025. Source for S&P 500 Index: Bloomberg. Source for large-caps with low price multiples and high profitability: Avantis Investors and Sunil Wahal, CRSP/Compustat, U.S. securities. Large-caps generally represent the top 90% of the U.S. market capitalization. “Low Price Multiple” is defined as companies with a high book-to-market ratio. “High profitability” is defined as companies with a high profits-to-book ratio. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Asset Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock