Download the 08.08.25 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Asset Management

We had quite an exciting week last week with a Federal Reserve (Fed) interest rate meeting, a new Gross Domestic Product (GDP) print, a surprising jobs report, and not to mention a never-ending supply of tariff headlines. The market was not short on volatility throughout the week and ended on a negative note, but the S&P 500 is still up more than 8% on the year, with international markets up over 18% and bonds up close to 5% (year-to-date through Aug. 4, 2025). Overall, it continues to be a strong showing for balanced, diversified portfolios.

Let’s take a closer look at the key drivers of returns over the past week:

- Wednesday Morning – GDP Growth Beats Expectations. U.S. GDP expanded by 3.0% annual rate for the second quarter, exceeding expectations. This is a stark reversal of the first quarter which had a -0.5% contraction. Both quarters were skewed by tariff expectations: Imports in Q1 were ramped up in anticipation of tariffs and declined in Q2, and U.S. businesses cut back on foreign-made products. When averaging the two quarters, we are still at a decent 1.25% growth which doesn’t point to a recession.

- Wednesday Afternoon – Fed Leaves Interest Rates Unchanged. Unsurprisingly, the Fed decided to leave interest rates unchanged at the current 4.25% to 4.50%. But comments from Fed Chair Jerome Powell during his press conference sent September rate cut expectations lower, which the market didn’t like. Particularly, he mentioned large cuts are unlikely unless the labor market weakens significantly…

- Friday Morning – Non-farm Payrolls Labor Report Disappoints. The July jobs report indicated 73,000 jobs were added, significantly below estimates. More importantly, the previous two months were revised sharply lower, subtracting about 260,000 jobs from the totals — essentially indicating the job market may have flat-lined over the past few months. This is an indication the U.S. economy may be entering a softer growth patch. That said, keep in mind the unemployment rate ticked only slightly higher to 4.2%, meeting expectations and still well below historical averages.

The interesting thing about this situation is the week started with a 60% probability of a September interest rate cut, declined to 30% after the Fed meeting, and finished the week with more than an 80% chance after the job report. The market rebounded the Monday after the job numbers because investors realized the value the bad jobs news achieved. It’s what was needed to get the Fed off the sidelines and back into rate cutting mode to stimulate the economy, as well as provide a tailwind to keep markets progressing higher.

Tariff Deja Vu

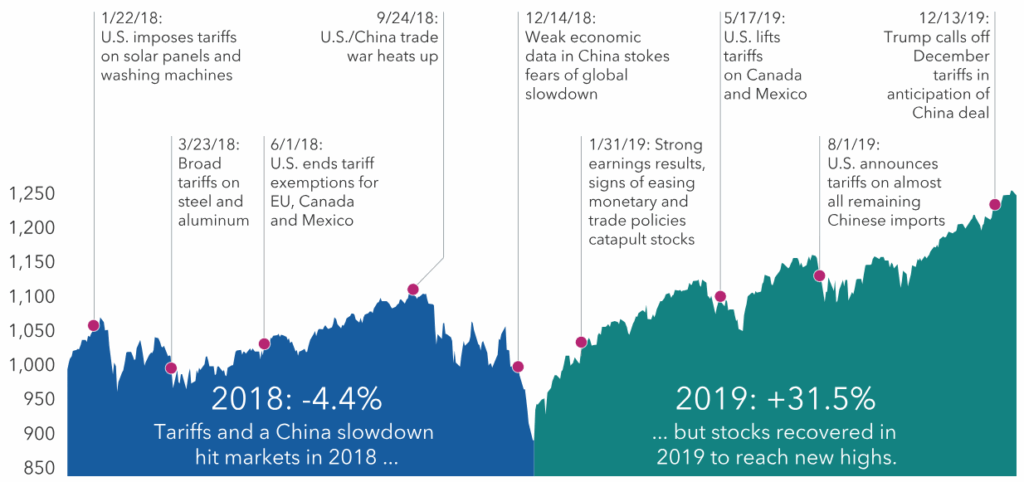

The other issue roiling the markets and contributing to higher volatility is continued tariff news. As always, it’s important to look at history to help find answers. Now it may seem like ancient history, but a similar tariff scenario played out in the not-too-distant past during President Trump’s first term. What happened back then, and how did it impact the markets? Let’s take a look:

- 2018: A series of new tariffs were imposed throughout 2018 against various trade partners. It didn’t phase the markets too much until China pushed back and a back-and-forth trade dispute erupted. Toward the end of the year, weak economic data out of China spooked global markets on fears of an economic slowdown and higher inflation.

- 2019: The storm clouds began to part the following year as many trade deals were reached, and other tariffs were simply rolled back. Combined with strong consumer spending, this resulted in a significant rebound in the market of over 30%.

- Markets are Resilient: Overall, the result can vary significantly from initial headlines. And history has shown us that even in adversity, the market has proven to be resilient. The best course of action, as always, is to try to block out the noise and focus on the long-term, because staying invested through the good times — and the bad — is the best way to achieve your investment goals.

Stay diversified, my friends.

Market Reaction to Trade Uncertainty in Trump’s First Term

Value of $1,000 Initial Investment in S&P 500 Index

Sources: Capital Group, Bureau of Labor Statistics, Peterson Institute for International Economics, Standard & Poor’s. Value of investment in the S&P 500 reflects the total return of the index over the period from Jan. 1, 2018, to Dec. 31, 2019. Past results are not predictive of results in future periods.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Asset Management team at (877) 257-3840, ext. 4 or assetmanagement@

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock