Download the 12.12.25 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Asset Management

The markets have roared back over the past few weeks, following the end of the government shutdown. The reason for the rebound has largely been rosy expectations for a third consecutive interest rate cut from the Federal Reserve (Fed), and Fed Chair Jerome Powell didn’t disappoint. The Fed officially cut overnight interest rates by 0.25% on Wednesday, December 10, 2025, to a range of 3.50% to 3.75%. This was well received by both stock and bond markets, as expected.

As of December 10, the U.S. stock market is now up more than 18% year to date as measured by the S&P 500, while international stocks continue to lead the charge with more than a 30% gain. Meanwhile, small-cap stocks are starting to catch up to their larger brothers with over a 16% gain. And last, but not least, we have bonds with just over a 7% gain on the year. Diversified, balanced portfolios are the true winners this year.

But can this rally persist into year end? And what can we expect in 2026? Here are a few things to be excited about as we wrap up the year and beyond:

- Accommodative Fed. An important additional data point that came out of the Fed meeting is expectations for future cuts, often referred to as the “dot plot.” It indicated one more reduction in 2026 and another in 2027, on their way to bring rates to a “neutral” or long-term level of about 3%. While one cut per year may not seem overly impactful, it does signal a continued accommodative stance, meaning a stable-to-lower interest rate environment over the next couple of years, supportive for all financial markets and the economy.

- Healthy Economic Data. While data has been sparce due to the government shutdown, we did get one of the most important data points just in time for the Fed meeting, the Personal Consumption Expenditures (PCE) index. It happens to be the preferred inflation gauge by the Fed, particularly core PCE, which strips out the more volatile food and energy prices. And the reading came in at a surprising 2.8% inflation growth over the past year, lower than the previous month and below expectations. This was the spark the Fed needed to lower rates in December and reinforces the narrative that inflation has stabilized and may potentially start to come down.

- Santa Claus Rally. Historically, the markets tend to perform well in December. This has come to be known as the “Santa Claus Rally” which is fueled by investor optimism going into a fresh new year and holiday spending providing a boost to corporate profits. The AAII Sentiment Survey shows an above average bullish sentiment from investors; in fact, it’s close to the highest levels this year. Meanwhile, FactSet reports 83% of S&P 500 companies have surprised on earnings results, and 76% have had a positive revenue surprise. Perhaps, after seeing the data, Santa Claus will come to town again for investors this year!

Overall, the unique combination of a lower interest rate environment and a healthy, growing economy as opposed to a recession — often the reason for lowering rates — tends to result in strong returns for the stock market. Given that we don’t see any dark economic clouds on the economic horizon, the Fed has reinforced their accommodative stance and sprinkled in some investor optimism. As a result, we could continue to see market strength going into year end and beyond.

Which Countries Are the Best?

No, we’re not talking about the FIFA World Cup coming up in 2026, but instead comparing market returns of various countries. As we have mentioned throughout the year, international markets appear to be the investment darlings of 2025, beating the U.S. market by a double-digit margin so far this year.

Some of this outperformance can be attributable to a weaker U.S. dollar, making investments abroad more valuable. Alternatively, international markets are enjoying much more attractive valuations, which may be driving investors away from the concentrations and “nosebleed” valuations of U.S. tech stocks. Lastly, there may be economic or monetary policy differences as certain countries may be seeing a resurgence of growth while the U.S. slows down from high levels.

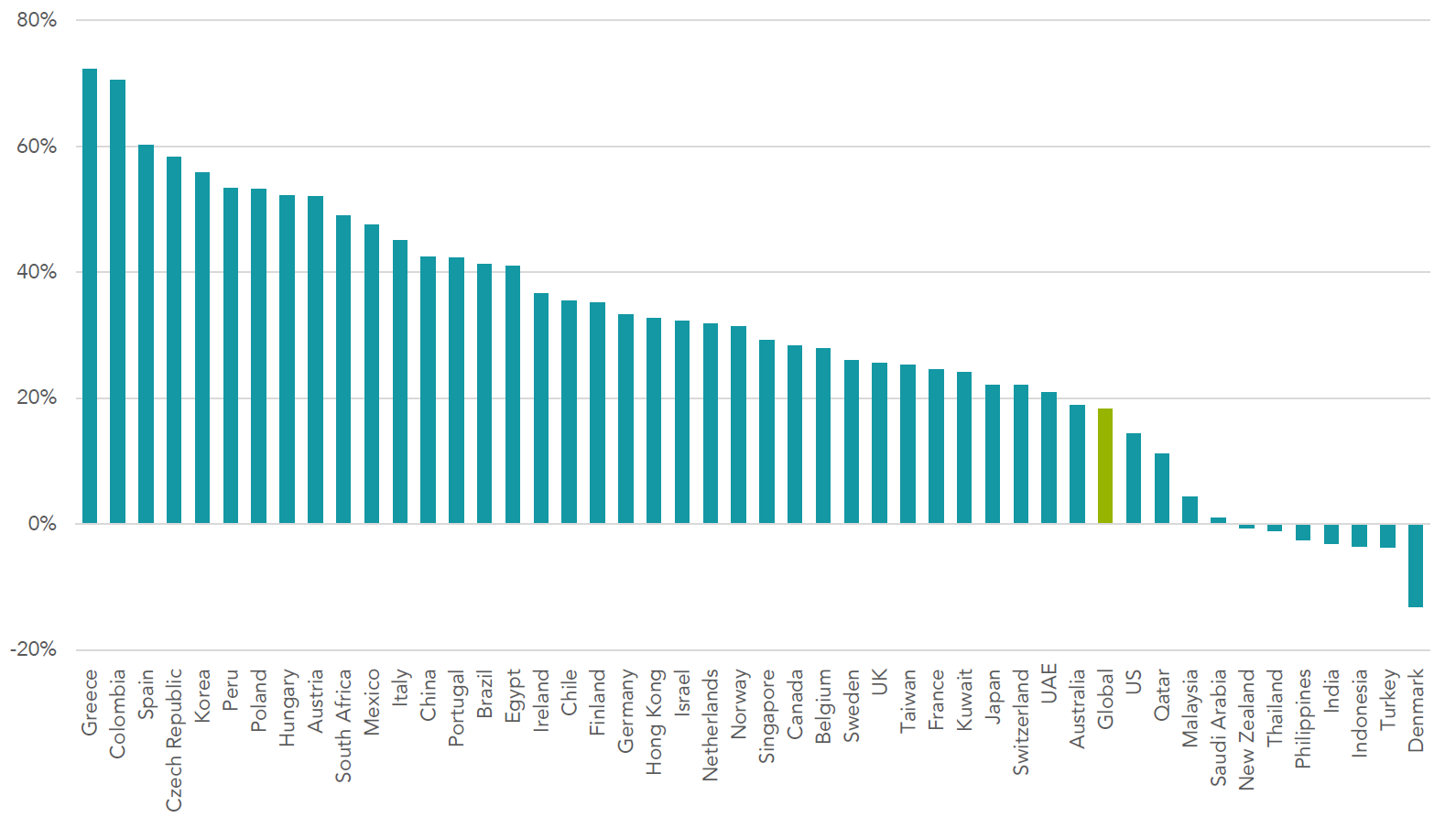

Regardless of the reasoning, which countries (with investable markets) have been the winners in 2025 and by how much? Let’s look at year-to-date returns for each country through Sept. 30, 2025:

- International on Top. It’s fascinating that 36 countries have beaten the U.S. this year. What’s even more staggering is that 16 of them had returns more than 40%. Not to mention a few with returns over 60%! Another interesting observation is the best performers are not concentrated in emerging markets (China, Brazil, etc.) or developed markets (Canada, Japan, etc.) but well spread out across the globe.

- U.S. Near the Bottom. While the U.S. is toward the bottom, it’s not in last place; there are 10 countries with worse returns, putting the U.S. in about the 22nd percentile. More importantly, there are seven countries with negative returns! So, remember, it could be worse.

- Diversification Wins. When looking across the globe, each country has its unique characteristics, including policies, specializations and cycles. Nobody really knows which country will outperform or when. The most important aspect of investing is diversification. So, why not invest in all the countries to ensure you participate in those unique opportunities, domestically and abroad?

Stay diversified and Happy Holidays, my friends.

Country Returns

Year-to-Date Returns (USD) as of Sept. 30, 2025

Source: Dimensional Fund Advisors (DFA). Past performance is no guarantee of future results. Country returns are the country component indices of the MSCI All Country World IMI Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of the MSCI All Country World IMI Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. MSCI data © MSCI 2025, all rights reserved.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Asset Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor. Photo: Adobe Stock