Download the 10.10.25 Dynamic Q3 2025 Bond Market Update

By Bill Smith, Fixed Income Trader and Portfolio Manager

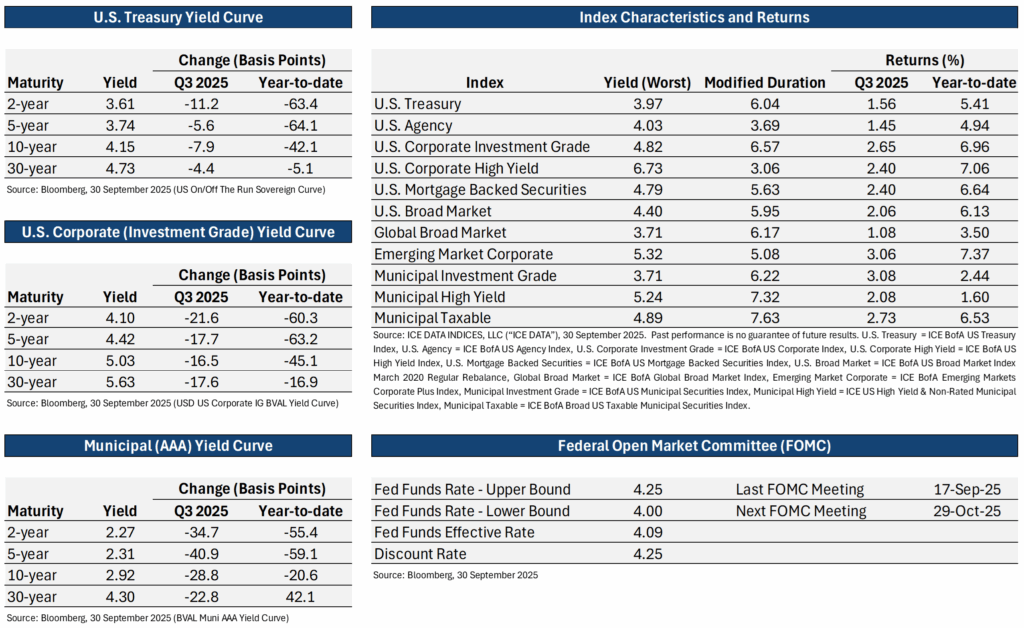

Fixed income performed well in the third quarter, supported by a softening labor market and a 25-basis-point rate cut from the Federal Reserve (Fed). Investment-grade municipal bonds outperformed most fixed income indices in Q3; however, their year-to-date returns continue to lag due to heavy supply and muted performance among longer-duration bonds. Emerging market debt, U.S. high-yield, and U.S. investment-grade corporate bond indices delivered strong quarterly gains and remain the total-return leaders for the year.

While some rate volatility is likely to persist, further monetary easing appears likely. As of October 7, Fed funds futures have priced in at least one additional cut in 2025, with a 95% probability of it occurring at the next Federal Open Market Committee (FOMC) meeting on October 29, according to Bloomberg’s interest rate probability model. If this scenario unfolds and inflation remains contained, yields may continue to drift lower into year-end.

The charts below summarize the yield and performance of select fixed income tenors and indices as of Sept. 30, 2025:

Past performance is not a guarantee of future results.

U.S. Treasuries Fare Well in Choppy Seas

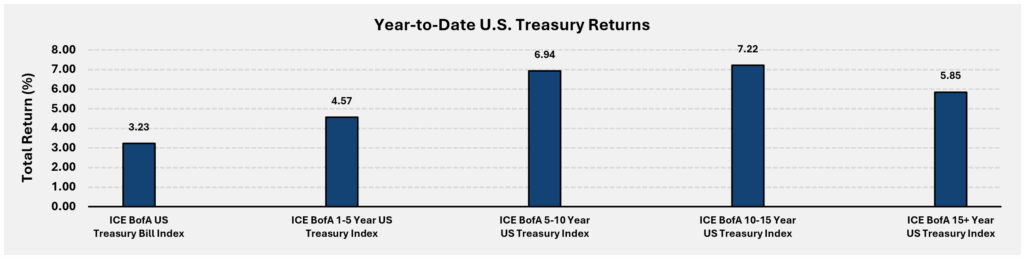

U.S. Treasuries (UST) have faced significant headline risk in 2025, from fears of resurging inflation and rising deficits to a Moody’s downgrade that stripped the U.S. of its last remaining AAA rating. Yet Treasuries have held up well, particularly in the five to 15-year part of the curve. While shorter-duration USTs have also performed solidly, year-to-date returns have lagged their longer counterparts as yields in this segment fell sharply after the Fed began cutting rates in 2024, as shown in the chart below.

Source: Bloomberg, ICE DATA INDICES, LLC (“ICE DATA”), as of 30 September 2025. Past performance is not a guarantee of future results.

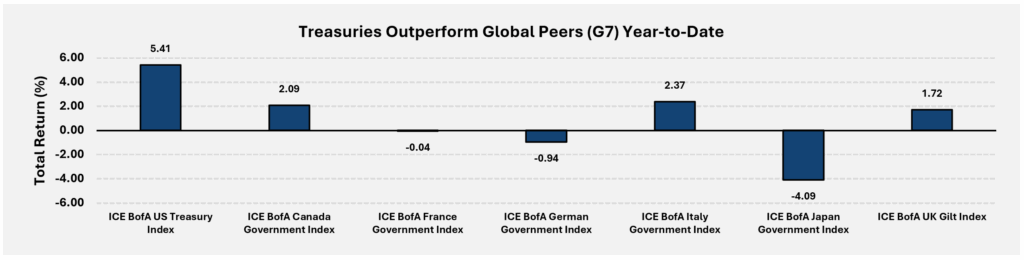

UST performance has also stood out relative to other major government bond markets. Year-to-date, USTs have outperformed their G7 peers on a local currency basis, benefiting from higher starting yields and sustained investor confidence in U.S. credit quality, as shown in the chart below. As the world’s largest and most liquid government bond market, USTs continue to anchor the global financial system and can play an important role in diversified fixed income portfolios.

Source: Bloomberg, ICE DATA INDICES, LLC (“ICE DATA”), as of 30 September 2025. Past performance is not a guarantee of future results.

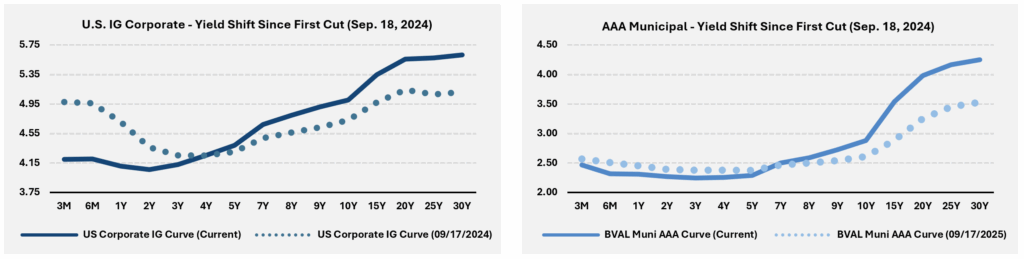

Yields Drop on the Short End/Rise on the Long

Despite 125 basis points (bps) in cumulative rate cuts since the Fed began easing last year, yields have moved higher across longer maturities in both U.S. investment-grade corporate bonds and AAA-rated municipals. For example, the yield on the 30-year tenor of the U.S. Corporate IG BVAL Yield Curve has risen 50 bps from 5.11% to 5.61% over this period, while AAA-rated municipals have increased by more than 72 bps. This contrasts sharply with the decline in yields observed on shorter bonds. The result is a compelling opportunity to capture additional yield further out on the curve, while also reinforcing the value of diversifying duration exposure to help manage reinvestment risk.

Source: Bloomberg as of Oct. 8, 2025. Past performance is not a guarantee of future results.

With yields still elevated and policy easing underway, the setup for total returns heading into year-end remains constructive. Despite short-term volatility and market noise, Q3 provided a solid reminder that an allocation to fixed income should be an important consideration for diversified investors.

Fixed income. Flexible thinking.

A prudent approach to fixed income investing calls for diversification across both credit and duration exposure. As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating fixed income for your clients, contact Dynamic’s Asset Management team at (877) 257-3840, ext. 4, or assetmanagement@dynamicadvisorsolutions.com.

Bill Smith serves as president, Portfolio Management & Trading, of Harmont Fixed Income in Phoenix.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor. Photo: Adobe Stock