Download the 8.2.24 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Present vs. Future

While the stock market maintains a strong return this year—up around 14% through July 30—volatility is starting to increase. Volatility in and of itself is a natural part of the markets and is not an intrinsically bad thing. However, it does have a tendency to spook investors. Much of the recent volatility can be attributed to uncertainty surrounding certain key events. Let’s review some of these to get a better understanding of the situation:

- Politics: Who will win the election? Uncertainty has increased with the announcement of President Biden exiting the presidential race and Vice President Kamala Harris potentially becoming the Democratic nominee. This uncertainty may be contributing to volatility as we get closer to the election. That said, this is not a unique phenomenon as volatility has historically increased leading up to an election. More importantly, volatility tends to normalize after the election as uncertainty subsides, adding potential market tail winds going into year-end.

- Interest Rates: When will the Federal Reserve (Fed) cut interest rates? This has been the most important question for investors this year. As we get closer to the expected start date—potentially as early as September— volatility may increase. The good news is that once we have the first cut, it may take the pressure off the Fed and uncertainty away from investors, thereby lowering volatility.

- Economy: Will there be a hard recession? This question has been an ongoing issue for investors for the last several years. More recently, an increase in unemployment may be raising the stakes in investors’ minds. On the other hand, second-quarter GDP growth not only exceeded expectations, but also doubled growth recorded in the first-quarter. The economy remains resilient, which certainly doesn’t point to a severe recession on the horizon.

As we move closer toward the end of the year, several questions surrounding politics, interest rates, and the economy should begin to resolve. As investor uncertainty recedes, so should volatility, creating upward potential for financial markets.

Risk vs. Reward

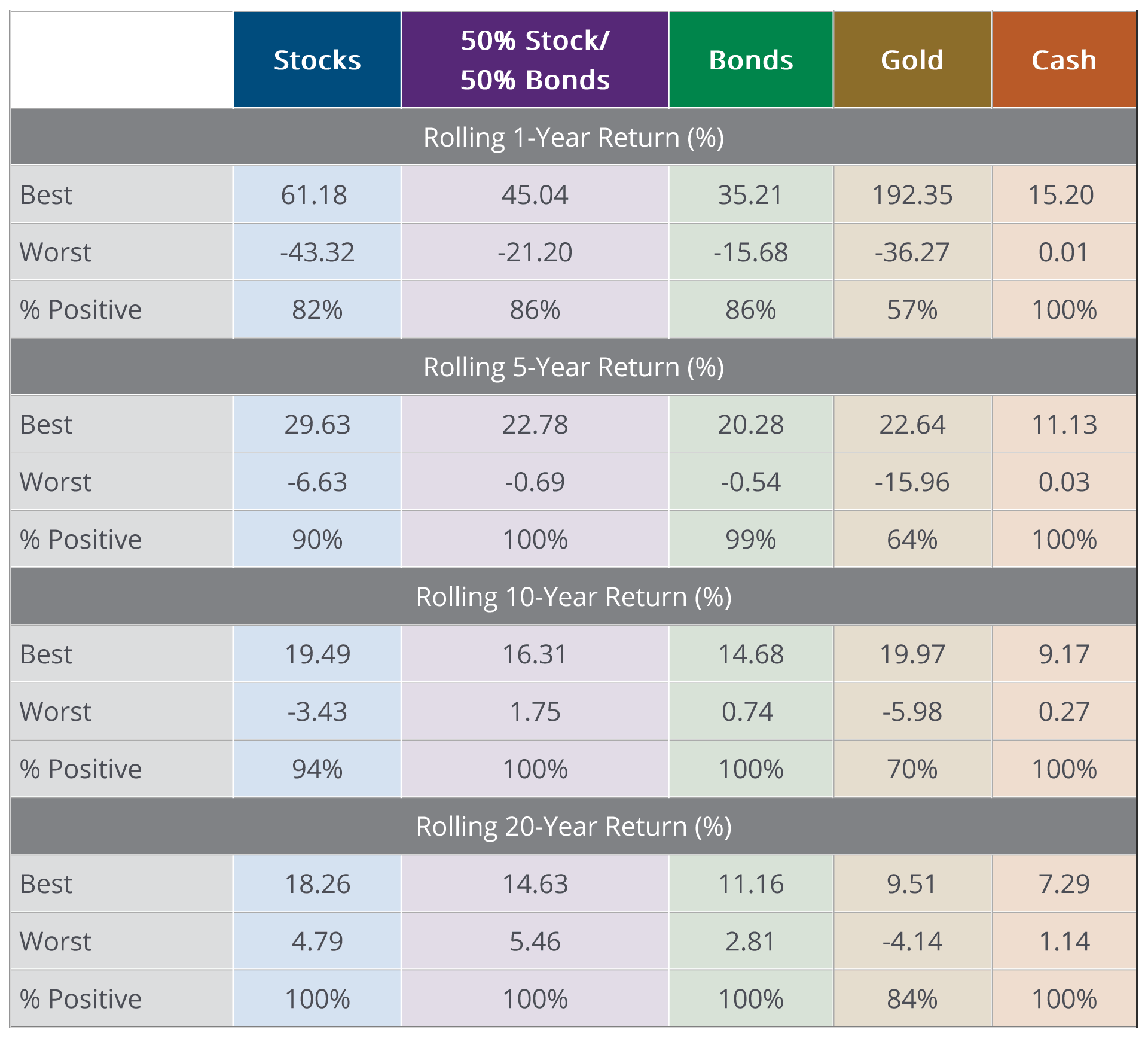

As volatility and uncertainty heat up, investors may react with fear. Fear and investing don’t mix well, as they can lead to bad investment decisions. But have no fear, there are solutions to help alleviate that fear. The chart below helps to illustrate how diversification can help alleviate some of these risks:

- Focus on Risk Management: Investors cannot control market returns, but they can control how much risk they take on. Taking on too much risk can result in sustained periods of negative returns and potential for large losses over shorter periods of time. Taking on a low amount of risk may make investors more comfortable, but it could limit the return potential needed to reach investment goals. Aligning a given investment goal with an appropriate amount of risk helps investors succeed.

- Diversification Provides Stability: One of the best ways to combat uncertainty, volatility, and fear is to invest in balanced and diversified portfolios composed of a variety of asset classes. By allocating to a diversified portfolio, you are better able to weather market downturns while still participating in market upside. Diversifying investments helps investors succeed.

- Investing for the Long-Term: While investing in in a mix of stocks and bonds increases the probability of positive returns over shorter time periods, it is fascinating to see that the percentage of positive returns for rolling 20-year periods is 100% for both stocks and bonds. Focusing on the long-term truly helps investors succeed.

Stay diversified, my friends.

Risk-and-Reward Trade-Off for Different Asset Classes

Average Annual Returns 1978-2023

Source: Hartford Funds. As of 12/31/23. Past performance does not guarantee future results. % Positive in the chart is the percentage of time each asset class had a positive return based on rolling monthly returns for the time periods shown; results may be rounded. For illustrative purposes only. Data Sources: Morningstar and Hartford Funds, 5/24.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock