Asset managers and technology firms are luring retail advisors into alts with easier access and promises of diversification and enhanced returns. Here’s what advisors themselves think about broadening their client portfolios.

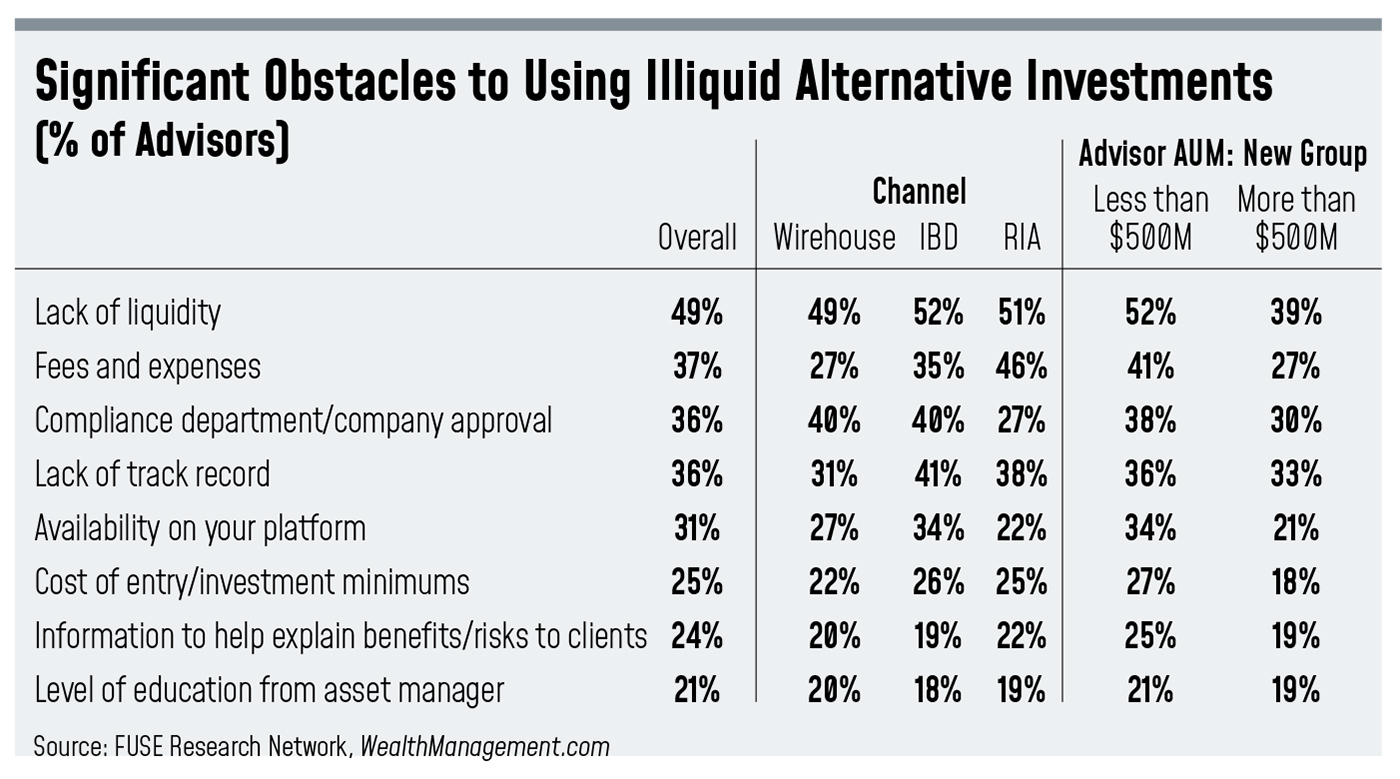

Alternative assets have long been the domain of ultra-wealthy and institutional investors, guarded as they were by astronomical investment minimums, hefty fee structures and lack of liquidity. A wide swath of personal investment advisors could be forgiven for never bothering to gain more than a vague understanding of this wide-ranging asset class in all its varied complexity.

But new investment wrappers, sleek advisor technology platforms and business partnerships have made alternatives considerably more accessible, just in time for world events, heightened inflation, rising interest rates and volatile markets to lay bare the vulnerabilities inherent in the traditional 60/40 portfolio.

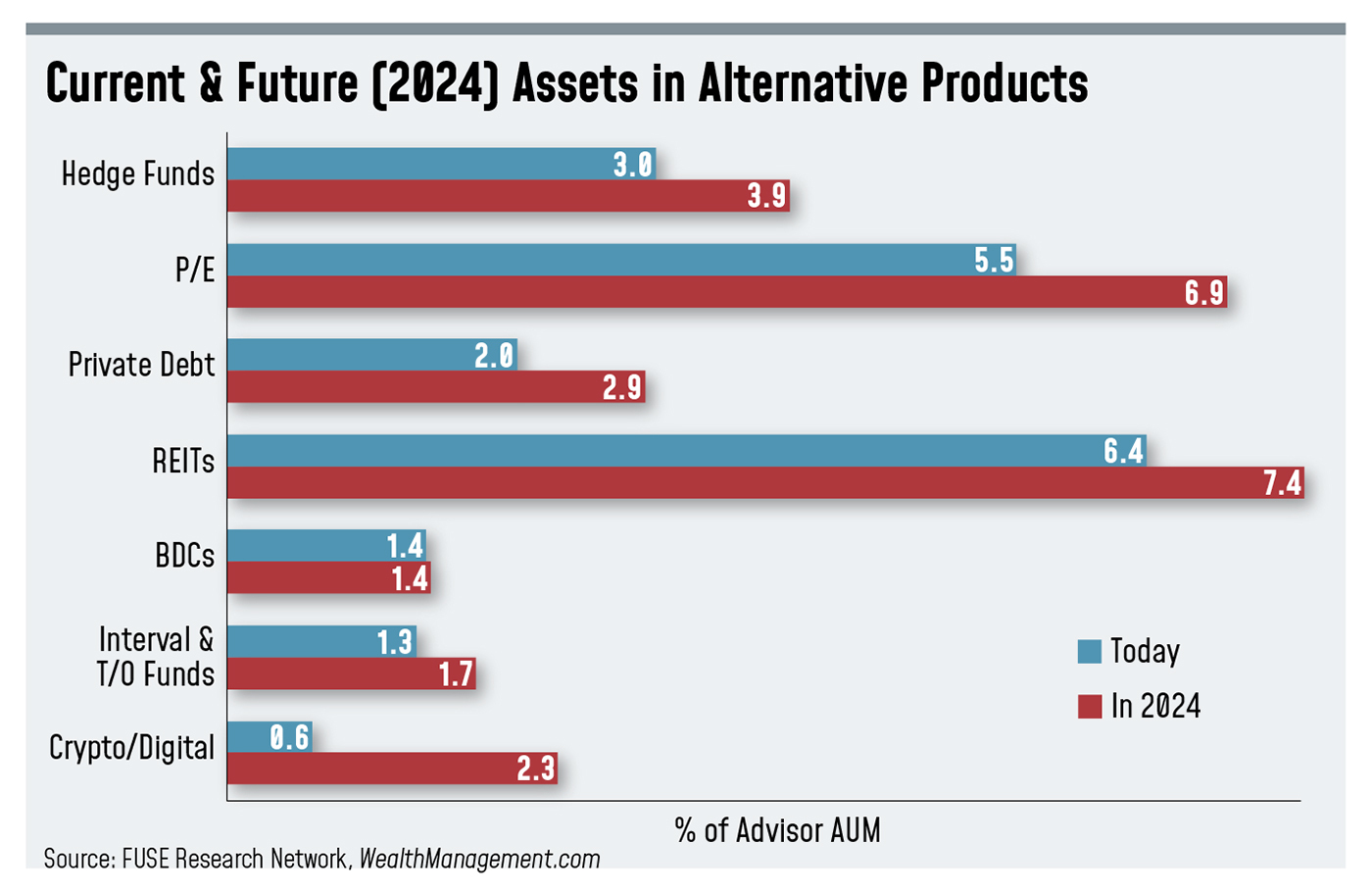

As alternative asset managers clamor to corner the merely high-net-worth market and wealthtech providers continue to innovate in the space, financial advisors are faced with a growing menu of potential products to offer their clients in the name of risk management, protected income and alpha.

WealthManagement.com reached out to advisors around the country to learn how they’re incorporating alternatives into their own practices and found that, while many remain wary, the majority who have accessed the investments for clients are happy with the results so far.

Most reported similar challenges around the client education, research and due diligence efforts needed to invest successfully in the space, as well as the additional paperwork required by most private investments—an onerous task that has been at least partially solved by large, tech-driven alternative platform providers and new investment vehicles.

Jason Siperstein, Eliot Rose Wealth Management

“Alternatives are a very broad category and can be confusing and intimidating to most advisors, let alone the investing public,” said Jason Siperstein, president of Eliot Rose Wealth Management in West Warwick, R.I. An RIA catering to individuals nearing retirement, the firm manages around $116 million in client assets.

Eliot Rose, a 20-year-old firm, only recently began offering alternative investments to clients for the first time, as a substitute for a portion of its bond exposure. All alternative investments are accessed through custodian Charles Schwab, adding an extra layer of diligence while limiting the scope of potential investment opportunities. (Siperstein said that Schwab offers “more than enough options.”)

His firm considers only liquid and semiliquid alternatives with risk profiles similar to the bonds they’re replacing, with different yield drivers and low correlation to the rest of the portfolio, he said.

“Sure, you give up a little potential return, but the flexibility for our client base was worth it,” he said. “In addition, we wanted to make sure our alternatives investments were not only uncorrelated to the rest of the portfolio, but also uncorrelated among themselves. I think a common mistake a lot of advisors make is choosing only one alternative strategy with a high correlation to the rest of the portfolio. To really make this work, you need to carve off a whole alternative sleeve of your portfolio and ensure this piece moves independently.”

Research and client communication have presented the biggest challenges to adopting alternatives, said Siperstein. Practice, and visual aids, can ease the client communication part, he said, but there is no getting around the additional due diligence.

“You want to make sure you choose the right manager for your alternative sleeve,” he said. “The dispersion in returns between good managers and bad managers is massive!”

Year to date, said Siperstein, the alternatives sleeve in his firm’s portfolio has been its best performer. “We, for one, are glad we did it. … Just be aware that it takes a lot more research and due diligence to enter this space,” he said. “However, with proper effort, it can add meaningful performance to your portfolio at large.”

Jeff Nauta, Henrickson Nauta

Jeff Nauta is a principal at Henrickson Nauta, a Belmont, Mich.–based RIA with more than $400 million in assets under management. His firm is developing its own inhouse alternative access funds and funds of funds, with administrative and logistical support from Fund Formation Group.

Nauta said his firm approaches alternatives as they would any other asset class in a portfolio—as a tool to improve its risk/reward profile.

“We see a lot of investors and advisors chasing the strong returns of alternatives this year,” he said. “We are strong believers that traditional alpha is fleeting at best, so we look for alternatives that provide returns as compensation for identifiable risks or structural reasons for a lack of capital in the asset class.”

An investment isn’t an alternative, Nauta explained, unless the risks differ from those seen in equity and fixed income markets such as liquidity, complexity and headline risk.

“With that in mind, we exclude a lot of things like traditional private equity funds or long/short hedge funds given the heavy reliance on equity risk premiums in one form or another,” he said. “Instead, we invest in more niche opportunities like reinsurance and life settlements, both of which have their futures.

In addition to the extensive due diligence involved, Nauta also said considerable effort and time are required to educate clients and manage expectations. He pointed out, too, that these investments can cause more work for advisors on the administrative side, depending on the vehicle and how an advisor manages portfolios.

“For purchases, interval funds look and feel a lot like a mutual fund, so it’s very easy to incorporate them into model portfolios and allocate across clients,” he said. “For private funds, clients will need to sign subdocs, which can be time-consuming. The CAIS, iCapital and Prometheuses of the world are trying to make the process more efficient, but it’s still labor-intensive.”

Commingled private funds, said Nauta, provide diversity within a single fund while minimizing paperwork and providing access to lower minimums.

“We think custom funds like these will be the next evolution in RIAs allocating to the space,” he said. “It certainly puts more onus on the RIA to source and diligence the investments, but for RIAs with the ability to do so, it provides greater flexibility, access to more niche funds, lower costs and the panache of having the firm’s name on the fund. As an example, we’re able to access a smaller litigation finance fund that simply wouldn’t have the capacity to make it worth iCapital’s or CAIS’ time.

“The setup and ongoing administration definitely require more time,” he added, “but we think the benefits outweigh the costs.”

Kostya Etus, Dynamic Advisor Solutions

Some firms prefer to take advantage of one or more of the alternative platforms—such as iCapital or CAIS—that have been instrumental in making these products more widely accessible, whether on a turnkey basis or as part of a full-service platform.

Kostya Etus is head of investment strategy for Dynamic Advisor Solutions, a Phoenix-based asset management firm and RIA with around $3.3 billion in assets under management. Last month, Etus and Dynamic announced a partnership with CAIS to provide end-to-end alternative investment solutions to Dynamic advisors.

For advisors with the scale and resources, Etus believes the platform solution is the easiest route for advisors to swiftly and safely access private alternative investments that can return considerably higher yields than publicly traded mutual funds or ETFs.

“Private investments require complex paperwork and subscription documents, and it’s sometimes tough to understand how to complete or get access to some of these things,” he said. “And the CAIS platform is just a really seamless digital experience.”

Comparing it to an online marketplace, Etus said the platform not only makes it easy to complete transactions, but also provides a comprehensive, customizable and searchable menu of investment options.

“You can filter the list by private investments, private equity, private real estate, private credit, hedge funds, structured notes, and everything is consistent. You can see all their limitations or restrictions, the holding period, the minimum investment. Everything’s easy to understand, and they have the education right there; they have the Mercer research reports.”

Independent vetting of all CAIS investments by industry giant Mercer is his favorite perquisite, but Etus also appreciates that Dynamic advisors in need of extra help now have access to CAIS experts and portfolio managers. “I think that’s really great,” he said, “because oftentimes you don’t really know who to call or how to get more information.”

Even with all the new options, support and interest, Dynamic recommends that traditional investors allocate no more than 20% of their portfolio to alternatives, said Etus. “And that’s for more of a diversified basket of alternatives. Depending on the risk and client situation, perhaps closer to 10%.”

“I think if advisors want to compete for high-net-worth clients with some of the larger, more traditional users of these funds like the wirehouses or the institutional banks, they really need to have solutions for alternative investments.

By Ali Hibbs

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Nick Chong, Unsplash