Broadening the Investment Universe for HNW Individuals

May 27, 2022

3 Key Reasons to Consider Private Markets

The case for private markets investing is mounting, according to various industry sources that liken the vast opportunities within private markets to the Marvel Multiverse. In an investment brief, Hamilton Lane cited private markets represent a “much larger investable universe” as the No. 1 reason private investments may warrant consideration in most portfolios for high-net-worth (HNW) individuals.

That ever-expanding universe of innovative, growth-oriented companies comprises 17,000 private businesses with annual revenues of more than $100 million, according to Source Capital IQ, as of February 2021, cited in the brief. Comparatively, there are only 2,600 public companies of the same size.

“By this measure,” according to the Hamilton Lane brief, “investors allocating only to public equities are limiting their opportunity set to just 15% of the largest firms in the U.S.”

In the brief, research conducted by Professor Jay R. Ritter at the University of Florida found the number of public companies is dwindling, shrinking from 7,810 at the beginning of 2000, to 4,814 at the end of 2020.

Concurrently, the ranks of public companies are thinning with the indices that invest in them becoming more top-heavy. Case in point, within large-cap indices, the vast majority of market cap has become concentrated in a small number of firms. According to the Hamilton Lane brief, just five stocks account for about one-fifth of the S&P 500 index, as of March. “For investors allocating solely to public equities, this further limits their exposure to the broader corporate universe.”

Beyond the dimensions of the “investable universe” private markets present to wealth advisors and their clients, there are three key factors to keep in mind when considering private market investing:

Innovation and Growth

Steve Jobs, considered the “Master of Innovation,” once said, “I want to put a ding in the universe.” With that, he had much to say on innovation, even in down markets:

“Innovation distinguishes between a leader and a follower…A lot of companies have chosen to downsize, and maybe that was the right thing for them. We chose a different path…The cure for Apple is not cost-cutting. The cure for Apple is to innovate its way out of its current predicament.”

Innovation is predominant in the companies that represent the investible universe of private markets. Think of industry disrupters like Carvana and Tuft & Needle. And their potential to experience significant growth can be exponential. The Hamilton Lane brief discusses that most of these companies never go public at all, but those that do are waiting longer to make the transition. According to Ritter’s research findings, “Initial Public Offerings: Updated Statistics,” he writes:

“In the technology space, the age, on average, of a new public company has gone from 4.5 years in 1999 to more than 12 years in 2020. As more tangible examples, Uber and Airbnb, two of the 10 largest-ever tech IPOs, waited 10 and 12 years, respectively, before going public, long after they had disrupted the industries in which they operate.”

Head of Strategy Kosta Etus, CFA®, Dynamic Investment Management, weighs in on innovation and growth within private market investing, “There are more opportunities in this larger universe of innovators for growth and returns to help supplement and/or complement the deficiencies in public markets.”

The Hamilton Lane brief points out, “Private markets represent a much wider swath of businesses, and often these companies are in the dynamic and innovative phase of their development.”

Resiliency

Etus also notes that private investments are typically more resilient during tough times. He explains, “Much of this is due to the illiquidity of private companies in which investors are much more stable and not reactionary to market headlines. This can allow the investment to realize its long-term potential in a better way.”

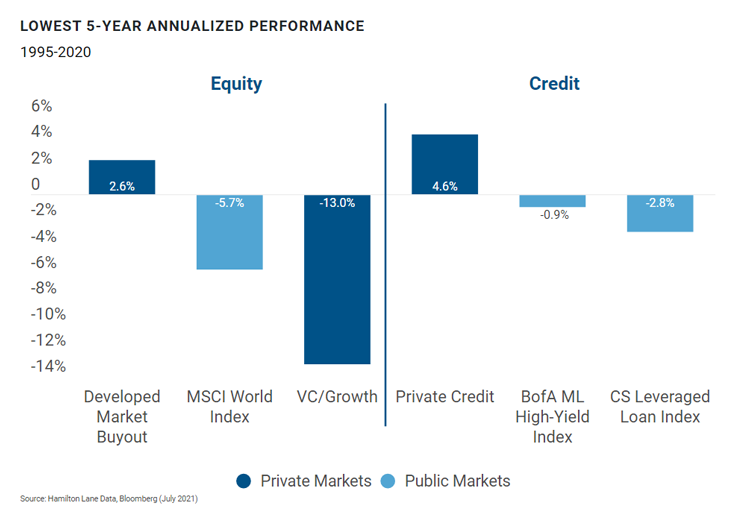

Source: Hamilton Lane Data, Bloomberg (July 2021). Past performance is no guarantee of future results.

According to the brief, perhaps the most underappreciated aspect of private markets’ outperformance is in how it was achieved. The brief goes on to read: “Namely, demonstrating resilience during market downturns. The chart below shows the lowest five-year annualized performance of various markets over the past 25 years. Developed market buyout and private credit never had negative returns over any five-year stretch.

“In short, private markets have largely outperformed their public market counterparts, but often with lower downside risk.”

Historical Performance

There’s data to prove what some may consider the No. 1 argument for investing in private markets: Performance. The Hamilton Lane brief advocates that the statistics speak for themselves:

- Over the past three years, private equity has generated a premium of 38% over public equities.

- One dollar invested in the private markets in 2018 would be worth $1.96 today, compared with just $1.42 for a dollar invested in public equities.

- Private real estate and private credit have performed quite well compared with public equities when you consider their different risk profiles.

- Private equity and private credit have each outperformed global public equity and credit markets, respectively, in 19 of the last 20 years.

Traversing the Private Market ‘Multiverse’

McKinsey’s “Global Private Markets” annual review reveals several critical growth insights. Among them:

- Global private equity (PE) net asset value has multiplied eight times since 2000, almost three times as fast as public market capitalization, which has grown approximately 2.8 times over the same period. Yet it is important to keep in mind that even after two decades of torrid growth, private market AUM remains miniscule next to public markets, coming in at less than 8% of total public equity market capitalization and 3% of public debt.

- The outlook for continued growth in private market AUM, from both traditional and new sources of capital, remains strong. For all the attention they receive, LP allocations (pension funds, sovereign-wealth funds, etc.) to private markets still tend to account for only 5% to 15% of portfolios. And according to Preqin, LPs are underweight relative to their target allocations for PE.

- All the evidence suggests that despite the record amount of capital committed to PE over the last several years, there’s likely more to come.

When advisors are exploring the multiverse of private market investing with their HNW clients, Etus points out there can also be higher risk. “Dynamic recommends not exceeding 10% to 20% in alternative investments for HNW individuals. That said, larger endowments with very long-term horizons are sometimes allocating upwards of 30% to 40% in private investments.”

For help navigating private market investing, advisors are encouraged to contact Dynamic’s Investment Management team at (800) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability.

These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment.

Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

A private fund is an investment vehicle that pools capital from a number of investors and invests in securities and other instruments. In almost all cases, a private fund is a private investment vehicle that is typically not registered under federal or state securities laws.

The primary risks of private funds include the following: (a) Private funds do not sell publicly and are therefore illiquid. An investor may not be able to exit a private fund or sell its interests in the fund before the fund closes.; and (b) Private funds are subject to various other risks, including risks associated with the types of securities that the private fund invests in or the type of business issuing the private placement.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.