Market Update: Interest Rates Up, Market Down – We Have Good News & Bad News

May 6, 2022

By Kostya Etus, CFA® Head of Strategy, Dynamic Investment Management

Download the 5.6.22 Dynamic Market Update PDF for advisors’ use with clients

What Happened?

As expected, the Federal Reserve (Fed) raised its benchmark interest rate by 0.50% on Wednesday and announced plans to start reducing its large balance sheet in June. The primary reason to raise rates is to help restrict high inflation (latest reading at 9.6%), but if the Fed is too restrictive, it may lead to a recession. The reasons to hike rates are justified; both the Fed and government injected a tremendous amount of stimulus into the Covid economy, saving us from a crisis. The economy is now on level footing and no longer needs this support.

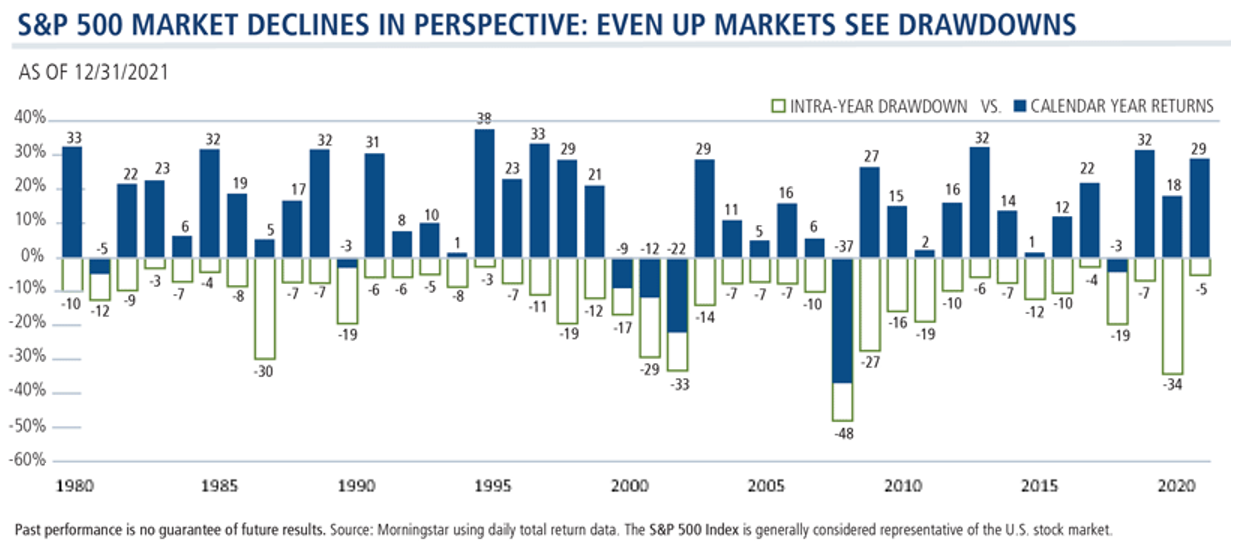

Fed Chairman Jerome Powell eased concerns of overtightening by saying they are not actively considering increases of more than 0.50% in the future, which had an immediate positive market reaction with the S&P 500 finishing Wednesday, May 5, up close to 3%. Unfortunately, the market seems to be feeling greed and fear at the same time. After having a night to sleep on it, the S&P 500 fell 3.6% on Thursday. During periods of high volatility, it’s important to remember that the market can have significant drawdowns in any given year, but typically the result is a positive annual gain (see chart below).

The Bad News

- Higher Rates: When interest rates go up, it becomes more expensive to borrow money. This means higher interest costs for home mortgages, credit cards, car loans as well as increased costs for business loans for companies large and small. This creates headwinds for consumers and businesses to spend, slowing the economy.

- Market Volatility: Volatility on its own is not necessarily a bad thing for long-term investors. In fact, it can create attractive entry points into the market. But wild market swings tend to create fear and uncertainty, which can lead to bad investment decisions.

The Good News

- Smooth Transition: The Fed has clearly telegraphed its expectations to raise rates slowly and likewise to slowly taper the size of its balance sheet. This should reduce the uncertainty related to rate hikes as well as maintain ample liquidity and relatively low rates, supporting the market and economic growth.

- Inflation: With support from the Fed and reduced fiscal spending, inflation should begin to cool from its extremes as we transition to more normal, pre-Covid conditions. This means cheaper prices for goods and services, driving up consumer spending, supporting the market and economic growth.

- Consumer Demand: Inflation is primarily high because consumer demand is much higher than goods supplied. This is not a bad thing. As supply chain issues get resolved and back on track, consumer demand will be met, leading to more spending, supporting the market and economic growth.

- Job Market: Unemployment is at a 50-year low and there is a wide gap between job openings and people looking for work. A healthy job market will fuel wage growth, leading to more spending, supporting the market and economic growth.

- Corporate Earnings: According to FactSet, more than half the companies in the S&P 500 have reported first quarter earnings. 80% of them have reported a positive earnings surprise and 72% have beaten revenue expectations. The blended earnings growth rate is currently at 7.1%. Earnings appear to be in great shape, supporting the market and economic growth.

- Valuations: Stock market valuations were at extremes as the S&P 500 hit an all-time high to start off the year, this is particularly true for growth companies. Since then, markets have fallen and valuations have come down to more reasonable levels, creating attractive investment opportunities and supporting future market growth.

- Sentiment: Sentiment readings are exceedingly bearish, as measured by the AAII Investor Sentiment Survey. In fact, they have been bearish since the start of the 2009 bull market, supporting future market growth.

- Russia Conflict: While there is still turmoil in the region, the headline uncertainty and geopolitical fear may be on the way down. Hoping that the worst is behind us, any improvements in this space would result for global markets and economies.

- Commodity Prices: As inflation starts to get under control, supply chains improve and issues in Eastern Europe are resolved, commodity prices should fall to more normal levels, leading to easier access to goods and further support for global markets and economies.

- It’s the Weekend: Let’s put this crazy week behind us and focus on the future. A lot of fear and uncertainty is priced into the markets; any marginal improvements in data will result in favorable market reactions. As you can see from the reasons stated above, there is sufficient support to not seeing a recession any time soon and potential for the market to reverse course.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (800) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Photo: Engin Akyurt, Unsplash

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.