by Karen DeMasters

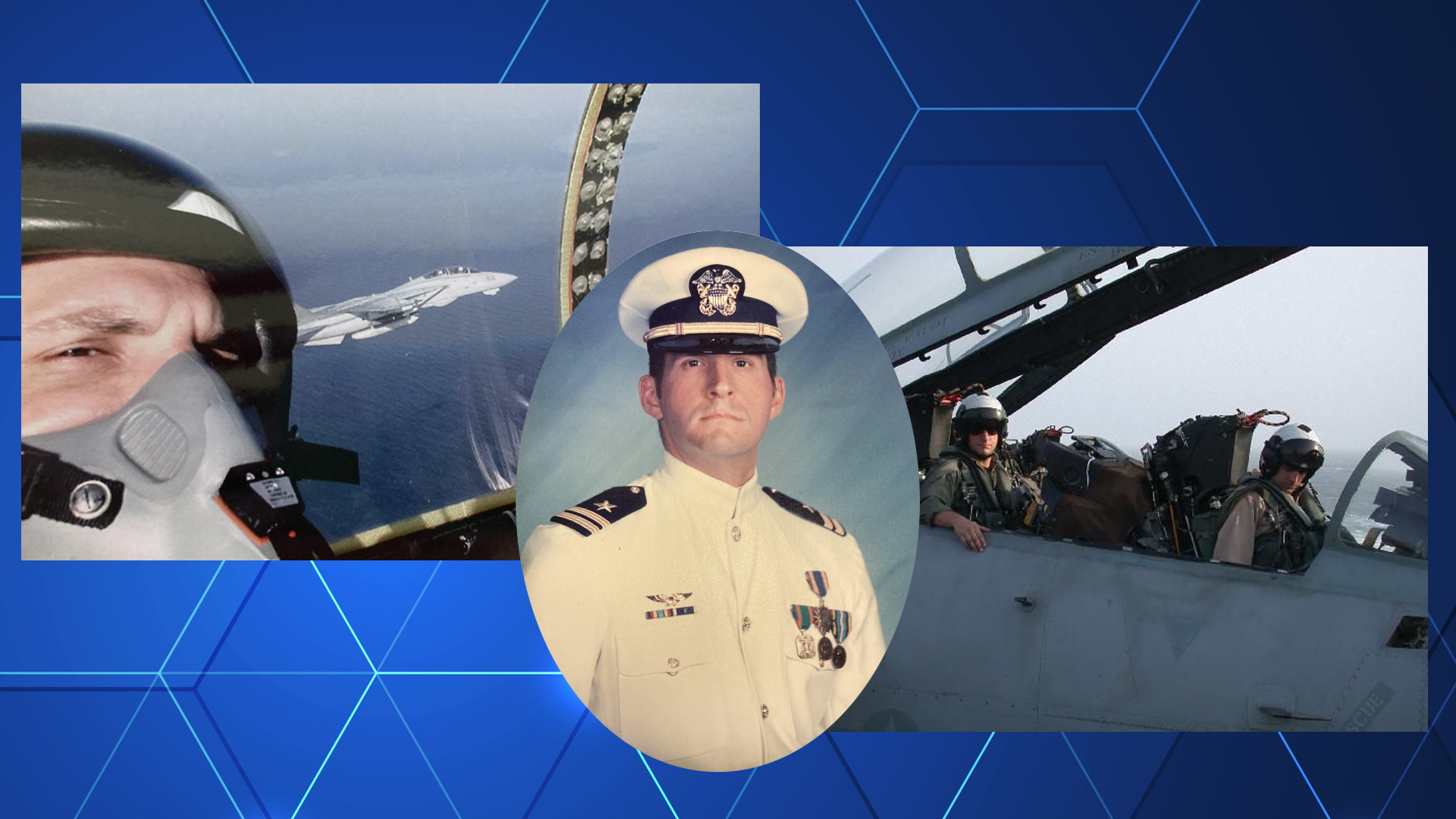

Patrick Huey, a former Navy flight officer, took his love of precision and applied it to his second career – being a financial advisor.

Huey, who considered going into education after being honorably discharged from the Navy 15 years ago, said he sort of fell into the financial industry after deciding teaching was not what he wanted to do next.

“It was sort of a happy accident,” Huey said in a recent interview. “Like a lot of vets, I was not sure how my skills translated to civilian life.”

He started working for a brokerage firm and found a good fit, at least for the financial part. But he soon found he wanted to offer more holistic planning than the brokerage provided and, after working for another firm, he founded Victory Independent Planning in Macro Island, Fla. He now has 87 families as clients across the country with more than $100 million in AUM.

“With financial planning, the process has to be meticulous to guide clients,” a skill he learned in the Navy, he said. “We are a boutique firm that is small enough that if someone calls, they get me on the phone. They don’t have to call a big office.”

Huey’s typical client is a retired military officer like himself who is nearing the end of a second career and looking at retirement.

“These people have a lot of moving parts to their financial lives and they need a holistic plan. That’s who we do a lot of work for,” he said. He started in Washington State but said he can live anywhere now, so he and his wife, Dixie, chose the beach.

He also relies on his love of history to connect to clients on a personal level and put investing in context. Huey is the author of two books: “The Seven Pillars of (Financial) Wisdom: A Historical Perspective on Modern Investment Advice” and “History Lessons for the Modern Investor.”

“There are five things you can do with money: spend, save, invest, pay taxes and gift. We help balance those things for our clients,” he added. Huey said his clients, who are mostly mass affluent, feel comfortable enough with him and his advice to come to him with a variety of questions about their money, from whether they can afford to take a luxury vacation to buying a second home.

“These are middle-tier people who need advice the most,” he added.

Huey said he decided to go out on his own in 2016 to maintain control of what he does, rather than having to answer to a corporate headquarters. He is an affiliate of Dynamic Advisor Solutions, which gives him the support he needs to free him to work with clients.

Jim Palumbo, chief development officer at Dynamic Advisor Solutions, said, “Once people reach a certain level in the military, they have good character and good habits.”

“I once asked Patrick what was the most dangerous flying situation he had been in and he told me about a time his plane’s engine failed while he was hooked up to a refueling tanker over Afghanistan. He told me calmly he just fell back on his training and went through the steps necessary to right the situation. I think that applies to financial planning: Do not panic and fall back on the plan,” Palumbo said.

In a totally different situation, Huey and his wife found her wedding ring in a couch years after it was lost and they had been paid for it by an insurance company. Huey returned the money to the insurance company “because it was the right thing to do. I think that tells you who Patrick is at his core,” Palumbo said.

Dynamic Advisor Solutions, based in Phoenix, serves 80 advisory practices, both IARs and RIAs, serving nearly 4,000 clients and approximately $2.8 billion of assets. Huey said the partnership with Dynamic brings scalability to his “mom and pop practice,” which he runs with his wife.

“With Dynamic’s support, I don’t have to grow my payroll in order to grow my practice,” Huey said in a statement. “Dynamic brings an enhanced platform and technology suite on which to accelerate growth, developing prospects while allowing me to spend more time delivering real value—broad planning and ongoing coaching—to my current clients. As a fiduciary, value goes way beyond performance.”

All Dynamic Advisor Solutions numbers provided are approximate and as of 12/31/2020. Dynamic Advisor Solutions, LLC dba Dynamic Wealth Advisors is an SEC registered investment advisor. Investment advisory services are offered through Dynamic.