At Dynamic, we understand there are several ways your advisor manages investments to meet your needs. Different account types can utilize an array of investment selections based on risk, account size and type, tax sensitivity and many other factors.

Our goal is to provide a range of robust portfolio strategies that align with your long-term investment goals. To do that, we rely on a series of core strategy types that comprise various asset types that best represent our investment philosophy and process.

We Put Risk Management First in Strategically Designing Global, Well Diversified, Balanced Portfolios that are Focused on the Long-Term. All Strategies Range from 100% to 30% Equity in 10% Increments.

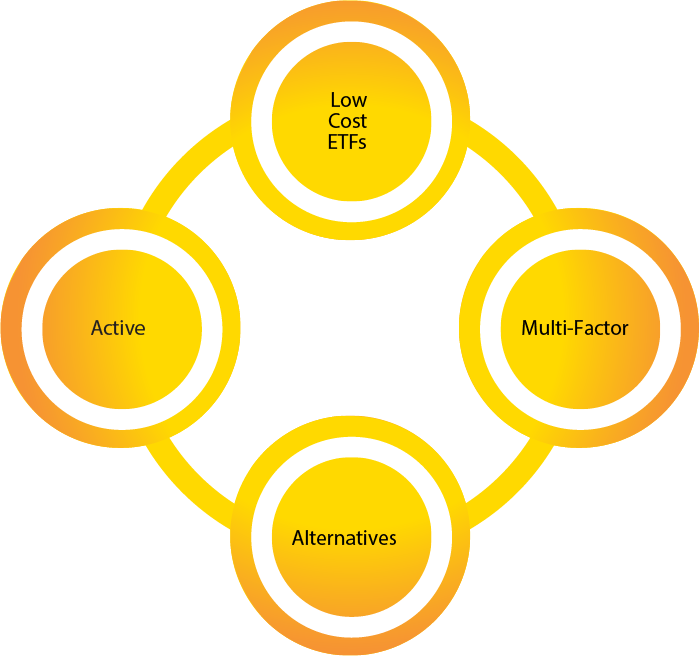

Total Return ETF Strategies

The following broadly diversified portfolios focus on maximizing long-term risk adjusted returns:

Dynamic Core

Low-cost passive exposures with lighter portfolio tilts.

- 7-12 Holdings

- $25k Minimum

- 5-6 BPS Fund expenses

Dynamic Smart

Multi-factor (Smart Beta) equity exposures combined and actively managed fixed income with higher conviction portfolio tilts.

- 11-18 Holdings

- $150k Minimum

- 32-41 BPS Fund expenses

Dynamic Custom HNW

More personalized and customized portfolio management focused on high-net-worth clients’ unique desired outcomes, including the potential utilization of ETFs, Stocks, Bonds and Alternative Investments.

- $2M Minimum per client

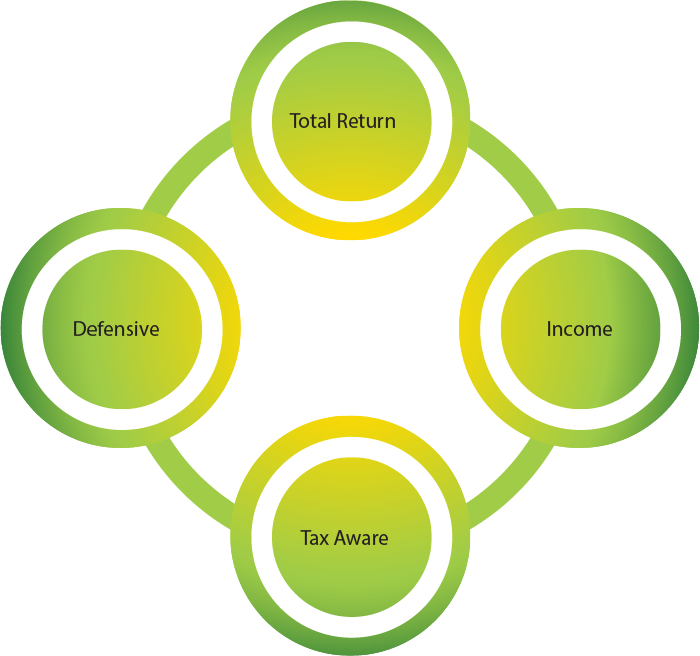

Objective Based ETF Strategies

The following broadly diversified portfolios focus on specific client objectives:

Dynamic Income

Higher yielding equities and fixed income to help clients with higher income needs. Generally, these strategies have the objective of yielding approximately double the income of broad based benchmarks and Dynamic’s other models.

Dynamic Defensive

Buffered and lower risk holdings designed to hold up better in down markets for risk averse clients. Generally, these models have the objective of achieving approximately 15% to 20% lower risk than broad based benchmarks and Dynamic’s other models.

Dynamic Tax Aware

Tax Aware strategies have an intentional focus on reducing the tax burden for tax sensitive clients through Dynamic’s management.

This includes allocations to tax-advantaged investments such as municipal bonds.

Unique Strategies

The following represent a wide variety of solutions to meet a multitude of potential investor situations:

Manager Specific

DFA (ETF and MF),

American Funds (MF)

Specific Use

ESG (ETF), Direct Indexing (Stocks), Separately Managed Accounts (Bonds), Alternative Investments (Funds and Private)

Talk to your financial advisor to learn how Dynamic’s Investment Management Strategies can help you along your journey to financial freedom.

What Sets Us Apart?

People

Dedicated team helps advisors grow their practices with direct access to professionals in portfolio management and trading.

Philosophy

Risk-focused philosophy aims to deliver balanced portfolios to achieve consistency of returns and ultimately, better client outcomes.

Process

Disciplined, focused and rules-based investment framework supports asset allocation, security selection, investment themes, rebalancing and trading.

Contact Dynamic for your free consultation

Schedule a demo today to find out more and meet the team!

(888) 997-4212

Click for Dynamic’s Form CRS (Client Relationship Summary) and Dynamic’s ADV Firm Brochure. For additional information click here.

The material in the website has been distributed for informational purposes only. The material contained in this website is not a solicitation to purchase or sell any security or offer of investment advice. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed. No part of this website may be reproduced in any form, or referred to in any other publication, without express written permission.

Dynamic Wealth Advisors provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Dynamic Wealth Advisors is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.

Information about your visits to our website. We store records of the activities on our sites in our web server logs, which automatically capture and save the information electronically. The information we collect helps us administer the site, analyze its usage, protect the website and its content from inappropriate use, and improve the user’s experience.

Dynamic Advisor Solutions, LLC dba Dynamic Wealth Advisors is an SEC registered investment advisor. Investment advisory services are offered through Dynamic. You can learn more about us by reading our ADV. You can get your copy on the Securities and Exchange Commission website. See https://adviserinfo.sec.gov/IAPD by searching under crd #151367. You can contact us if you would like to receive a copy by calling 877-257-3840 x720.