Markets Climb the Wall of Worry

October 11, 2024

3 Wins and 3 Uncertainties

Download the 10.11.24 Dynamic Market Update Presentation for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

We officially have three quarters under our belts and the markets are three-for-three in terms of strong performance. The S&P 500 increased by 10.6% in Q1, 4.3% in Q2 and 5.9% in Q3—putting us at a compounded 22.1% year-to-date annual growth rate through the end of the third quarter. More importantly, we are starting to see strong performance from other areas of the market as small companies, international markets and real estate are all posting double digit returns this year. And all these gains are happening despite some key uncertainties.

When markets begin to feel this euphoric, it may be time for investors to manage expectations for future market returns. After all, the market cannot persistently go up, and every once in a while, the freight train needs to let out a bit of steam. Below are the key uncertainties which continue to weigh on investors, which may shape the outcome for the fourth quarter and beyond:

- Middle East Tensions: Geopolitical concerns between Israel and Iran continue to be on investor minds. Any escalation could disrupt oil and energy supplies, as well as increase market volatility. That said, the U.S. has ramped up oil production in recent years, which means we are now much less dependent on imports.

- Labor Market Strength: The U.S. Bureau of Labor Statistics released their much-anticipated Non-Farm Payroll jobs report which had a surprising spike in 254,000 new jobs created in September, versus only 140,000 expected. Furthermore, the unemployment rate dropped to 4.1%, below last months reading and expectations of 4.2%. While this is a great sign for the economy, it unfortunately it may be a red flag for the markets. It could be indicative of a “no landing” scenario where the economy and inflation heat back up and the Federal Reserve suspends their rate cutting plans.

- Presidential Election Outcome: With less than a month left before the election, it is becoming a larger area of focus for the markets. This is the case primarily because the presidential and Congressional races remain relatively tight, and victory margins could be narrow across key states. That uncertainty in outcome may create market volatility leading up to the final results.

While some uncertainty remains in the markets, we are luckily moving into the holiday months which tend to support market strength. November and December, in particular, tend to be seasonally strong as holiday shopping heats up and investors worry less about the markets, instead focusing more on spending time with friends and family.

Presidential Election Investment Impact

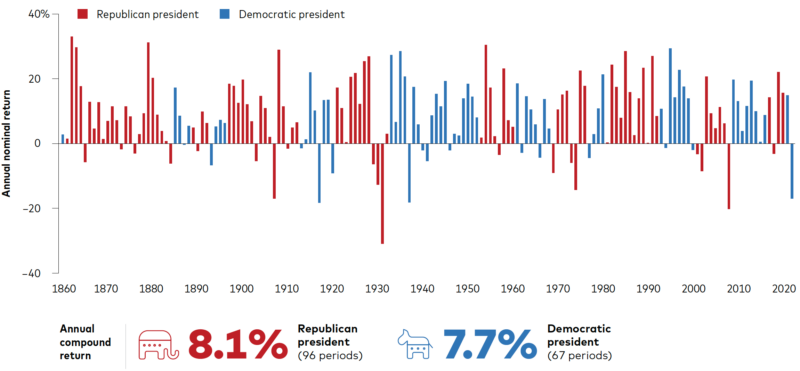

As we near the presidential election, a question often asked is how will the outcome of the election impact my investment portfolio? To help answer this question, we can turn to research from Vanguard examining how market performance compares over the past 160 years based on the presidential political party. Thus, we can use history to help guide our expectations for returns based on who becomes president:1

- Republican vs. Democratic: It may come as a surprise, but the average annual return for a 60/40 stock-bond portfolio is about the same, close to 8% per year, whether a Republican or a Democrat president is in office.

- Diversification Wins: What is perhaps more important from the chart is that positive years greatly outnumber the negative ones over the full time period. This would suggest that it is always a good idea to be invested rather than moving to cash, and it is always a good idea to be diversified by investing in a variety of asset classes such as a mix of stocks and bonds.

- Presidential Elections Shouldn’t Dictate Your Investment Decisions: The presidential race creates some sensation headlines and uncertainty, which often leads to market volatility. But, as history suggests, the markets don’t care who is president. The data shows that the differences in performance are not statistically significant. But what is significant, is tuning out the noise while staying invested and diversified for the long-term.

Stay diversified, my friends.

Presidential Political Party vs. 60/40 Portfolio Returns

Annual Returns 1860-2020

Sources: Vanguard calculations, based on data from Global Financial Data (GFD) as of December 31, 2022. The 60% GFD US-100 Index and 40% GFD US Bond Index, is calculated by GFD. The GFD US-100 Index includes the top 25 companies from 1825 to 1850, the top 50 companies from 1850 to 1900, and the top 100 companies by capitalization from 1900 to the present. In January of each year, the largest companies in the United States are ranked by capitalization, and the largest companies are chosen to be part of the index for that year. The next year, a new list is created and chain-linked to the previous year’s index. The index is capitalization-weighted, and both price and return indices are calculated. The GFD US Bond Index uses the U.S. government bond closest to a 10-year maturity without exceeding 10 years from 1786 until 1941 and the Federal Reserve’s 10- year constant maturity yield beginning in 1941. Each month, changes in the price of the underlying bond are calculated to determine any capital gain or loss. The index assumes a laddered portfolio that pays interest monthly. Notes: Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Source:

- “Presidential elections matter but not so much when it comes to your investments,” Vanguard Group, Sept. 5, 2024

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock