So Much News, So Little Time

November 8, 2024

Less Uncertainty Makes Way for Fundamentals

Download the 11.8.24 Dynamic Market Update Presentation for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Let’s start with the bad news, the S&P 500 index has had back-to-back weekly losses. That said, the index still holds a solid return of over 21% through the end of last week (11/01/24).1 Much of the market volatility has been driven by uncertainties surrounding the presidential election and potential interest rate decisions from the Federal Reserve (Fed). Additionally, we have had weaker economic data reported and mixed earnings releases from big tech companies.

It’s important to remember that there is often short-term market volatility driven by news headlines, but in the long-run the market cares more about fundamentals. Let’s review some of the latest releases and evaluate if the market reactions were warranted:

- Corporate Earnings: It was a huge week for earnings releases, and we have now had 70% of S&P 500 companies reporting earnings, according to Factset.2 While the popular tech stocks dominated the headlines, the breadth of strong earnings is the real story, with 75% of companies across many sectors posting positive earnings surprises.3 We are on track for a year-over-year earnings growth rate of 5.1%, marking in the fifth consecutive quarter of growth.4

- U.S. Labor Market: The non-farm payrolls for October, reported by the U.S. Bureau of Labor Statistics, came in at a measly 12,000—versus expectations of over 100,000.5 But these figures were largely skewed by last month’s hurricanes and labor strikes. If we look at the unemployment rate, a more stable measure of labor market strength, it remained unchanged and in line with expectations at a healthy 4.1%.6

Another factor which leads to volatility is uncertainty. Well, two huge uncertainties were alleviated this week, let’s review:

- Presidential Election: The results are in, and we have a new president in Donald Trump. As we discussed in a recent commentary, the elected president, or their political party, do not have a significant impact on investment returns. But what is helping boost markets is the simple fact that we now have an answer, and the uncertainty is removed.

- Fed Interest Rate Decision: A couple days after the election, the Fed lowered interest rates by 0.25% to a target range of 4.50%-4.75%.7 There was uncertainty over the cut leading up to the decision over fears that inflation and the economy may heat up again after the last oversized “double-cut” of 0.50%.8 These fears were abated as Fed Chair Jerome Powell reassured investors that the economy, labor market and inflation are all moving in the right direction, toward a more neutral stance.9

After reviewing the key variables driving recent market moves, it appears that we are in good shape as we get close to the holidays, which are often seasonally strong periods for the markets.

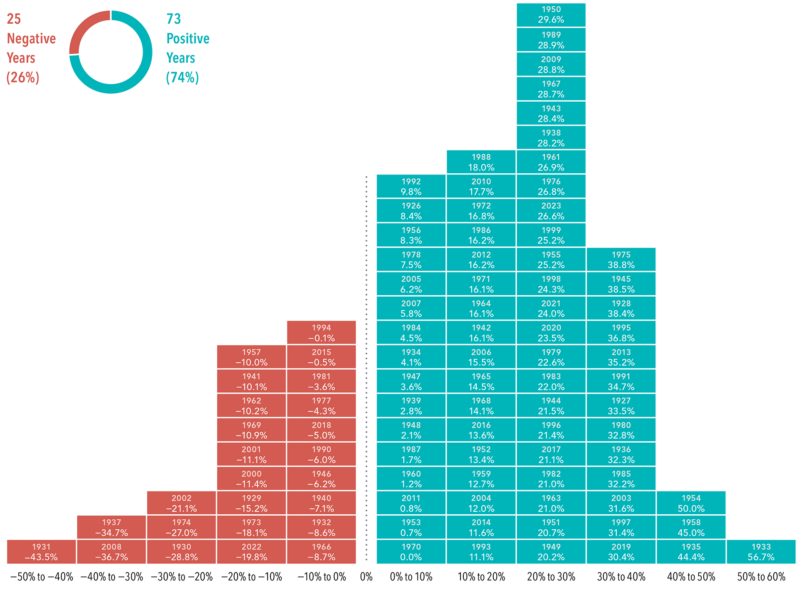

Stock Market Return Distributions Favor Investors

As we discussed in the last market update, we are on track for a historic occurrence of back-to-back annual returns of over 20% for the stock market.10 But how rare is a return of over 20% in a given year? Let’s take a look at the distribution of annual market returns back to 1926 to see the range of returns the market provides. Key observations include:

- More Ups Than Downs: The data shows that about three-fourths of the time, the annual market return is positive. This is reassuring for investors who find downturns particularly painful. But this reinforces the idea of staying invested for the long-term, as returns may be more rewarding over longer period

- Double Digit Average: The highest frequency of positive returns happens to be 20%-30%. The highest frequency of negative returns is a smaller -10%-0%, and it is about half as frequent. This suggests the market favors stronger upside potential, additionally reinforced by the market average over the entire period of a positive 10%.

- Returns Are Unpredictable: While markets favor positive returns, negative returns do happen, and some are quite large with six occurrences of drops over 20%. The best way to defend against market drops and make the investment experience less painful, is to invest in a diversified portfolio with a variety of asset classes which may provide a smoother ride over the long-term.

Stay diversified, my friends.

Total Stock Market Annual Return Distribution

(1926-2023)

Sources: Dimensional. Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In USD. Return in 1970 was 0.002%. CRSP data provided by the Center for Research in Security Prices, University of Chicago. The CRSP 1–10 Index measures the performance of the total US stock market, which it defines as the aggregate capitalization of all US securities listed on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Source:

- “Market Performance Summary as of November 1, 2024,” Wespath, Nov. 1, 2024.

- “S&P 500 Earnings Season Updates: Nov. 1, 2024,” FactSet Research, Nov. 1, 2024.

- “S&P 500 Earnings Season Updates: Nov. 1, 2024,” FactSet Research, Nov. 1, 2024.

- “S&P 500 Earnings Season Updates: Nov. 1, 2024,” FactSet Research, Nov. 1, 2024.

- “Employment Situation Summary,” Bureau of Labor Statistics, Nov. 1, 2024.

- “Employment Situation Summary,” Bureau of Labor Statistics, Nov. 1, 2024.

- “Federal Reserve Issues FOMC Statement,” Board of Governors of the Federal Reserve System, Nov. 7, 2024.

- “Major brokerages expect 25 bps of Fed rate cuts in November,” Reuters, Nov. 7, 2024.

- “Federal Reserve Issues FOMC Statement,” Board of Governors of the Federal Reserve System, Nov. 7, 2024.

- “Stocks head towards something that hasn’t happened since the days of the dot-com bubble,” MarketWatch.com, Sept. 28, 2024.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock