By Lucas Felbel, CIMA®, Director, Portfolio Services As Thanksgiving descends upon us in the U.S., Canadians (myself included) celebrated the holiday in mid-October, coinciding with the final farmers’ harvest. Simultaneously, the financial world experiences its own harvest season in October, Tax-Loss Harvesting (TLH) season. As we approach the conclusion of 2023, financial advisors engage in […]

Download the 11.10.23 Dynamic Quarterly Investing Insite for advisors’ use with clients By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management “The world has just changed so radically, and we’re all running to catch up. I don’t want to jump to any conclusions, but look… Dinosaurs and man, two species separated by 65 million […]

Download the 10.27.23 Dynamic Market Update for advisors’ use with clients By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management Trick or Treat: Rising Bond Yields Happy Halloween! Both stock and bond markets have seen an increase in volatility recently as the iconic 10-year Treasury yield crossed the 5% level for the first time […]

Download the 10.20.23 Dynamic Bond Market Update for advisors’ use with clients By Bill Smith, Fixed Income Trader and Portfolio Manager Fixed Income Volatility Remains High Yields continue to rise in October as a strong labor market, inflation above the Fed’s 2% target and increased Treasury supply reinforce the “higher for longer” rate narrative. High […]

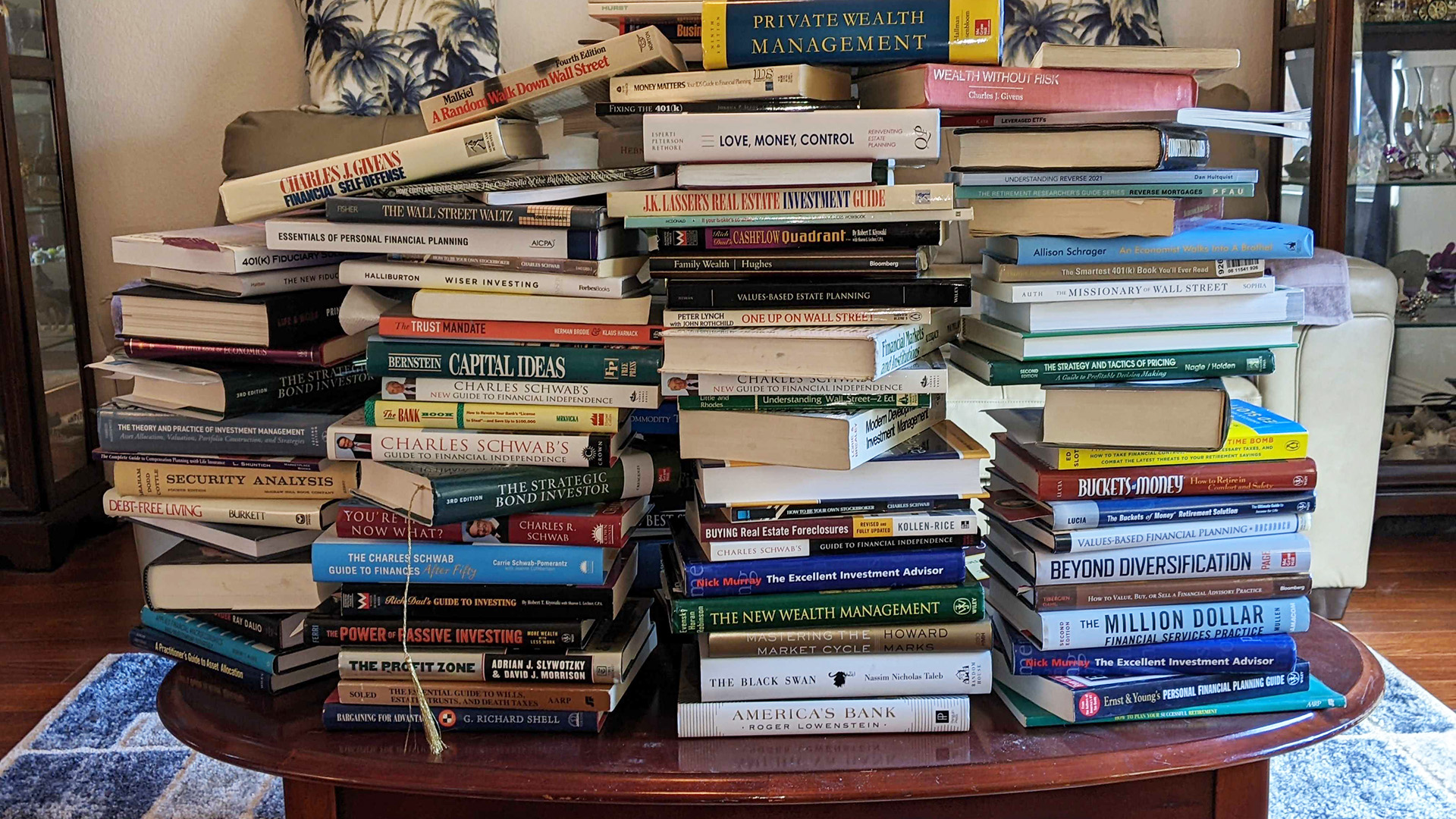

Unlock Knowledge and Intentionality with 16 Invaluable Books By Craig Morningstar, Chief Operating Officer In the realm of financial planning, a multifaceted tapestry of wisdom and principles intertwines with the intricate nuances of individual aspirations and financial landscapes. It is a discipline where monetary artistry meets the profound spectrum of human experience. And where practitioners […]

Download the 10.13.23 Dynamic Market Update for advisors’ use with clients By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management The Great Debt Debate Happy Friday the 13th! But more importantly, Happy Birthday to me! It’s a fun birthday to have during Halloween month. Speaking of scary times, recent headlines have been heavy with […]