Bond Market Update – June 2024

June 28, 2024

Download the 6.28.24 Dynamic Bond Market Update for advisors’ use with clients

By Bill Smith, Fixed Income Trader and Portfolio Manager

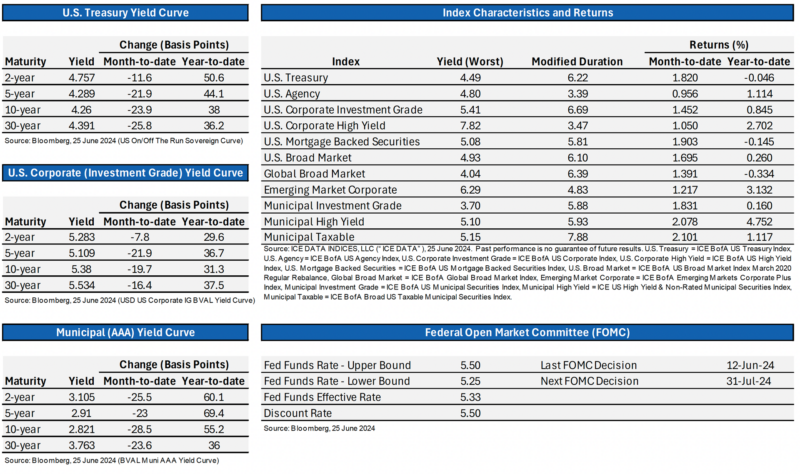

Prices are up and yields are down across major fixed income indices this month as softer U.S. economic data strengthened the case that interest rates have likely peaked this cycle. The Bureau of Labor Statistics reported that unemployment ticked up to 4%, its highest level in over two years, while inflation cooled for a second consecutive month. In a widely anticipated move, the Federal Reserve (Fed) held interest rates steady in June, noting “modest further progress toward the Committee’s 2 percent inflation objective” but that greater confidence is needed before interest rate cuts can begin. High-yield municipal, high-yield U.S. corporate, and emerging market bonds continue to outperform this year, while U.S. Treasuries and mortgage back securities continue to lag. The charts below summarize the yield changes and performance of select fixed income tenors and indices as of June 25.

[Click on image of charts and graphs to enlarge.]Past performance is no guarantee of future results.

Interest Rate Snapshot

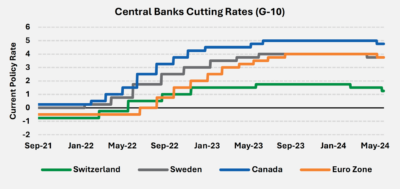

The Central Bank Easing Club has some new members. On June 5, Canada became the first G-7 country to cut interest rates—4.75% from 5.00%—in 2024, followed by a cut from the European Central Bank on June 6—3.75% from 4.00%. Including the cuts already seen in Switzerland and Sweden, a broad pivot from tightening to easing appears to be well underway.

Source: Bloomberg, 25 June 2024. Past performance is no guarantee of future results.

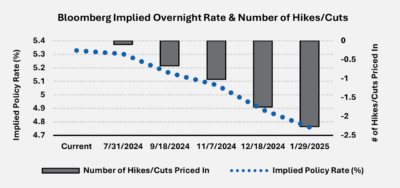

Expectations for a U.S. rate cut in 2024 remain high. Bloomberg’s interest rate probability model, which analyzes the Federal Funds futures market, currently estimates a 100% probability of a rate cut by November. This is roughly in line with the Fed, which expects 25 basis points of easing this year, according to the median “Dot Plot” projections released in June.

Source: Bloomberg, 25 June 2024. Past performance is no guarantee of future results.

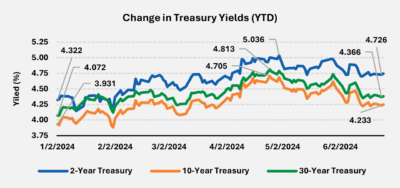

Treasury Market Snapshot

Treasury yields are trending lower. After a weak start to the year that saw yields on 2, 10 and 30-year Treasuries increase by over 70 basis points, U.S. government bonds are finally seeing increased demand. The rally that started in May continued into June, with yields collapsing 30-45 basis points across those same tenors as of the 25.

Source: Bloomberg, Bloomberg Intelligence. Past performance is no guarantee of future results.

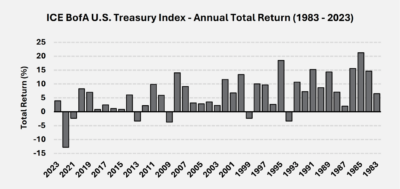

The ICE BofA US Treasury Index’s YTD performance has improved since yields started trending lower in May. As of June 25, the index is within 5 basis points of turning positive for the year. Years with negative total returns are historically rare in the Treasury market, with just six recorded in the last 40 years from 1983 to 2023.

Source: ICE DATA INDICES, LLC (“ICE DATA”), 25 June 2024. Past performance is no guarantee of future results.

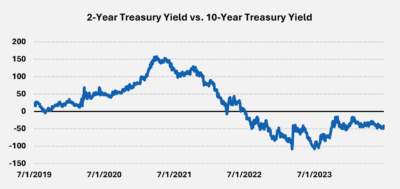

The Treasury curve remains deeply inverted. The two-year Treasury has yielded more than the ten-year since July 2022, making this the longest 2/10 curve inversion in history and the longest on record without a recession.

Source: Bloomberg, 25 June 2024. Past performance is no guarantee of future results.

A prudent approach to fixed income investing calls for diversification across both credit and duration exposure. As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating fixed income for your clients, please contact Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Bill Smith serves as president, Portfolio Management & Trading, of Harmont Fixed Income in Phoenix.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way. Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock