We put risk management first in strategically designing global, well diversified, balanced portfolios that are focused on the long-term.

All strategies range from 100% to 30% equity in 10% increments.

Investment Objective

The primary objective of Dynamic ESG is to maximize long-term risk-adjusted returns while allocating to a broadly diversified variety of asset classes utilizing ETFs.

Investment Approach

Utilize non-proprietary ETFs to invest in Environmental, Social and Governance (ESG) equity and fixed income exposures with lighter portfolio tilts and broader asset class exposures.

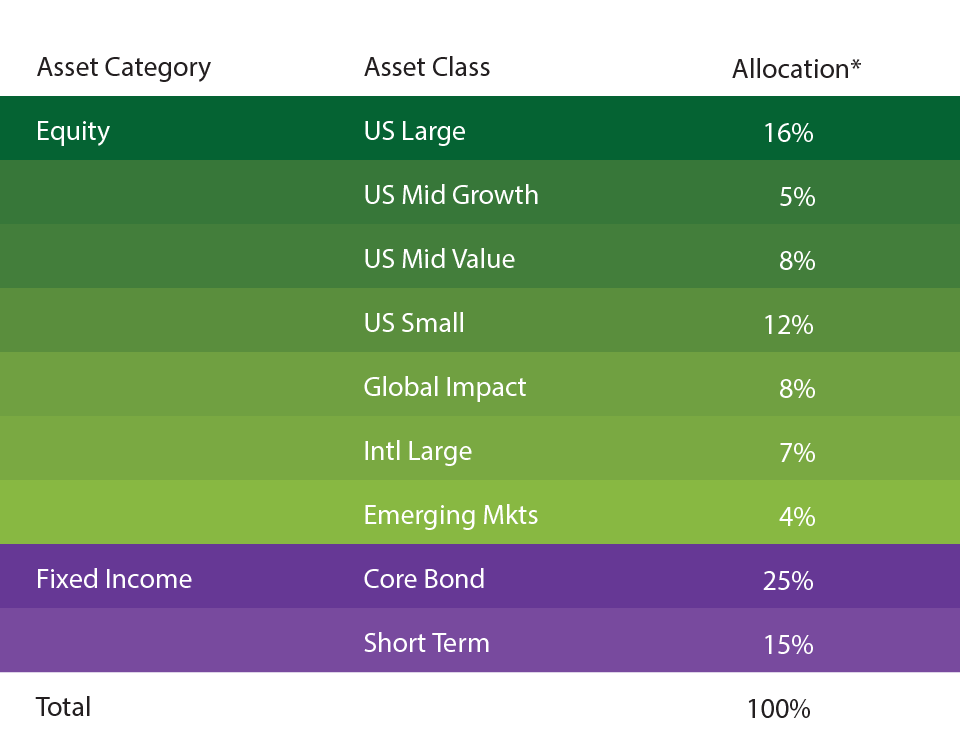

Asset Class Breakdown 60/40

*For illustrative purposes only. Allocations are subject to change.

Why ETFs?

- Lower cost: ETFs typically offer a significant cost savings relative to mutual funds.

- Tax efficiency: ETFs typically distribute fewer capital gains than mutual funds.

- Transparency: ETFs typically report their holdings daily and track an index, providing stability in exposure and risk.

What is ESG?

ESG is an innovative view of values-based investing that utilizes an inclusionary methodology (as opposed to simply excluding “sin stocks”) to select companies exhibiting favorable traits in three distinct categories:

- Environmental: A focus on the conservation of the natural world. Including: Climate change and carbon emissions, air and water pollution, energy efficiency, waste management, water scarcity, etc.

- Social: A focus on the consideration of people and relationships. Including: Gender and diversity in the workplace, customer satisfaction, data protection and privacy, labor standards, community relations, etc.

- Governance: A focus on enhancing the standards for running a company. Including: Board of directors’ composition, audit committee structure, bribery and corruption, executive compensation, lobbying, etc.

Why ESG?

Research has shown that companies focused on ESG factors tend to be higher quality in nature, provide increased stability and potentially outperform over time, all while making our world a better place.

- Higher Quality: More stable and profitable companies tend to share certain ESG characteristics, such as having excess cash to spend on environmental improvements, caring about employees and having diversified boards that keep all stakeholders in mind.

- Lower Risk: Companies with higher ESG standards tend to have confident, experienced leaders that can weather market downturns and potentially avoid lawsuits from financial and environmental wrongdoing.

- Enhanced Risk-Adjusted Returns: Companies doing “good” for the world tend to do well financially. Such companies are often higher quality and can avoid unique risks across various market cycles, ultimately having higher potential to outperform over the long-term.

Carbon Footprint

A hypothetical investment in the Dynamic ESG 100 strategy represents an annual reduction of close to 4 million metric tons of greenhouse gas emissions, representing a 60% reduction, compared to a global stock market benchmark.* This reduction is equivalent to:

503,481

Homes’ energy use

888,967

Gasoline-powered cars driven for one year

1,382,288

Tons of waste recycled instead of landfilled

66,054,560

Tree seedlings grown for 10 years

485,939,503,134

Homes’ energy use

*Source: Carbon emission data from Morningstar Direct as of 3/31/2023. Carbon emission equivalencies from United States Environmental Protection Agency (EPA) (epa.gov). Benchmark comprised of 75% iShares Russell 3000 ETF and 25% iShares MSCI ACWI ex-US ETF. For illustrative purposes only. Data subject to change.

What Sets Us Apart?

People

Dedicated team helps advisors grow their practices with direct access to professionals in portfolio management and trading.

Philosophy

Risk-focused philosophy aims to deliver balanced portfolios to achieve consistency of returns and ultimately, better client outcomes.

Process

Disciplined, focused and rules-based investment framework supports asset allocation, security selection, investment themes, rebalancing and trading.

Contact Dynamic for your free consultation

Schedule a demo today to find out more and meet the team!

(888) 997-4212

Click for Dynamic’s Form CRS (Client Relationship Summary) and Dynamic’s ADV Firm Brochure. For additional information click here.

The material in the website has been distributed for informational purposes only. The material contained in this website is not a solicitation to purchase or sell any security or offer of investment advice. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed. No part of this website may be reproduced in any form, or referred to in any other publication, without express written permission.

Dynamic Wealth Advisors provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Dynamic Wealth Advisors is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.

Information about your visits to our website. We store records of the activities on our sites in our web server logs, which automatically capture and save the information electronically. The information we collect helps us administer the site, analyze its usage, protect the website and its content from inappropriate use, and improve the user’s experience.

Dynamic Advisor Solutions, LLC dba Dynamic Wealth Advisors is an SEC registered investment advisor. Investment advisory services are offered through Dynamic. You can learn more about us by reading our ADV. You can get your copy on the Securities and Exchange Commission website. See https://adviserinfo.sec.gov/IAPD by searching under crd #151367. You can contact us if you would like to receive a copy by calling 877-257-3840 x720.