Market Update: A Glimpse of a Future

June 21, 2024

Download the 6.21.24 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Rate Cut Expectation Updates

The market continues its great run this year with the S&P 500 Index actually breaking 5,500 for the first time ever. We had several big data releases recently with some surprises. Some good, some bad, but ultimately, signs continue to point toward interest rate cuts in 2024. Let’s review some of the latest numbers:

- Inflation Below Expectations—Positive for Rate Cuts Sooner: May Consumer Price Index (CPI) came in at 3.3% annual growth, lower than expectations of 3.4% while Core CPI (less food and gas) was at 3.4% versus expectations of 3.5%. Most of the inflation data this year has been coming in above expectations, so this was a welcome turn of events given the Federal Reserve (Fed) needs inflation to drop in order to initiate rate cuts.

- Economic Softness—Positive for Rate Cuts Sooner: May Institute of Supply Management Manufacturing Purchasing Manager’ Index (PMI), an indicator of economic activity, came in at 48.7, lower than expectations of 49.6. Anything below 50 indicates economic contraction. A softening of the economy is needed to lower inflation and help support interest rate cuts from the Fed—bad news is sometimes good news.

- Federal Reserve June Meeting—Mixed for Rate Cuts: The Fed released their quarterly expectations for interest rates called the “dot plot.” Their projection for interest rate cuts in 2024 dropped from three cuts projected in March, to now only one cut. That said, their long-term interest rate projection stayed consistent with 3.1% by 2026. While the pace of the rate cuts may be less certain, it’s reassuring the end-goal remains the same as we look toward 2025 and beyond.

In terms of impact to the markets, when the CPI data was released both stocks and bonds were up. More importantly, a couple of more beaten-up asset classes such as real estate and small caps stocks outperformed. This could be a prequel of more to come after the interest rate environment reverses.

The Magnificent Seven

We often see headlines that growth stocks are outperforming, or technology companies, but in reality, the market performance has largely been driven by seven stocks both in 2023 and so far in 2024. These seven stocks have been cleverly termed The Magnificent Seven. These companies can attribute a lot of their success to being the biggest beneficiaries of the surge in artificial intelligence (AI) investment. Nvidia, a computer chip manufacturer, is perhaps the biggest beneficiary: up 144% year-to-date, after gaining 239% last year.

But the outperformance of these companies has led to significant divergences with other companies. The longer that these divergences continue, the higher the odds of a larger selloff when these “magnificent” companies inevitably lose momentum. This creates risk due to several factors:

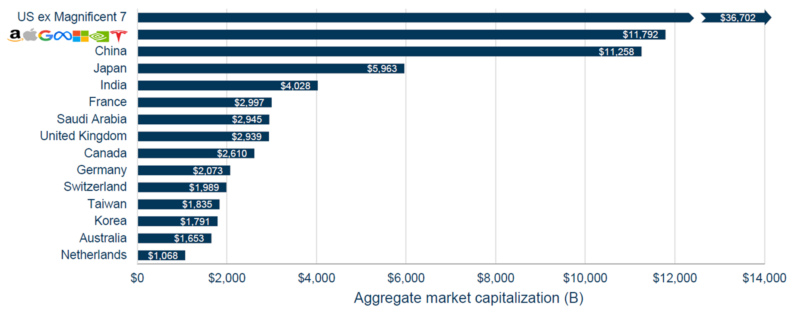

- Concentration Risk: As the chart below depicts, broad market performance has been concentrated in several companies, which now represent about a third of the U.S. market. In fact, those seven companies have a larger total market cap than most countries around the world. If these companies begin to lose momentum, it could have a significant impact on broad-market focused strategies.

- Markets are Cyclical: No single asset calls can outperform indefinitely. Historically, the top performers don’t stay on top for long. As the Magnificent Seven stocks become overvalued, it increases the probability for underperformance. It also creates an opportunity of outperformance for undervalued areas of the market, including smaller and value companies.

- Future Expectations: Aside from attractive valuations, small and value stocks have the potential to outperform as the Fed plans to lower interest rates soon. Regardless, diversification is a wise policy because an allocation to a variety of asset classes that may not always move in the same direction helps diversify portfolio returns and supports a smoother ride over the long-term. As an old adage goes, “if everything in your portfolio is working, you aren’t diversified”.

Stay diversified, my friends.

The Market Capitalizations of the Magnificent Seven in Perspective

(As of 12/29/2023)

Source: Research Affiliates, LLC.; Schwab Asset Management; market capitalizations data based on Morningstar Global Markets Index (USD), as of December 29, 2023. For the purposes of this chart, the Magnificent 7 represents the combined market capitalizations of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. This hypothetical example is only for illustrative purposes. For additional information, see The Charles Schwab Corporation Index and Investment Term Definitions page.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock