Market Update: Are We in a Bull Market?

June 9, 2023

Download the 6.9.23 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Another Goldilocks Jobs Report

It may be hard to believe, but the S&P 500 closed out last week (ending 6/2/23) up over 20% from its previous low point set in mid-October. This officially puts us into “bull market” territory (over 20% increase from trough to peak). It’s even more fascinating that we have notched the highest close since last August.

The reason these gains are surprising is because events like the recent debt ceiling debate, the banking crisis in March and Federal Reserve (Fed) interest rate hikes have caused volatility in the markets and increased fear and uncertainty. It’s sometimes hard to tell which way you’re going into a choppy market. Luckily, resiliency is tested over longer time periods and it often wins out for the market.

On the economic front, the biggest news was the jobs report from the U.S. Bureau of Labor Statistics. The key highlights include:

- Jobs Growth – Strong. Non-farm payrolls grew much more than expected in May, rising 339K, while expectations were a relatively modest 190K increase. This is the 29th straight month of positive job growth. Why is this good? It indicates the U.S. economy is still on solid footing and is a sign that we may avoid a strong recession.

- Wage Growth – Lower. Yearly wage growth moderated down to 4.3%. Why is this good? Lower wage growth is supportive of falling inflation and continued movement toward the Fed’s targeted inflation levels.

- Unemployment Rate – Higher. Unemployment rate increased from a 53-year low of 3.4% to 3.7%. Why is this good? It helps to support a decision from the Fed to not increase interest rates further.

It seems like all three bears are in a good spot and Goldilocks is here to stay: moderate economic growth with lower inflation. This further reinforces the view that the Fed may be done hiking rates and the potential that a severe recession can be avoided.

For more clarity, all eyes will be on the June 13 inflation report, which happens to coincide with the next two-day Fed meeting. If inflation continues to come down, as I expect it will, there is low probability of a hike.

The Great Reversal

There has been a rally across all asset classes since the markets reversed to the upside on October 13 (my birthday). That’s quite a different story from the first nine months of the year where is seemed like nothing could go right and all hope was lost.

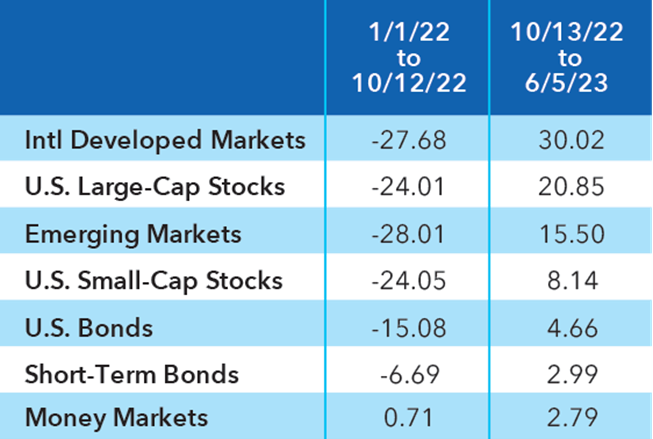

We all know about cyclicality and the benefits of staying diversified and invested, but this last year and a half has put investors to the test. The table below, “Performance of Key Asset Classes,” shows broad based asset class performance before and after the inflection point. Here are the key observations:

- Markets Are Cyclical – What goes down, must come up. History has shown that markets cannot perpetually go down and eventually reverse course. This was very evident over this period as U.S. stocks have almost made up all of their losses from last year.

- Diversification Works – Different asset classes behave differently over different time periods. If you ever find yourself happy with every investment in your portfolio, it means you aren’t diversified. Notice how international developed markets were the laggards prior to the reversal, but have outperformed domestic markets by almost 10% since.

- Cash is Rarely the Answer – Money markets may have seemed like a good investment last year, but if you missed out on any of the reversal, it would paint a different picture. Staying well diversified among the key asset classes and staying invested for the long-term is the key to reaching your investing goals.

Performance of Key Asset Classes

(Before and After the Low in U.S. Stocks 2022)

Source: Morningstar Direct as of 6/5/2023. Intl Developed Markets represented by MSCI EAFE NR USD Index, U.S. Large-Cap Stocks represented by S&P 500 TR USD Index, Emerging Markets represented by MSCI EM NR USD Index, U.S. Small-Cap Stocks represented by Russell 2000 TR USD Index, U.S. Bonds represented by Bloomberg US Agg Bond TR USD Index, Short-term Bonds represented by Bloomberg US 1-5Y GovCredit FlAdj TR USD Index, Money Markets represented by Bloomberg Short Treasury 1-3 Mon TR USD Index. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock