Market Update: Are We in A Recession?

July 22, 2022

By Kostya Etus, CFA®, Head of Strategy, Dynamic Investment Management

Key Economic Updates

1. Inflation Still Elevated – The Consumer Price Index (CPI) in June increased 9.1% over a year ago, above estimates, and at the highest reading since 1981. Inflation is primarily driven by energy, food and housing prices, the key necessities. The market’s negative reaction is due to both persistent inflation and recession fears, the latter of which is fueled by persistent inflation.

Despite the high reading, there are signs that inflation may moderate in July:

- Gasoline prices have come down from their June peak, following oil prices.

- Wheat, soybean and corn commodity futures have also dropped recently.

- Lastly, given higher mortgage rates, home prices are also expected to fall

2. Job Market Still Healthy – Payrolls in June increased by 372,000 and average hourly wages rose by 5.1% from a year ago, both beating expectations, while the unemployment rate remained at a healthy 3.6%. The market perceived this “good news” negatively, as it signaled to the Federal Reserve (Fed) that the economy is still strong and may be resilient to continued rate hikes designed to combat inflation.

What Does this Mean for Economy and Potential of Recession?

Persistent high inflation and aggressive rate hikes from the Fed are certainly headwinds for the economy, and some investors believe that the U.S. is already in a recession. However, there are a few things to consider:

1. What is the definition of a recession?

- A generally recognized definition is two consecutive quarters of economic decline, meaning two consecutive quarterly readings of negative real GDP growth. While nominal GDP in the first quarter of 2022 rose 6.5%, inflation was at 8%, so the real GDP growth was an unexpected -1.5%. It is possible that second quarter real GDP will be negative also (although expectations are for low but still positive growth). However, that would mean we have been in a recession already—and it could be over. Because GDP is a lagging indicator, since the quarterly growth data is only published after the quarter ends, recessions are often only known after the fact—in hindsight.

- The National Bureau of Economic Research (NBER), which officially declares recessions, believed that the “two quarter” definition was a bit nuanced, and instead defines a recession as, “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales.” Well, industrial production has been up this year and, as mentioned, the job market is in great shape. And if Amazon Prime Day was any indication, consumer spending is alive and well. It’s hard to believe that we would call this period a recession.

- If not now, then when?

- While we may not be in a recession now, it doesn’t mean it’s not on the horizon. One signal to watch for to hint a potential recession is the inversion of the three-month Treasury bill interest rate and the 10-year Treasury note rate. Typically, this inversion precedes a recession by 12 to 18 months. If the Fed continues its trajectory of raising rates, we could see this inversion before the end of the year, which could potentially signal for a recession in late 2023.

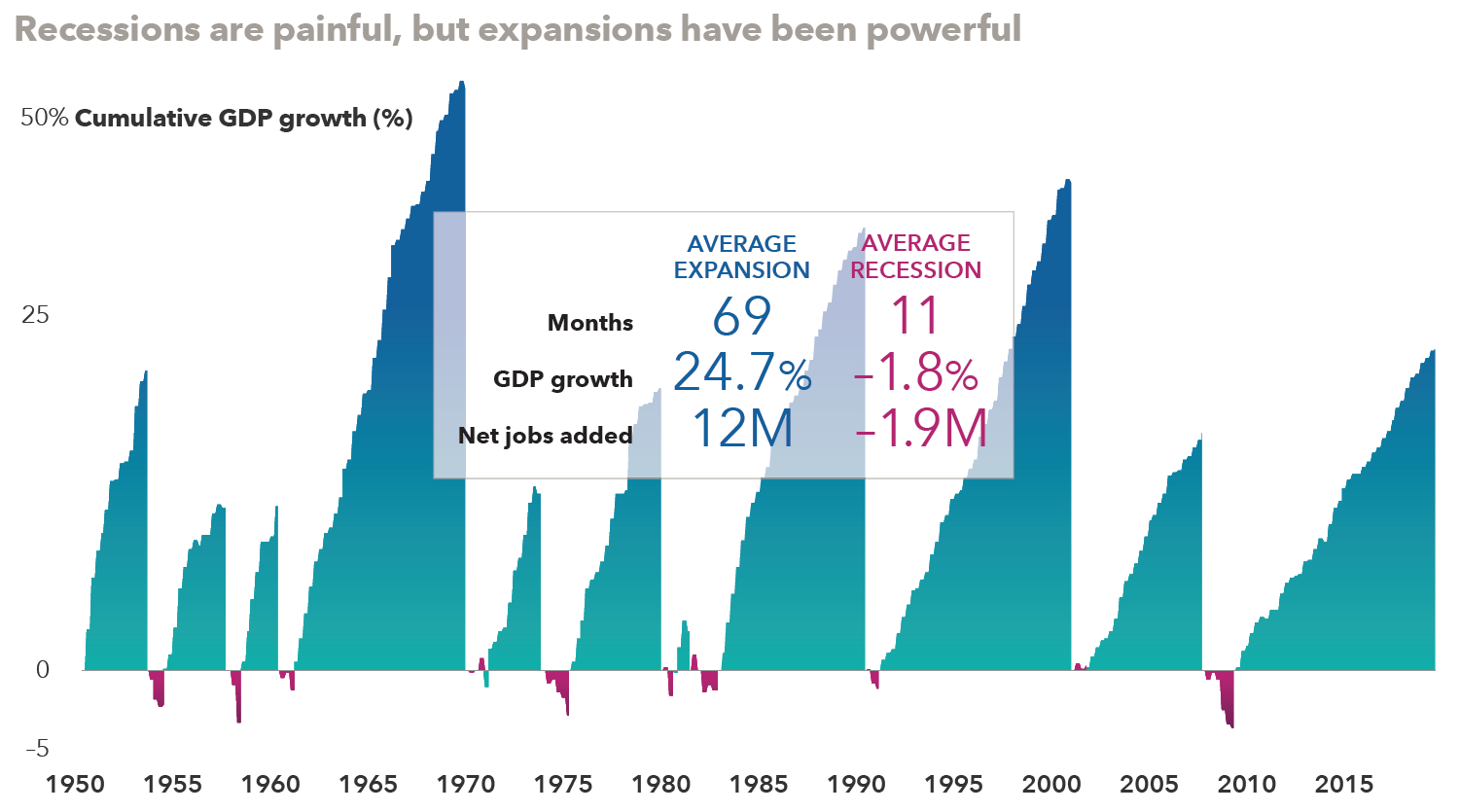

- But it’s important to remember that just like market corrections, recessions are a normal part of a growing economy and not something to be afraid of over the long term. Looking at the chart below, you can see that recessions do happen regularly, but are overshadowed by the overwhelming length and strength of historic expansions. As you can see, the average expansion lasts close to six years (69 months), while the average recession is less than a year. Similar to the stock market, the economy has a strong tendency to go up over the long term, and it’s important to take a step back and look at the big picture.

SOURCES: Capital Group, National Bureau of Economic Research, Refinitiv Datastream. As of 12/31/19. Since NBER announces recession start and end months rather than exact dates, month-end dates are used as a proxy for calculations of jobs added. Nearest quarter-end values used for GDP growth rates. GDP growth shown on a logarithmic scale. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (800) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Roberto Junior