Market Update: Bumpy Road Ahead

January 19, 2024

Download the 1.19.24 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Not ‘If’ but ‘When’

While the S&P 500 remains close to its all-time highs, we have seen some choppiness this year. Much of this is driven by uncertainty around timing of Federal Reserve (Fed) interest rate cuts. The Fed is waiting for inflation to creep down closer to their target of 2%. Thus in 2024, inflation readings may be the most important economic data points to watch.

The first reading of the year for the Consumer Price Index (CPI), a primary measure of inflation reported by the U.S. Bureau of Labor Statistics, was released on Jan. 11, 2024. Key findings are as follows:

- Overall Inflation Up. In a bit of a surprise to market participants, inflation came in higher than expectations at 3.4%, also higher than last month’s reading of 3.1%. While the number is not egregious (keep in mind we started 2023 at more than 6% inflation), it did cause some market volatility as the Fed’s potential reaction to the news cast doubt among investors.

- Core Inflation Down. Core CPI, which excludes the more volatile food and energy prices, continued to slow at 3.9%. The Fed is more concerned with “core” inflation measures as a long-run inflation gauge. The good news: This is the lowest reading in two and a half years. The bad news: We are still about double the Fed’s target level.

- Trend Remains. Bottom line is that inflation is continuing its downward trend, but at a slow pace. Investors will need to be patient; we could be in for a bumpy road ahead as the Fed digests all economic data as it prepares for interest rate cuts in 2024.

The market is currently pricing in an approximately 50% chance of the first rate cut in March. Between now and the March Fed meeting, there are two more inflation readings and two jobs’ reports on the docket. While the decision to cut or not will be data driven, the key takeaway is that lower interest rates are on the horizon and it’s simply a matter of when they will cut, not if.

Cash Isn’t Always King

Interest rates have reached the highest levels since the early 2000s at more than 5% given the Fed’s aggressive rate hiking policy over the last couple years. This has made cash-like investments (such as money market funds and CDs) quite attractive, particularly given their low-risk profiles.

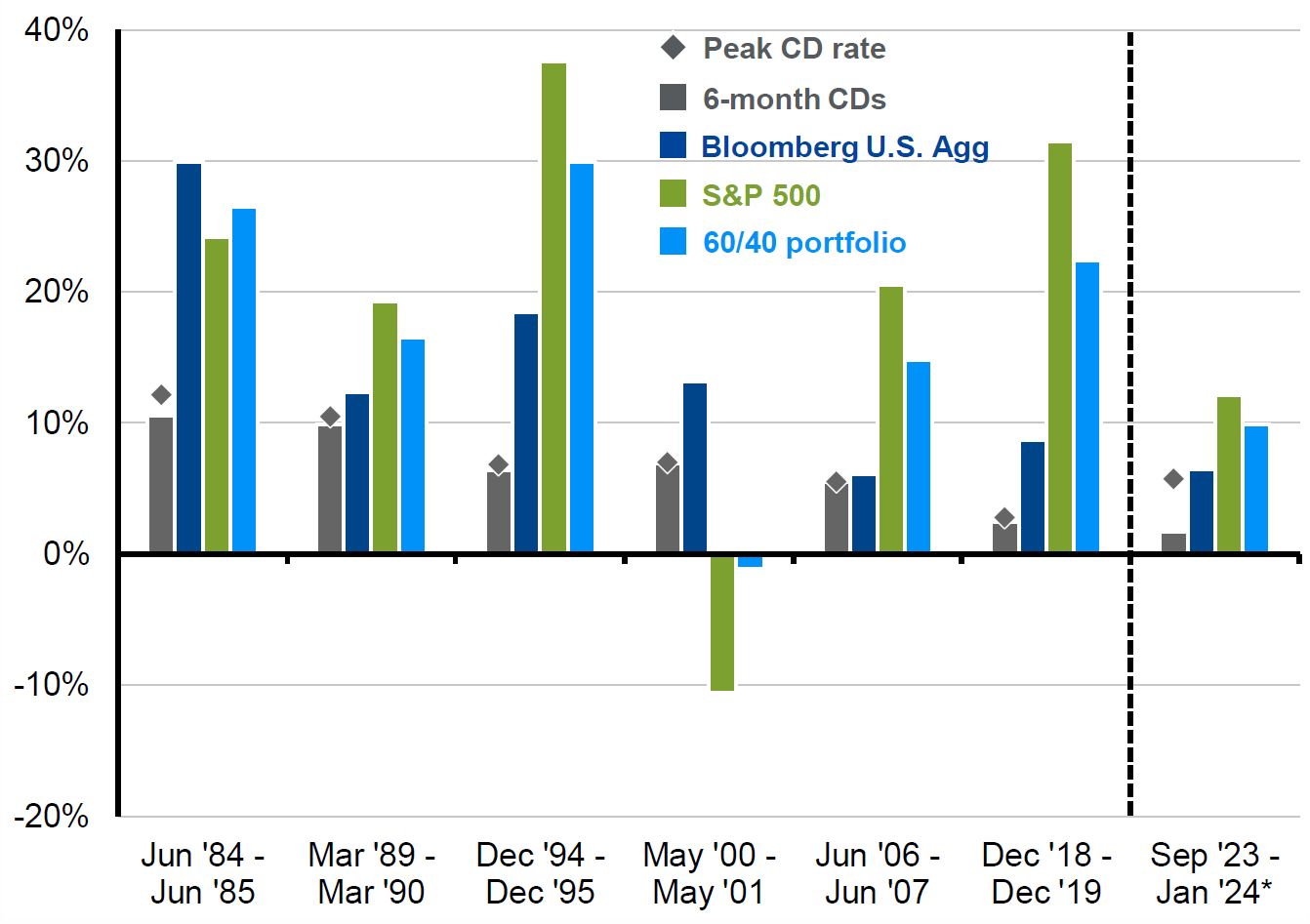

But what happens to these cash-like investments (and others) as interest rates top out? The graph below from J.P. Morgan, “Investment Opportunities Outside of Cash,” helps shed some light on what to expect based on previous rate hiking cycles. As illustrated:

- Stocks Win: The stock market likes it when rates fall. Cash investments do not. Lower interest rates mean it’s easier for companies to borrow money, and thus reduces their costs and improves growth. Cash investments simply pay out short-term interest rates; as rates fall, so do investment returns in lockstep.

- Bonds Win: The bond market LOVES when rates fall. This is simple bond math. As rates go down, bond prices go up. Bonds have faced a couple rough years in the rising rate environment. Now they are spring loaded to rebound in an environment where rates may be falling. We started to see this play out in late 2023.

- 60/40 Wins: Stocks appear to be No. 1, but they’re not always (given the significant drop in one of the years). Stocks are volatile and less predictable, which is why it’s always prudent to diversify your investments and stay balanced with a mix of stocks and bonds. This approach helps investors navigate a variety of unexpected market scenarios.

Stay diversified my friends.

Investment Opportunities Outside of Cash

Peak 6-month CD rate during previous rate hiking cycles and subsequent 12-month total returns

Sources: J.P. Morgan Weekly Market Recap. Bloomberg, Federal Reserve, Robert Shiller, JPMAM. 60/40 portfolio is 60% S&P 500 and 40% Bloomberg U.S. Agg. S&P 500 data prior to 1988 from Robert Shiller. Month-end CD data from the Federal Reserve before 2013 and Bloomberg thereafter. CD return assumes reinvestment at prevailing 6-month rate when initial CD matures. *Return calculated through 1/12/2024. Past performance is not a guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock