Market Update: Christmas Comes Early for Investors

December 15, 2023

Download the 12.15.23 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Gifts from Santa Powell

Both stock and bond markets rallied on Wednesday, December 13, as the Federal Reserve (Fed), led by Chair Jerome Powell, not only held rates steady for a third straight time (as expected), but also surprised investors with an indication of three rate cuts in 2024 (0.25% each). The Fed’s “dot plot” (committee member expectations) also suggested an additional four cuts in 2025 (a full percentage point). The market reaction helped the Dow Jones Industrial Average (Dow) surpass 37,000 for the first time, ever.

This is a nod from the Fed that rate hikes are over. Here are some of the recent developments which may have led to their decisions:

- Healthy Jobs Growth. Nonfarm payrolls, reported by the Labor Department on December 8, rose by 199,000 for November, beating estimates. Meanwhile, the unemployment rate declined to 3.7%, below the previous 3.9% reading in October and below expectations. This was a welcomed relief to alleviate recession fears.

- Lower Inflation Rate. On December 12, the U.S. Bureau of Labor Statistics reported Consumer Price Index (CPI) of 3.1% for November, the lowest reading in five months. As long as inflation continues to inch closer to the Fed’s 2% target level, they have little reason to hike rates further.

- Higher Economic Growth. The U.S. Bureau of Economic Analysis released an updated estimate of third quarter Gross Domestic Product (GDP) growth at 5.2%, higher than the initial estimate of 4.9% and above consensus forecasts from economists of 5.0%. This may have led to the Fed upgrading their GDP growth forecast for 2023 to 2.6%, highlighting the resilience of the U.S. economy.

Overall, a strong labor market is supporting of economic growth while lower inflation supports the idea of lower interest rates in the future. In terms of the markets, a stable-to-lower interest rate environment is supportive for both stocks and bonds (as we saw on Wednesday). Merry Christmas and Happy Holidays!

How’s the View from Up There?

As you know, stock market performance in 2023 has been dominated by a handful of technology companies which were boosted by the artificial intelligence (AI) boom. These companies, which have come to be known as the “Magnificent 7,” now trade at “nosebleed valuations” and as the saying goes, “What goes up, must come down.” That saying tends to be quite prevalent in investing, considering markets of all shapes and sizes are cyclical.

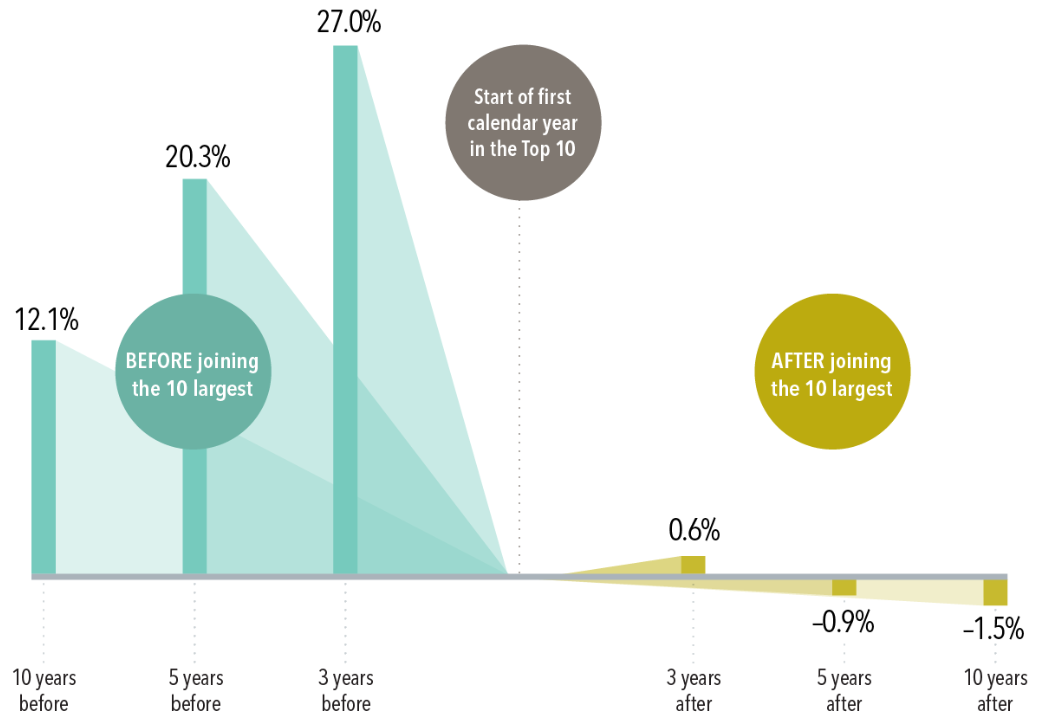

To help illustrate this point, Dimensional Fund Advisors (DFA) has produced a fascinating chart (below) which shows the performance of the top 10 largest stocks each year (relative to the U.S. market) over the past 95 years, before they became the largest, and after. Let’s take a look:

- The Way to the Top is Fun. Before reaching the top 10, we see some magnificent relative returns. In fact, double digit annual outperformance versus the broad market over a 10-year period.

- The Way Down Hurts. But after they reach the top 10, we see a drastic shift and reversal of performance going forward. The 10 years after reaching the top, these companies underperform the broad market by an annualized -1.5%. Thus, the companies in the top 10 may not stay there for too long.

- A Cautionary Tale. This story relates to our often-discussed concept of diversification. Chasing mega-cap stocks means you are always buying high (buying overvalued companies). Diversifying into smaller companies—or within different styles, sectors and regions—helps to lower your risk and to potentially capture the returns of those other hungry, young fighters who may make it to the top 10 in the future.

Stay diversified, my friends.

Performance of Largest U.S. Stocks Before and After Joining the Top 10

Annualized Excess Returns vs. U.S. Market, January 1927–December 2022

Sources: Dimensional Fund Advisors. Past performance is not a guarantee of future results. In USD. Data from CRSP and Compustat. Companies are sorted every January by beginning-of-month market capitalization to identify first-time entrants into the top 10. The market is defined as the Fama/French Total US Market Research Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See “Index Description” for a description of the Fama/French index data. Indices are not available for direct investment. The index has been included for comparative purposes only. https://my.dimensional.com/magnificent-7-outperformance-may-not-continue?_cldee=FNMKOM6rrXoTte07Mmfrk4ZK54XdxZQB4B6ivz0uXvKTjQmF3fXLiMYrqvU8gnvBMd19MTQUXsMFuCbMO9u2eQ&esid=bfdc8e1b-0e99-ee11-be37-000d3a37677b&recipientid=contact-70f8cba14ee6eb11bacb00224804a8e8-4424aa0220084a7dabbc3f4001d0fec9&utm_campaign=US%20Weekly%20Digest%202023&utm_medium=email&utm_source=ClickDimensions

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock