Market Update: Do Bonds Still Matter?

August 18, 2022

Download the 8.19.22 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Head of Strategy, Dynamic Investment Management

Key Q&A

Q. Stocks and Bonds Are Both Down in 2022. Is This a Rare Occurrence?

A. This has truly been a historic year in the markets. Yes, we have experienced a stock market selloff, however as we noted in the June 27th Market Update, Persistent Inflation Leads Fed to Take Action, that’s not new. What’s unique is the bond market sold off at the same time! Through the first half of 2022, the S&P 500 was down close to 20% while the U.S. Aggregate Bond index was down more than 10%. Prior to 2022, both stocks and bonds fell in the same calendar year only three times.

Q. Why is it Rare for Stocks and Bonds to be Down Together?

A. Because these two asset classes are typically uncorrelated with each other (meaning when one goes up, the other goes down). Stocks are generally considered higher risk assets while bonds are more conservative. Thus, when investors are fearful, they typically sell stocks (dropping prices) and buy bonds (raising prices). This traditional offset of performance makes the pairing of stocks and bonds a key component of diversification when considering long-term investing.

Q. What Makes 2022 Unique?

A. The Federal Reserve (Fed) has kept interest rates low since the financial crisis and maintained a loose monetary policy, attempting to increase the money supply and boost economic growth. 2022 has brought us extreme levels of inflation that we haven’t seen in decades caused by multiple factors discussed in the March 15th Market Update, Why is the Fed Raising Rates and What Are the Implications?; the Fed had to make a sudden course correction, shifting to aggressively raising rates and a more restrictive policy to try to curb inflation. The Fed’s actions moved interest rates significantly higher in a short period of time, leading to the extreme drop in bond prices.

Q. Is the 60/40 Dead?

A. The answer is a resounding no. Bonds play a key role in diversified portfolios by providing a ballast to protect from stock market losses. Over the long-term, they bring stability to a portfolio and the ability to better weather significant downturns with potential of the portfolio to rebound more quickly on the way out (investors win by losing less). They also allow an investor to target a more specific risk level that may be most appropriate for their unique situation.

Q. What’s the Outlook for the Bond Market?

A. Bonds are known as a “self-healing” asset class for two important reasons.

1) Bonds are required to pay back their principal at maturity. As interest rates go up and bond prices drop below fair value, the likelihood increases for prices to rebound back to par value as maturity nears. While stock market valuations can persist for long periods of time, bonds are more finite when the value will appreciate.

2) While stock prices are impossible to predict, the current yield is one of the best predictors of future bond prices. As interest rates go up, bond managers are able to invest in bonds with higher yields, thereby increasing their future return potential. The 10-year treasury yield started the year at 1.5% and has since nearly doubled to 3%. Perhaps investors should be happy that rates are rising given future return prospects for bonds (and portfolios as a whole) are now higher.

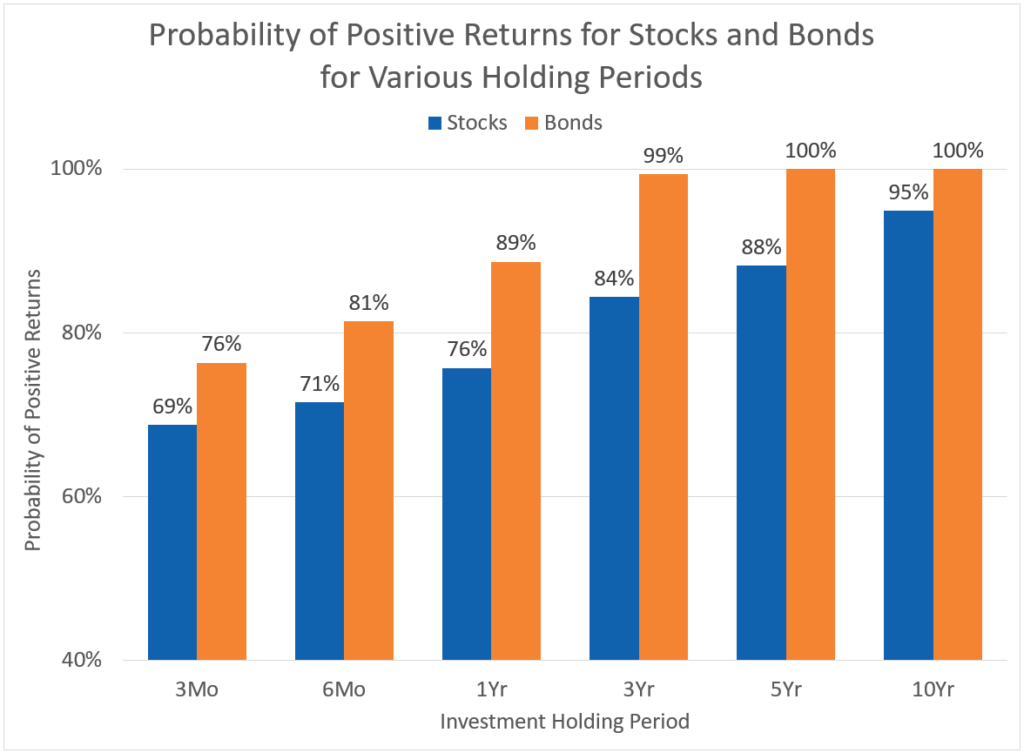

Probability of Positive Returns for Stocks and Bonds

The chart below, “Probability of Positive Returns for Stocks and Bonds for Various Holding Periods,” dates back to 1926 to help understand stock and bond price movements:

· Bonds Have “Almost” Never Had a Negative Three-Year Return. While the stock market is certainly better than a coin-flip over longer time periods, the bond market has the edge in more consistent and stable positive returns. Additionally, it’s important to note that the magnitude of losses is quite different. Looking at the one-year rolling data, for example, we found that the average stock market drop was close to -14% while the average bond market drop was less than -2%. So not only is the bond market up more frequently, but also the size of the losses is considerably lower.

· Whether Investing in Stocks or Bonds, Long-Term Investing Is the Key to Success. Perhaps the most important concept that this graph relays is the benefit of long-term investing. The longer and investor stays in the market, the higher the probability of a positive return. Over a 10-year period, the probability of positive returns for both stocks and bonds is close to 100%.

Source: Morningstar Direct utilizing IA SBBI US Large Stock TR USD Ext to represent Stocks and IA SBBI US IT Govt TR USD to represent Bonds between 12/31/1925 and 7/31/2022. Past performance is not indicative of future returns.

Source: Morningstar Direct utilizing IA SBBI US Large Stock TR USD Ext to represent Stocks and IA SBBI US IT Govt TR USD to represent Bonds between 12/31/1925 and 7/31/2022. Past performance is not indicative of future returns.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (800) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Nicholas Cappello, Unsplash