Market Update: Holiday Gifts for the Stock Market

December 16, 2022

Download the 12.16.22 Dynamic Market Update PDF for advisors’ use with clients

By Kostya Etus, CFA®, Head of Strategy, Dynamic Investment Management

Recent Activity

As we had predicted, despite continued volatility, the fourth quarter of 2022 has been relatively favorable for the stock market as various uncertainties were abated and a healthy consumer market was introduced to the holiday season.

More recently, Christmas came early for investors with the presentation of a few gifts to unwrap. They have been mostly “nice”…

- Gift #1: Reduced Inflation – The Consumer Price Index (CPI), a key measure of inflation, rose by only 0.1% in November, and the annual rate dropped to 7.1%. This was below expectations and the lowest level since the end of last year. This was a healthy sign that inflation could be tempering, which could result in lower interest rate hikes from the Federal Reserve (Fed) and a benefit for the markets.

- Gift #2: Smaller Rate Hike – The Federal Reserve (Fed) hiked the federal funds rate by another 0.50% to a range of 4.25% to 4.50%. This broke the string of 0.75% increases we have had at the last four meetings—one of the most aggressive policies on record. The decrease in hike magnitude indicates that while the fight against inflation isn’t over, there is promise of better days ahead.

- Lump of Coal: More Rate Hikes in 2023 – Fed officials indicated expectations to keep rates higher through next year, with no reductions until potentially 2024. The projected rate of where hikes would end was placed at 5.10%, according to individual Fed member expectations.

Future Outlook

What are the implications of high inflation, rate hikes and an inverted yield curve (short term rates are higher than long term rates)? Often this combination results in an economic recession. The Fed does its best to not overtighten the economy to prevent a recession, but sometimes it’s unavoidable. But more importantly for investors, what is the impact to the stock market?

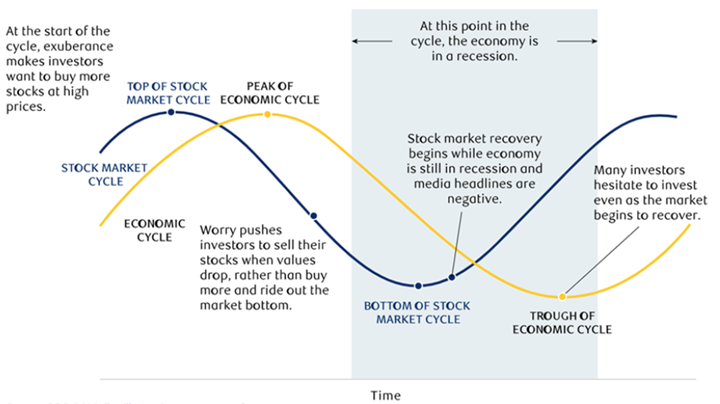

The graph below, “The Stock Market and The Economy: How the Two Cycles are Related,” helps to identify the typical relationship between the economy and stock market. Key ideas include:

- The Economy is Backward Looking. Did you know that we only find out we’ve been in recession after the fact? The National Bureau of Economic Research (NBER) officially declares a recession based on a decline in economic activity, often measured by a variety of data including the Gross Domestic Product (GDP). GDP and other such metrics measure activity over a previous period (i.e., last quarter or year). Thus, by the time the NBER officially announces a recession, it’s typically over. We could be in one right now and not know it.

- The Stock Market is Forward Looking. The stock market is based on expectations for the future and is known as a leading indicator. Investors evaluate expectations about corporate earnings, economic activity, inflation, interest rates and just about everything else to decide where prices should be. Thus, a recession if often “priced” into the stock market before it actually happens.

- How the Two Cycles are Related. To recap, while economic data is backward looking, the stock market is always looking to the future. The market often starts falling well before a recession begins and bottoms out before the economic trough. This means that a market recovery could happen, and often does, during periods of economic weakness. It is possible that in 2022 this “future recession” has already been priced in and we may have seen the market bottom.

The Stock Market and The Economy

How the Two Cycles are Related

Source: RBC Global Asset Management. For illustrative purposes only.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Dynamic Market Update will be on holiday hiatus, returning to its bi-weekly schedule on Jan. 6, 2023. Happy Holidays and see you in the New Year!

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: freestocks, Unsplash