Market Update: Market Performance around Crisis Events

February 24, 2022

By Kostya Etus, CFA® Head of Strategy, Dynamic Investment Management

Download the 2.24.22 Dynamic Market Update PDF for advisors’ use with clients

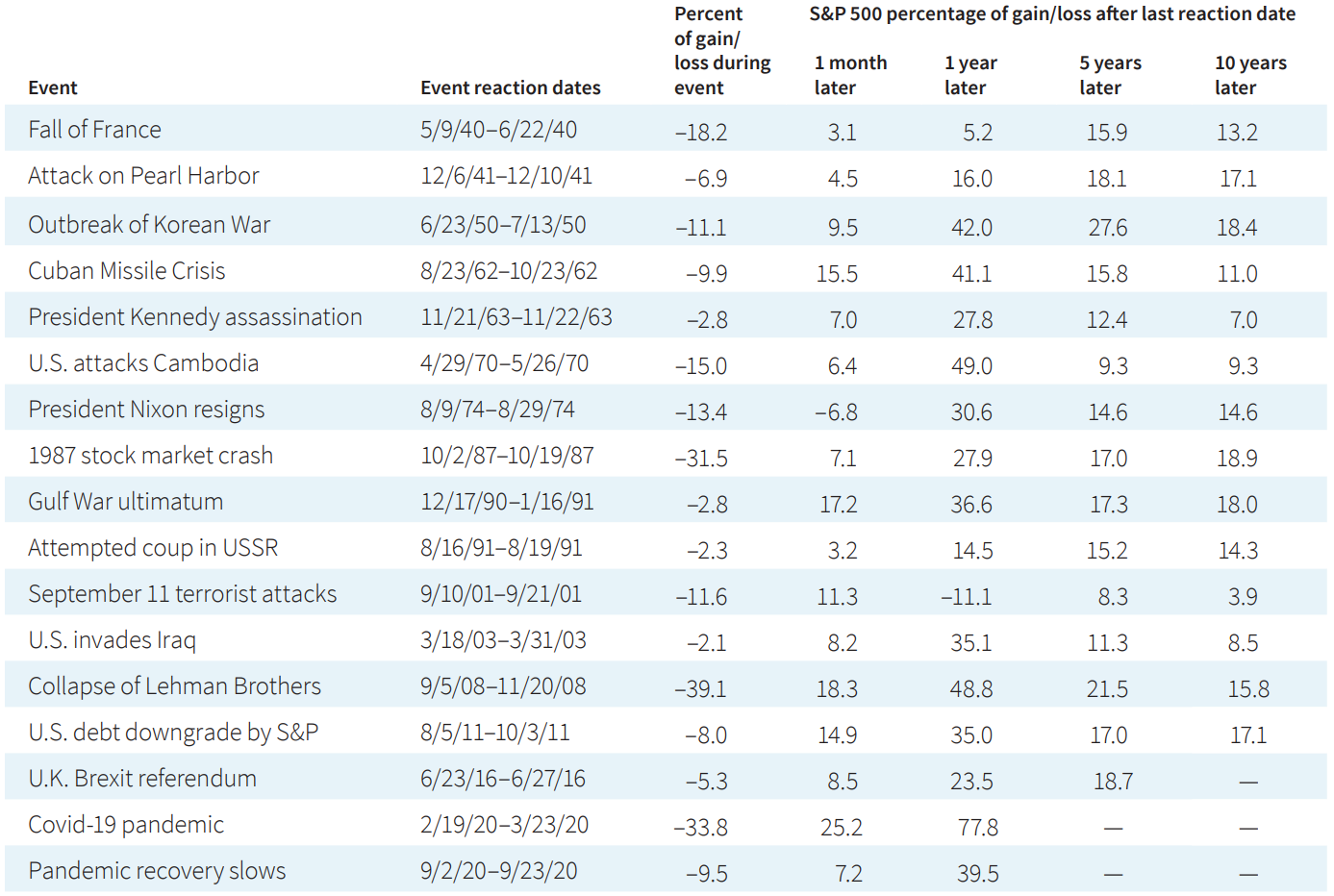

The U.S. stock market (as represented by the S&P 500 Index) fell sharply on Thursday (February 24) after Russia launched military attacks on Ukraine. This marks the fifth consecutive down day for the market and moves deeper into correction territory (more than a 10% drop), down close to 12% since the market peaked at a record high on January 3. As history has shown, while crisis events elicit an emotional response, the stock market has a general resiliency to move upward and crisis events often prelude strong forward market returns. (Please see the chart below, “Crisis and Market Recovery.”)

Current Market Considerations

- Diversification Works: Not every asset class has been down each day. For example, higher quality bonds, defensive stock sectors, U.S. dollar, gold, oil and other diversifying assets have risen in price and helped support diversified portfolio returns. These time periods of market weakness are when portfolio diversification shows its true benefit.

- Bad News is Sometimes Good News: While military conflict is never a good thing, the economic and market disruptions it has caused have led to a silver lining. In this environment, central banks may want to slow their plans for tightening (raising rates) and therefore actually support financial markets in the future.

- Inflation Persists: One thing to be conscious about is that oil and gas prices (as well as other commodities) will be further disrupted, along with continued supply chain problems, adding to already high inflation readings. Given that inflation erodes wealth and could be a headwind to portfolio returns, it will be important to set “real” return expectations.

Future Market Considerations

- “In the short run, the market is a voting machine but in the long run it is a weighing machine.” – Benjamin Graham reminds us to focus on fundamentals. In the short term, there is often market turmoil driven by news headlines and fear. But the long-term backdrop has not changed: Economic and corporate earnings remain strong. Remember that in the long-term, the market is driven by fundamentals.

- “Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffet’s quote leads to the notion that you must try and avoid behavioral biases that lead to poor investment decisions. Given the strong fundamental backdrop and a potentially oversold market, this could be an opportunity to add quality investments at discounted prices.

- “It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.” – Charlie Munger delivers the point that sometimes the best thing to do is “nothing” in the face of market volatility. Being invested in a portfolio based on your risk tolerance and long-term goals, while weathering short term volatility, is the key to investment success.

These situations can be opportunities to engage with clients, especially when they may question their tolerance for risk, to ensure they are appropriately positioned across their portfolios for the longer term. As always, Dynamic recommends staying balanced, diversified and invested. Despite these short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for clients to reach their investment goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (800) 257-3840, ext. 4 or trading@dynamicwealthadvisors.com.

Crisis and Market Recovery

(S&P 500 Index Performance Post Historical Crisis Events)

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. The S&P 500® Index is an unmanaged index of common stock performance. You cannot invest directly in an index. Indexes are unmanaged and used as a broad measure of market performance. Source: Putnam Investments

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. The S&P 500® Index is an unmanaged index of common stock performance. You cannot invest directly in an index. Indexes are unmanaged and used as a broad measure of market performance. Source: Putnam Investments

Photo: Yiorgos Ntrahas, Unsplash

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.