Market Update: Mixed Bag for March

March 15, 2024

Download the 3.15.24 Dynamic Market Update for advisors use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

We Have Good News and Bad News

March has seen some mixed results from the markets and the economy. Both stock and bond markets have exhibited some choppy sessions as investors try and digest available data and Federal Reserve (Fed) rhetoric as to when the first interest rate cut may come. So far, the stance from Fed Chair Jerome Powell is that we are “not far” from gaining confidence needed to begin a rate-cutting cycle. In fact, investors are currently pricing in expectations for interest rates to drop in June.

Ultimately, the Fed is data driven, meaning their decision will largely be driven by economic data in two key areas of employment and inflation. Here’s the most recent data as reported by the U.S. Bureau of Labor Statistics:

- Employment

- Good News: The Non-Farm Payrolls report showed the U.S. economy added 275,000 jobs in February 2024, beating estimates of 200,000. This yet again reinforces the continued health of the labor market.

- Bad News: Last month’s reported figure was revised lower by more than 100,000, and the unemployment rate climbed from 3.7% to 3.9%, approaching the highest rate in two years. Keep in mind, this still results in positive job growth and a historically low unemployment rate, however, we do seem to be seeing some signs of fatigue.

- Inflation

- Bad News: The Consumer Price Index (CPI), a primary gauge of U.S. inflation, unexpectedly increased to 3.2% in part due to energy costs remaining elevated. This may give the Fed some pause as we are not moving closer to their 2% target inflation rate.

- Good News: Core CPI, on the other hand, which doesn’t include the more volatile food and energy prices, decreased to 3.8%, nearing a three-year low. Additionally, part of the employment report indicated a slowdown in wage growth, which could be an indicator of lower inflation in the future.

Overall, while the data was mixed, we appear to be on track for lower interest rates at some point this year. And the continued strength of the labor market with moderate inflation reinforces the notion of a relatively healthy economy. All in all, this provides support for the financial markets moving forward.

Two Bears in Four Years

Can you believe it’s already been four years since COVID? Even more inconceivable, can you believe we have been through two bear markets in that time (more than 20% drops)?

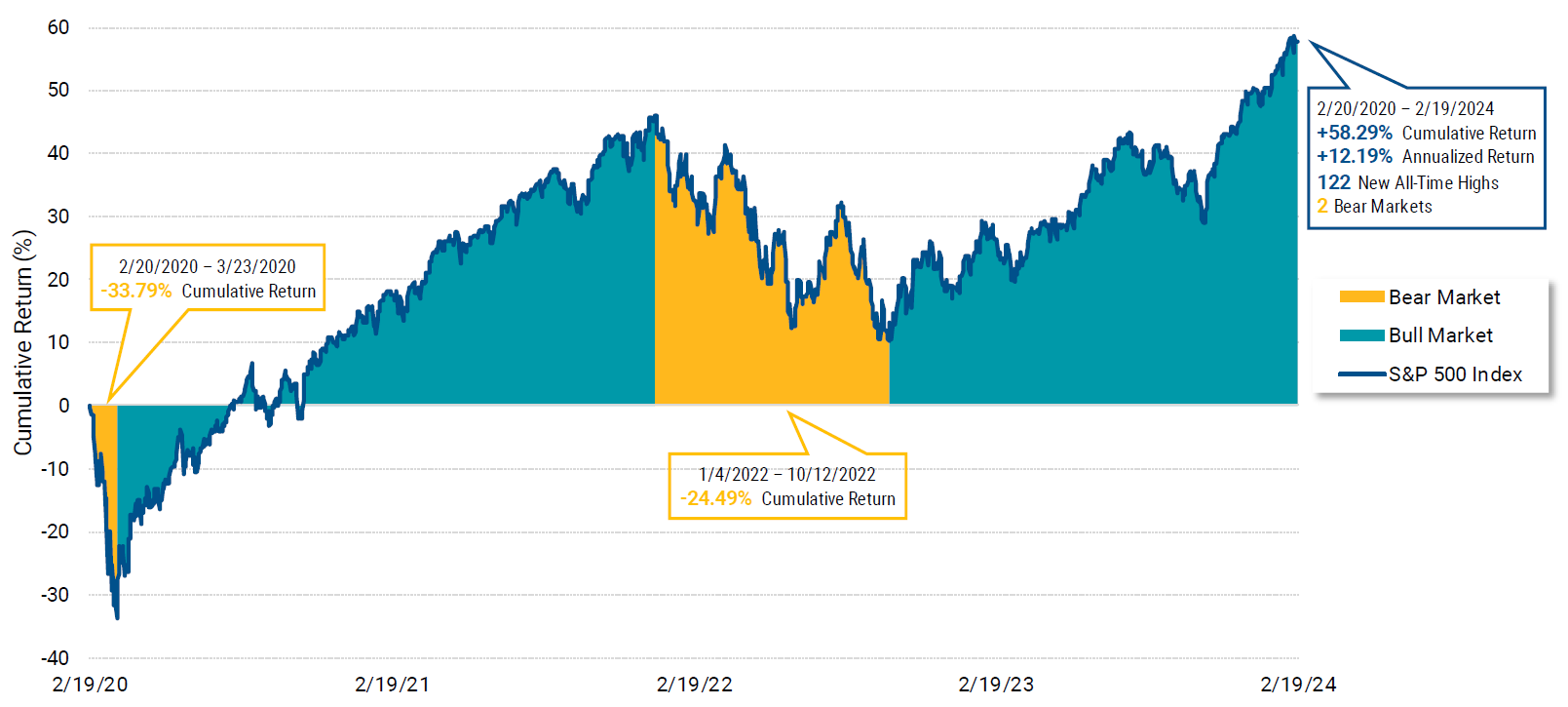

A picture is worth a thousand words and there is no better way to visualize what the market has been through than the chart below, “Four Years of S&P 500 Index Returns Since its Pre-COVID Peak”:

- Bear Market Returns: In the past two years, we had an almost 34% drop in the stock market and then another nearly 25% drop. It’s important to remember that bear markets are normal for the markets. Research shows that a 10% drop or greater happens about year and a half, while a drop more than 20% happens about every six years. So, it shouldn’t come as a surprise when one shows up, and you certainly shouldn’t panic.

- Bull Market Returns: Why shouldn’t you panic? Because bull markets (a rise more than 20%) have historically been longer and stronger than the bears. Looking at the graph is a perfect example of this happening. Furthermore, the amount lost during a bear is often quickly made up.

- Total Period Returns: As long-term investors, we shouldn’t focus on the single tree of shorter time periods, but instead look at the total forest of investment returns. The four years post COVID have delivered market returns of close to 60%, more than 12% annualized. You wouldn’t have wanted to be on the sidelines during any of those times.

Stay diversified my friends.

Four Years of S&P 500 Index Returns Since its Pre-COVID Peak

From Feb. 20, 2020 – Feb. 19, 2024

Source: Avantis Investors, Bloomberg. Data from 2/20/2020 – 2/19/2024. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock