Market Update: More Ups than Downs

January 5, 2024

Download the 1.5.24 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

A Great 2023!

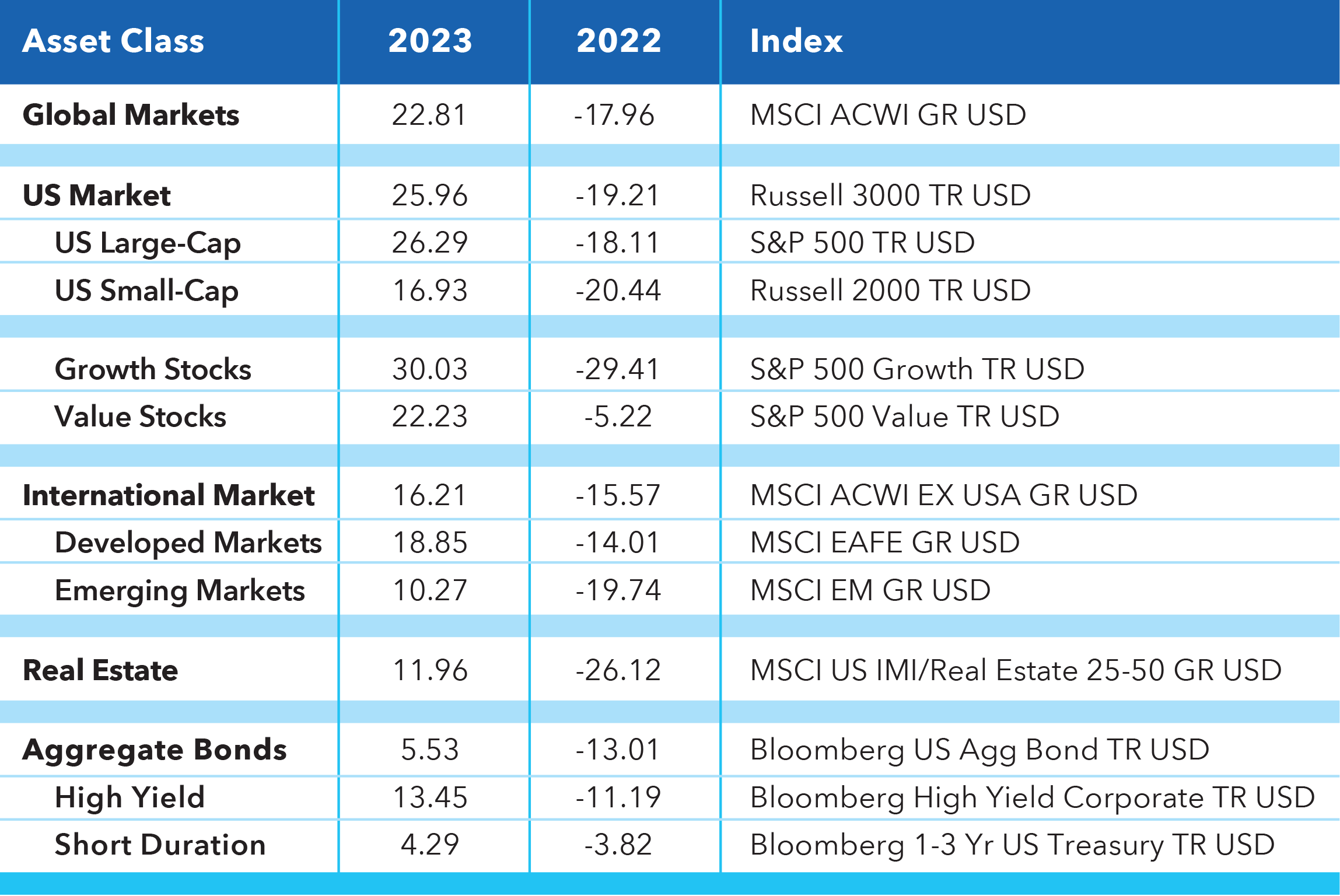

Happy New Year! As we embark on the great journey that will be 2024, let’s reflect on the key market highlights of 2023—as well as how it compares to 2022 to help put things into perspective. See the table below, “What Worked, What Didn’t in the Markets?”

- Stock Market: It was a great year for the stock market in 2023 as the global market was up close to 23%, more than making up for the losses in 2022. A notable performer was the S&P 500 which finished the year strong with nine consecutive positive weeks, the longest winning streak since 2004. But most importantly, all asset classes delivered double digit returns including smaller companies and international stocks, highlighting the strength and breath of the rally we exhibited.

- Bond Market: The losing streak is over! After two consecutive years of negative returns in the bond market (2021 and 2022), we see a positive return in 2023 of over 5%, due primarily to a fourth quarter rebound as interest rates fell based on Federal Reserve (Fed) expectations to lower rates sooner than later in 2024. High yield bonds were the standout performers given a risk-on environment and expectations for a milder recession (if any) in 2024.

- Real Estate: The past few years have been a roller coaster ride for the real estate market. After being a top performer in 2021 (more than 40% return), it was one of the worst performers in 2022. The sector experienced some choppiness in 2023, given continued increases in mortgage rates to levels we have not seen since the early 2000s. However, the real estate market was able to squeeze out a positive return close to 12% in 2023, based on expectations for lower rates in the future.

Looking ahead to 2024, we see a lot of the same tailwinds still intact that pushed 2023 ahead. Notably, the Fed is projected to start cutting interest rates in 2024 as inflation continues to come down and fears of a strong recession subside. This will support growth in stocks, boost bond prices and increase real estate demand.

What Worked, What Didn’t in the Markets?

Source: Morningstar Direct as of 12/31/2023.

What Else Happened?

There wasn’t a shortage of downs in 2023. We had a regional banking crisis to kick off the year, persistently high inflation, increases in interest rates by the Fed, hard landing recession fears, government debt and shutdown concerns, and worst of all, continued geopolitical issues in Ukraine and new ones in Israel.

Despite all the turmoil, there were a lot of ups in the markets. So, how did the stock market end the year up 26%? To help answer this question, see the chart below, “As Much of 2023 that Fits on One Page,” with a plethora of key events overlaid on the S&P 500 returns. Some key takeaways:

- Short-Term Noise: On a day-to-day basis, markets tend to be volatile because they’re driven by investor emotions. These negative market reactions are often led by attention-grabbing headlines. However, they may not be representative of the true impact to the markets.

- Long-Term Fundamentals: After the noise quiets and the dust settles, the market turns to what truly matters: fundamental drivers of returns. Are companies making money? Are consumers spending money? Is inflation coming down? Is unemployment low? Is the economy growing, etc.? The answers to these questions rarely make front-page news, but they are the things the market cares about.

- Stay the Course: The beauty of the markets is that patient investors are the ones most rewarded. Instead of trying to time markets based on the latest news, staying diversified and invested for the long-term is often what leads to better investor outcomes and an increased ability to reach investment goals.

Stay diversified, my friends.

As Much of 2023 that Fits on One Page

Overlaid on S&P 500 Returns

Sources: FactSet, Avantis Investors. Data from 1/1/2023 – 12/29/2023. Past performance is no guarantee of future results. Consumer Price Index (CPI): A commonly used statistic to measure inflation from the consumer’s perspective. The Bureau of Labor Statistics calculates the index from detailed consumer spending information. Changes in CPI measure price changes in a market basket of consumer goods and services such as gas, food, clothing, and cars. Federal Reserve (Fed): The U.S. central bank responsible for monetary policies affecting the U.S. financial system and the economy. Gross domestic product (GDP): A measure of the total economic output in goods and services for an economy. S&P 500® Index: A market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities. Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results. The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any Avantis fund. This information is for an educational purpose only and is not intended to serve as investment advice. References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock