Market Update: The Dangers of Timing the Market

September 30, 2022

By Kostya Etus, CFA®, Head of Strategy, Dynamic Investment Management

Download the 9.30.22 Dynamic Market Update for advisors’ use with clients

Recent Market Activity: Inflation Surprises, Fed Hikes Rates, Markets Fall

- August 13: The Consumer Price Index (CPI), the primary measure of inflation, had a surprise increase of 0.1% for August and 8.3% over the past year while economists were expecting a drop from previous periods. The stock market (as measured by the S&P 500) had an aggressive 4.32% drop from fear of increased rate hikes.

- August 21: The Federal Reserve (Fed) increased interest rates by 0.75% for the third consecutive time to an overall rate of 3-3.25%, the highest level since the financial crisis. Additionally, they forecasted reaching 4.6% in 2023, in an effort to curb persistent inflation.

- August 20-27: As of this writing, the stock market has fallen for six consecutive days, totaling a cumulative drop of close to 6.5%. The S&P 500 has hit a new 2022 low, down close to 23% on the year. The bond market (as measured by Bloomberg U.S. Aggregate Bond) has had similar weakness, down close to 15% on the year.

- Looking Ahead: As we enter Q4, there are a few reasons to be optimistic:

- A lot of the negative news and expectations have already been priced into the market; any subsequent improvements in data or expectations may have a strong positive reaction.

- The bond market is finally producing attractive yields, with the two-year Treasury bond yielding more than 4.3%. This is supportive of increased expected returns for the bond market going forward.

- The fourth quarter generally has strong cyclicality and market strength, and we enter the holiday season with increased consumer spending and a boost to corporate profits.

- Removed political uncertainty post mid-term elections tends to be a benefit for the market.

- There are signs that inflation may be coming down, which could lead to positive surprises from the Fed and provide strong market tailwinds. Two primary components of CPI appear to be cooling:

- Shelter: Home pries cooled in July at the fastest rate in the history of the S&P CoreLogic Case-Shiller Index in the face of rising interest rates.

- Energy: Oil prices are below $80 for the first time since mid-January; they were close to $100 at the start of August and more than $120 at the start of June. This has already started to reflect in gasoline prices as the national average as of September 27 has fallen to $3.75, compared with approximately $5.00 in early June.

What can happen if you try to time the market during a correction?

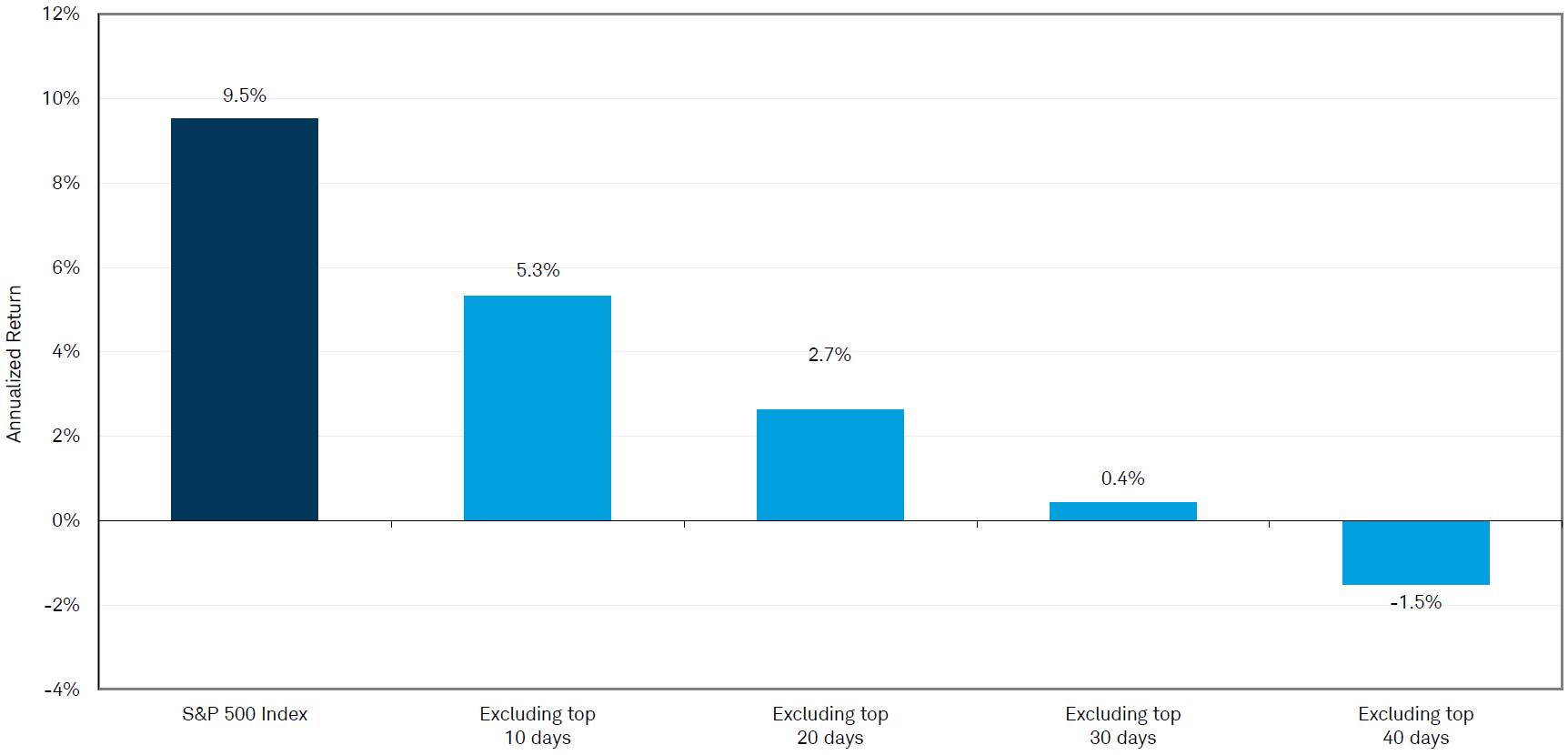

Timing the market is hard. Primarily, because you have to get it right twice! Once on the way out, and again on the way in. It’s hard enough to get one of those right, but the probability of getting them both right is not in favor of the investor. As we saw post the COVID crash of 2020, the market can have a very quick snap back. If you miss out on any of that rebound, you could be locking in the losses and deteriorating your long-term returns, which could be a detriment to your life-long investment goals. The chart below, “Time ‘In the Market’ is More Important than ‘Timing the Market,’” shows the potential impact of not being invested in the market for various periods of time:

Time “In the Market” Is More Important than “Timing the Market”

Annualized Return S&P 500 Index (Total return)

2002-2021 Market-Update_9.30.22.DWA_

Source: Charles Schwab Quarterly Chartbook Q3 2022. Bloomberg as of 12/31/2021. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

To summarize the chart:

- If you stay invested for the entire 20-year period, your return is close to 10% per year.

- If you tried to time the market and missed out on the 10 best days, the annual return was almost cut in half.

- If you missed about a month of top days (30), you essentially returned nothing.

- The most interesting—and most difficult to overcome—concept around market timing is that the best days often happen within weeks, or even days, of the worst days.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Kai Pilger, Unsplash