Market Update: The Debt Ceiling Debate

May 26, 2023

Download the 5.26.23 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Do the Right Thing

We haven’t had a shortage of headline risks this year with the turmoil in the banking sector, the potential for a recession, trying to predict the Federal Reserve’s (Fed) next interest rate move and most recently, the debt-ceiling drama.

Debating the debt ceiling isn’t something new. It seems to come up for discussion every couple of years, and there’s always an impasse. There are heated debates, sensational headlines and increased investor fear. The point is, it always seems to come down to the last minute, but it always gets resolved. And the reason is simple: At the end of the day, no politician wants the U.S. to default. They recognize the importance of preserving the full faith and credit of the United States, which is key to maintaining its world leadership status, and ultimately the U.S. government will do the right thing.

Despite some of the short-term noise, as always, it’s important to focus on the data. Both the stock and bond markets remain resilient. Much of the positive performance can be attributed to increased expectations of the end of the Federal Reserve (Fed) interest rate hiking cycle. In fact, the market expectations are that we have seen the last hike in May, AND we might see cuts before the end of the year.

We are starting to see signs of a “return to normal,” highlighted by three key observations:

- Volatility Coming Down: Volatility levels (daily swings in the markets as measured by the Market Volatility Index VIX) were elevated throughout 2022, but are starting to come back down to earth.

- Correlations Coming Down: Correlations between stocks and bonds were at historically high levels in 2022, according to Morningstar data, but we are starting to see more traditionally expected behaviors: When stocks are down, bonds are up (and vice versa).

- Inflation Coming Down: Inflation in 2022 was the highest we have seen in decades, but we have now seen 10 consecutive monthly drops in the Consumer Price Index (CPI), as measured by the U.S. Bureau of Labor Statistics.

Overall, we’re seeing continued resilience from companies, consumers, and the overall economy and markets.

U.S. Market Resilience

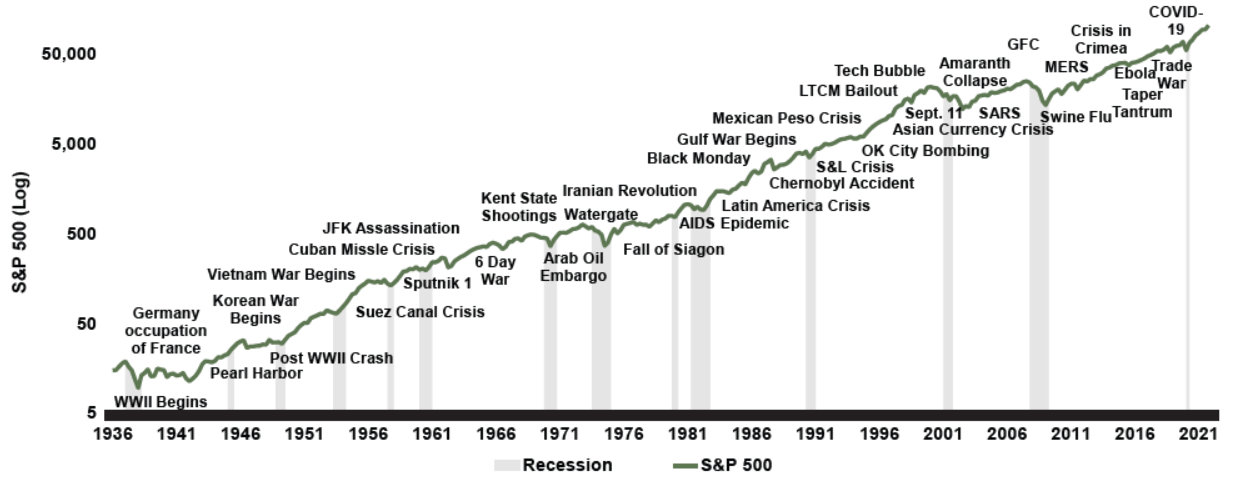

A famous quote from Benjamin Graham: “In the short run, the market is a voting machine, but in the long run it is a weighing machine.” What Graham is trying to relay is that in the short-term, there is often market turmoil driven by news headlines and fear. But in the long-term, the market is driven by fundamentals (how profitable companies are).

The chart below, “Performance of U.S. Stock Market and Crisis Events,” shows significant crisis events back to 1936, compared to stock market growth. These events were certainly painful when they happened, but how impactful were they to long-term market performance? Taking a step back and looking at the long-term view paints a different picture:

- Investor Fear: Fear can lead to emotional decisions and irrational behaviors for investors, which often translates to increased volatility and potential market drops.

- Fundamentals: Companies grow their profits over time because consumers continue to spend more money as they earn more money. This relationship is unlikely to change any time soon.

- Long-Term Focus: Consumer spending, corporate profits and the stock market are intertwined. They may be cyclical in nature, but the long-term trend shows consistent growth.

With this in mind, often the best thing you can do around crisis events is “nothing.”

Performance of U.S. Stock Market and Crisis Events

(S&P 500 Since 1936: A History of Moving through Difficult Times)

Source: St. Louis Fred & Morningstar Direct. S&P 500: Daily market return index as of 12/31/2021. Log: Lognormal Scale. Graph obtained from https://topforeignstocks.com/2022/07/21/performance-of-us-stock-market-and-crisis-events-since-1936/. Past performance is no guarantee of future results.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock