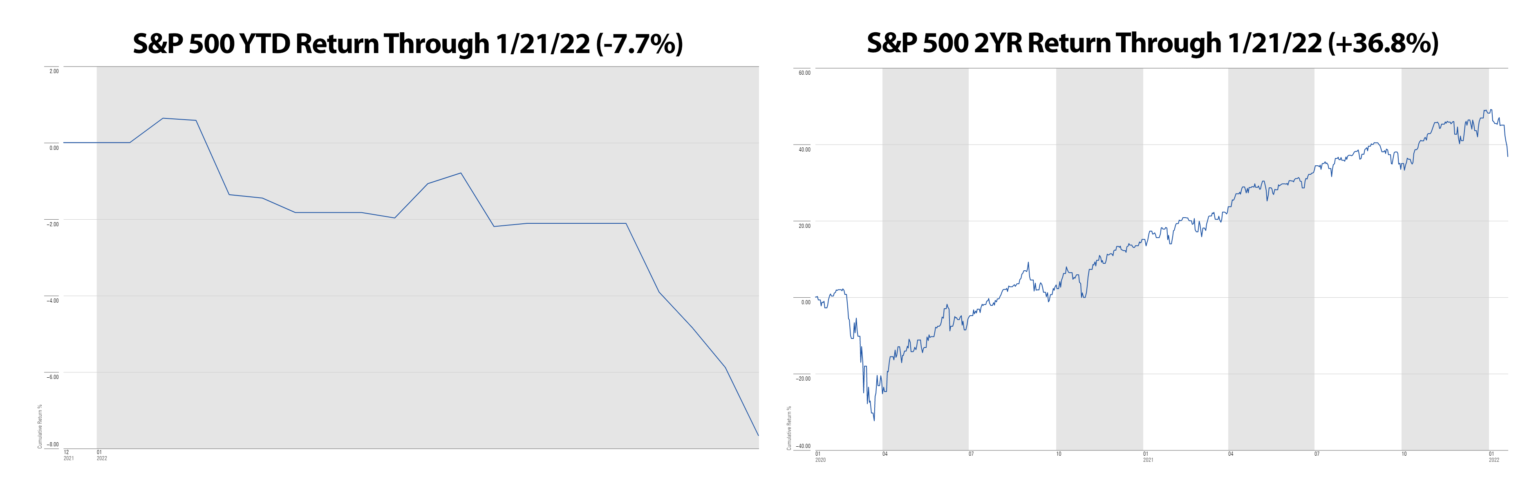

Market Update: The Market is Down, But Not Out

January 25, 2022

By Kostya Etus, CFA® Head of Strategy, Dynamic Investment Management

Download the 1.25.22 Dynamic Market Update PDF for advisors’ use with clients

The U.S. stock market (as represented by the S&P 500 Index) has recently experienced some volatility and downward pressure. It’s always important to take a longer-term perspective on the market: Looking at the two charts above, you could draw different conclusions about the market situation. Yes, the market has fallen, but it is not as significant as it may seem.

Why is the market down?

- Recency Bias – Not every year can be 2021. The S&P 500 returned close to 29%, had one brief 5% drop, rock bottom interest rates and continued stimulus. Many investors have gotten complacent with such favorable market conditions, and any negative news may have an exaggerated reaction.

- Fear – In the short term, the market is driven by fear, not fundamentals. 2022 has welcomed us with rising interest rates as expectations for tightening and rate hikes from the Federal Reserve (Fed) have spooked investors in what may simply be a knee jerk reaction.

- Transitory Period – We are transitioning from a period of astounding economic and earnings growth to more stable levels. Last year, we had almost 50% growth in corporate earnings and a rebound for the economy. There will be some growing pains as we move closer to long-term trends.

What can investor clients expect going forward?

- Sentiment Support – Remember that stock market sell-offs are normal. Historically, the market falls 5% or more about every seven months. More severe drops are typically preceded with exceptional market optimism. Looking at investor sentiment surveys, such as the one provided by the American Association of Individual Investors (AAII), we have not had extreme sentiment readings prior to the sell-off, decreasing the chances of a prolonged drop.

- Economic and Earnings Growth Remain Positive – In the long-term, the market is driven by fundamentals such as growth. Yes, last year’s growth rates may not be sustainable for the year ahead, however expectations remain for positive growth for both companies and the U.S. economy as a whole. Leading economic indicators continue to stay at elevated levels, and earnings growth expectations are for high single digits during the year ahead.

- Supply Chain, COVID and Inflation Improvements – Coming into year end, COVID rates spiked to unprecedented levels while supply chain problems impeded the strong consumer demand amidst the recovering economy, leading to high inflation rates not seen in decades. The market is set for strong tail winds as these issues begin to be resolved in the year ahead and inflation settles down closer to historic averages and Fed target of 2%.

As always, Dynamic recommends staying balanced, diversified and invested. Despite these short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for clients to reach their investment goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (800) 257-3840, ext. 4 or trading@dynamicwealthadvisors.com.

This material has been distributed for informational purposes only. All investments carry certain risk and there is no assurance that an investment will provide positive performance over any period of time. Past performance is not a guarantee or a reliable indicator of future results. Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.