Market Update: Too Hot to Handle

April 19, 2024

Download the 4.19.24 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Inflation Issues

After a historically strong first quarter, we have had some weakness in the stock market to start off Q2. While most of us had our eyes on the eclipse, investors were blinded with an update on inflation. Unfortunately, a hotter-than-expected inflation print “eclipsed” the optimism around Federal Reserve (Fed) interest rate cuts and created more uncertainty for the markets.

Summary of results for the reported Consumer Price Index (CPI) from the U.S. Bureau of Labor Statistics:

- CPI, a measure of consumer prices, increased by 3.5% for March (year-over-year), up from the previous month’s 3.2% and above consensus estimates of 3.4%. This is the highest reading since last September and was primarily driven by large increases in medical costs, insurance premiums, and oil prices.

- Core CPI, which strips out the more volatile food and energy prices, held steady with 3.8%, although also above estimates.

The good news – Core inflation, which is the preferred metric for the Fed to monitor, continues to stand steady at nearly a three-year low and there is potential for it to continue to come down toward the Fed’s key target inflation rate of 2%.

The bad news – Probabilities of interest rate cuts starting in June and July dropped significantly. Current market expectations indicate cuts could start in September, with potentially fewer cuts for 2024.

The bottom line remains the same, the next move for the Fed is a cut, but we may have to wait a while longer. And the prospects of lower interest rates this year will continue to be a tail wind for investment markets.

Perception Versus Reality for Investment Returns

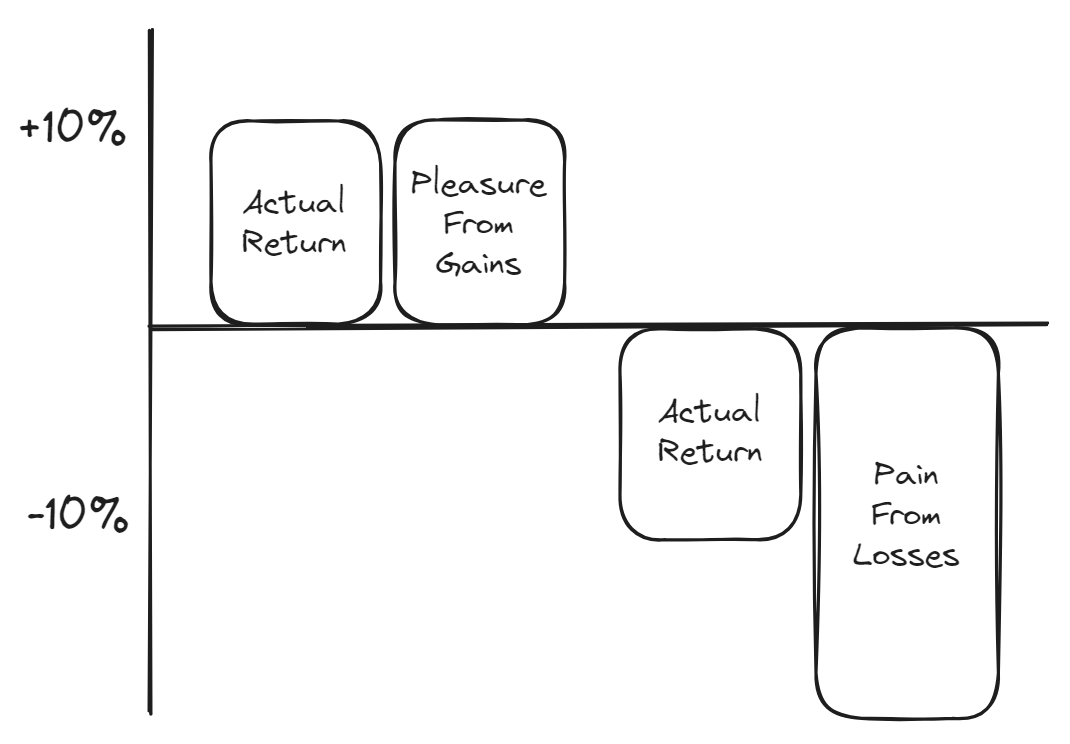

When the market takes a tumble, it’s natural to feel some internal pain, after all loss hurts. There is some science behind it. Prospect theory is a concept in behavioral economics based on a study done by Daniel Kahneman and Amos Trevsky, for which Kahneman won a Nobel prize in 2002 as the pioneer of integrating psychology into economics.

I sum up his findings with a simple drawing:

- Loss Aversion – Humans feel the emotional impact of loss much more than gains. In fact, it is estimated that the impact of losses is double that of equivalent gains.

- Investment Implications – While history would suggest that stocks provide the highest returns over the long-term, and saving for retirement is a long-term game, loss aversion is powerful enough to impact decision making for most investors. This is why many continue to hold significant allocations in bank accounts, which yield almost nothing, but give us peace of mind that the money will not be lost.

- Controlling Emotions – It is healthy to understand and manage risks as best as possible to avoid detrimental losses. However, the biggest risk is not having enough savings in retirement. By understanding our behavioral tendencies and the concept of loss aversion, we can be more conscious of short-term losses and focus more on long-term gains.

Stay diversified, my friends.

What Gaining and Losing 10% in the Market Feels Like

Source: Kostya Etus

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Unsplash