Market Update: What’s in Store in the Second Half? Stay Diversified, My Friends

July 14, 2023

Download the 7.14.23 Dynamic Market Update for advisors’ use with clients

By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Normalization and Moderation

The first half of 2023 has been great for the global stock market, with both domestic and international indices up double digits (S&P 500 Index up 16.9% and MSCI EAFE Index up 11.7%). And the bond market has been positive as well (Bloomberg U.S. Aggregate Bond Index up 2.1%). But will this rosy performance continue in the second half?

As always, let’s look to recent data on a few important variables to help guide our views:

1. Labor Market. The U.S. economy added 209,000 jobs in June (measured as non-farm payrolls by the U.S. Bureau of Labor Statistics). While this data points to continued resiliency in the labor market, it’s also a potential sign of the start of some softening. What are the implications?

a. First, moderation in the labor number is a favorable signal to the Federal Reserve (Fed) in terms of nearing a pause for rate hikes.

b. Second, the absolute number is still relatively high, which can make the case for a lower likelihood of a recession or downturn.

2. Economic Activity. The Institute of Supply Management (ISM) reported a surprise jump in the ISM Services Index to the highest level in four months to 53.9 (readings more than 50 indicate expansion). While manufacturing may be slowing down (ISM Manufacturing Index down to 46.0), it’s reassuring to see services rebounding, given that in the U.S., services account for more than 75% of the overall economy. What are the implications?

a. First, weakness in manufacturing will be another deterrent that the Fed will evaluate when considering additional rate hikes.

b. Second, the healthy demand for services reinforces the case for a softer economic slowdown, and we may avoid a more traditional recession.

3. Inflation. The inflation rate once again came in lower than the previous month for the 12th consecutive time, down to 3.0% (as measured by the Consumer Price Index (CPI) from the U.S. Bureau of Labor Statistics). What are the implications?

a. First, this places pressure on the Fed to hold rates where they are.

b. Second, given we are closer to normalization with inflation, the Fed may consider cutting rates sooner rather than later to help avoid a more severe recession.

Ultimately, what will drive the markets in the second half is the movement in interest rates and decisions from the Fed. While there may be one more Fed rate hike in July, given the recent data, it seems like the most likely trajectory for interest rates is downward in the future—which would bode well for both stock and bond markets.

Balance and Diversification

The 60/40 is certainly not dead and has been making a comeback in 2023 and could continue to do so in the second half. First off, 2022 was an extreme year where both stocks and bonds were down and certainly not the norm. Second, bonds are finally yielding attractive rates and can provide a more dependable return, particularly with stabilization in Fed rate hikes. And third, valuations for stocks are more attractive than they were going into 2022.

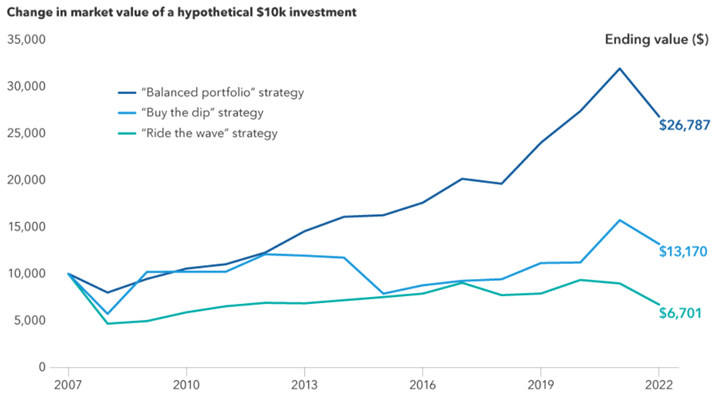

To help illustrate the benefits of staying balanced and diversified, the graph below shows the performance of three popular investment strategies. Key observations:

1. Buy the Dip. This strategy represents buying the prior year’s worst performing asset class every year. While this is often a popular strategy with “deep value” investors, it may be susceptible to buying assets after a big drop that continues to fall—often referred to with the expression, “catching a falling knife.”

2. Ride the Wave. This strategy represents buying the prior year’s best performing asset class every year. Chasing performance is rarely the best answer and, as the graph shows, this strategy would have lost money over the 16-year period.

3. Balanced Portfolio. This strategy represents maintaining a 60/40 split between U.S. large cap stocks (represented by the S&P 500 Index) and U.S. core bonds (represented by the Bloomberg U.S. Aggregate Index) with an annual rebalance. As you can see, a balanced portfolio approach would have outpaced the other strategies over the past 16 years.

Performance of Top 3 Investment Strategies

(2007-2022)

Sources: Capital Group, Bloomberg Index Services Ltd., FTSE Russell, ICE Benchmark Administration Ltd., MSCI, Refinitiv Datastream, Standard & Poor’s. Returns figures are as of December 31, 2022. Obtained from Capital Ideas™ “3 reasons why 60/40 portfolios may make a comeback.” Past results are not predictive of results in future periods.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock