Market Update: Why is the Fed Raising Rates and What are the Implications?

March 15, 2022

By Kostya Etus, CFA® Head of Strategy, Dynamic Investment Management

Download the 3.15.22 Dynamic Market Update PDF for advisors’ use with clients

The U.S. Federal Reserve (Fed) is expected to raise short-term interest rates by 0.25% on Wednesday, the first interest rate hike in three years. This will be the official start of a tightening, or more restrictive, monetary policy. This is typically not favorable for the financial markets, but it’s important to understand why they are doing it. Generally, a restrictive monetary policy is implemented to control an overheated economy and/or high levels of inflation.

The Fed is mandated to promote the goals of 1) maximum employment 2) stable prices and 3) moderate long-term interest rates. This generally translates to positive and stable economic growth as measured by gross domestic product (GDP), low unemployment rate, and low and stable inflation generally targeting 2% per year, as measured by personal consumption expenditures (PCE).

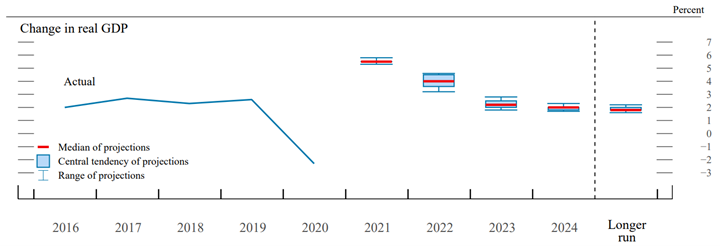

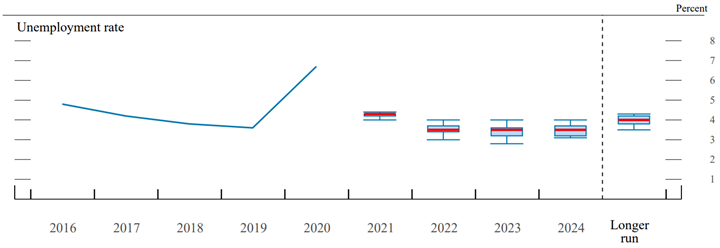

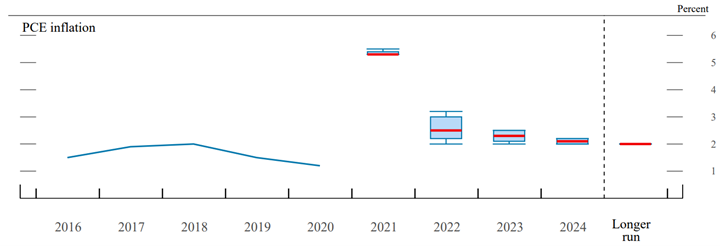

Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under their individual assumptions of projected appropriate monetary policy, December 2021

To get a better understanding of the Fed’s reasoning, let’s review the Fed’s last economic forecast from December 2021, and how the current economic environment may impact those projections.

3 Key Economic Indicators

- Economic Growth: The global pandemic hit economic growth hard in 2020, but it rebounded strong in 2021 from pent up demand. As the economy settles into a more sustainable level, the uncertainty surrounding Russia and Ukraine could impact consumer and corporate spending, putting downward pressure on future growth projections.

- Labor Market: The unemployment rate has dropped considerably since the pandemic highs, now at under 4%. Additionally, job openings outweigh unemployed workers by a wide margin. The labor market is quite strong based on historic standards and the unemployment rate projection may see an improvement, despite the geopolitical concerns.

- Inflation: As the economy heated up in 2021 with high consumer demand and government stimulus support, it was met with supply-chain disruptions caused by new COVID variants in the second half of the year, leading to significant increases in prices. The war has only made supply issues worse and raised prices for basic commodities such as food and energy, thus the expectation will be for even higher inflation.

Ultimately, the reason to increase interest rates is driven by the desire to curb inflation (which has increased to levels not seen in 40 years), supported by the notion that the U.S. economy is on level footing and strong enough to withstand the impact of the conflict in Eastern Europe.

3 Key Areas of Uncertainty

- China: On the COVID front, while the U.S. is seeing some of the lowest levels of cases since the start of the pandemic, China appears to be having a resurgence. Any significant outbreak could put yet another strain on the global supply chain with disruptions in manufacturing from shutdowns.

- Washington: Some U.S. government risks have been subdued with a debt ceiling increase last December and the spending bill that was passed last week. However, the outlook for any further fiscal stimulus may be limited and significantly lower than the past couple of years.

- Russia: Last but not least, the conflict in Ukraine remains the biggest question mark. Russian sanctions, global commodity prices, European energy dependence and many other issues will weigh heavily on the minds of Fed members as they contemplate the decisions for future monetary policy.

Ultimately, this global uncertainty will drive the Fed to a more cautious tightening cycle throughout the year. Fed Chairman Jerome Powell has repeatedly communicated the desire to proceed in a controlled and transparent manner to not cause further disruption in financial markets.

See Top 3 Ways to Diversify for Low and Rising Interest Rates for ideas on how to position portfolios in a rising rate environment.

As always, Dynamic recommends staying balanced, diversified and invested. Despite these short-term market pullbacks, it’s more important than ever to focus on the long-term.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (800) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Photo: Adobe Stock

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.