Q1 2023 Investing Insights: Top 3 Reasons the 60/40 Is NOT Dead

March 3, 2023

Download the Q1 2023 Dynamic Investing Insights for advisors’ use with clients

By Kostya Etus, CFA®

Chief Investment Officer, Dynamic Investment Management

“I’ve got the guts to die. What I want to know is, have you got the guts to live?”

– Jordan Belfort (Leonardo DiCaprio), “The Wolf of Wall Street,” 2013

With 2022 behind us, we look ahead to better days. 2023 has the potential to bring us lower inflation, improved supply chains, decreased pandemic cases, resolutions to geopolitical conflicts and most importantly, stabilization in interest rates with the potential to avoid a recession.

These things should benefit the markets, but they have uncertainty, so don’t expect stock market volatility to go away any time soon. One thing, however, that could be different in 2023 is how the bond market behaves. With interest rates at higher levels and the hike cycle potentially ending soon, we could have a more traditional bond experience.

Ultimately, what we may see in 2023 is the comeback of the 60/40 portfolio, believed by many to be dead. Over the long term, stocks and bonds have a special relationship and utilizing both is integral to achieving investment success. In the following sections, we review key reasons why the 60/40 is alive and well and may be primed for success going forward.

Key Takeaways:

- 2022 was unprecedented and we need to look to the future. However, a glance at the past can help us identify what to expect based on the historic relationship between stocks and bonds.

- Don’t abandon diversification; it may not always feel good to be diversified, but it’s still known to be the only “free lunch” in investing.

- Bond returns are driven more by math than emotions. This is why the best predictor of future returns for a bond is the current yield—and yields are up!

Forget 2022!

2022 was truly a remarkable year. We know it’s rare for stocks and bonds to fall together, but to fall by the magnitude that we experienced in 2022 has never been seen before.

Given the cyclicality in the markets, it’s unlikely that we’ll see this behavior continue for too long, and we may see bright skies ahead. If nothing else, the power of diversification, and the relationship between stocks and bonds, should start to revert back to normal.

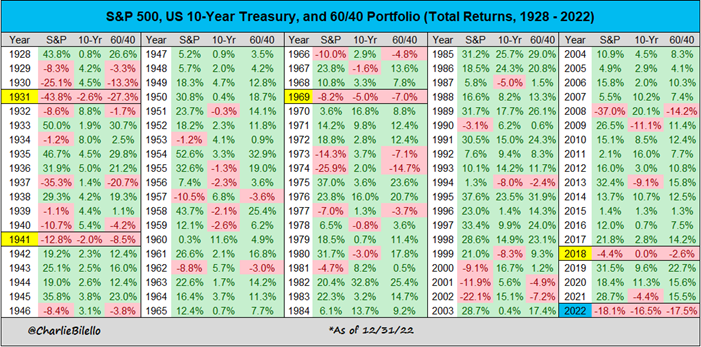

To understand how truly unique 2022 was, let’s take a look at annual returns for stocks and bonds going back to 1928. From the chart below, “Stock Market, Bond Market and 60/40 Portfolio,” here are some fun stats:

- Stocks and bonds were both down in only five calendar years. (1931, 1941, 1969, 2018, 2022)

- Stocks and bonds were both down more than 10% in only one year! (2022)

- Stocks had their fifth largest loss in history. (1931, 2008, 1937, 1774, 2022)

- Bonds had their worst year in history. (2022 -16.5%)

- The 60/40 had its third worst year in history, and the other two were in the 1930s. (1931, 1937, 2022)

Again, these numbers from 2022 are outliers and we’re looking forward to more normalcy in the future.

Stock Market, Bond Market and 60/40 Portfolio

Annual Returns 1928-2022

Source: Charlie Bilello, as of 12/31/22. Past performance is no guarantee of future results.

Diversification Works!

As we discussed in the previous section, the traditional 60/40 stock/bond portfolio had a historically tough year, but it could be poised for a rebound in the year to come.

You’ll often hear in the media headlines that the “60/40 is dead” or that “diversification no longer works.” That’s not something new. Diversification doesn’t always feel good over the short term, but if you take a step back and look at the long-term view, diversification often wins.

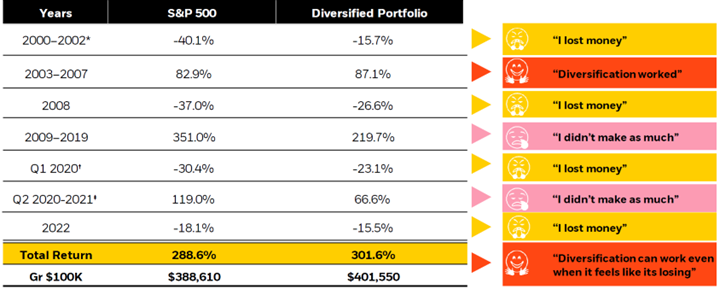

Let’s evaluate the ups and downs of the market over the last 20 years and have a head-to-head matchup between the S&P 500 and a diversified portfolio. In the chart below, “A Diversified Portfolio Can Work Even though It Never Feels Good,” a few things stand out:

- Bad years. When the overall market is down, investors often don’t care as much about the magnitude of the loss, they’re simply upset that, “I lost money.” AKA: Loss aversion (the pain of losing is more powerful than the pleasure of gaining).

- Good years. During a strong bull market, the magnitude of gains becomes very important to investors and they’re upset that, “I didn’t make as much” as the S&P 500 or my neighbor’s latest hot stock pick. AKA: Fear of Missing Out (FOMO).

- And the WINNER is… The diversified portfolio! Diversification DOES work over the long term because investors don’t lose as much during the down years and are able to rebound and compound faster during the up years, resulting in stronger risk-adjusted returns over the long term (typically higher returns with lower risk). AKA: Win more by losing less.

A Diversified Portfolio Can Work Even though It Never Feels Good

(Last 20+ Years)

Diversified Portfolio: 25% U.S. large stocks, 19% U.S. mid cap stocks, 7% international stocks, 5% U.S. small cap stocks, 4% emerging market stocks, 25% U.S. bonds, 15% high yield bonds

Source: Source: Morningstar as of 12/31/22. *Performance is from 9/1/00 to 12/31/02. †Performance is from 1/1/20 to 3/23/20. ‡Performance is from 3/24/20 to 12/31/21. Diversified Portfolio is represented by 25% S&P 500 Index, 19% Russell Mid Cap Index, 7% MSCI EAFE Index, 5% Russell 2000 Index, 4% FTSE Emerging Stock Index, 25% Bloomberg US Aggregate Bond Index, 15% Bloomberg US Corporate High Yield Index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

Bonds Are Back!

While stock movements are generally random, often driven by investor emotions, bonds are very much about math. The best predictor of future return for a bond is the current yield. Can you believe that in late 2021, just over a year ago, the two-year Treasury yield was 0.2%, not much of an expected return. Currently, it sits closer to 4.8%! We haven’t seen yields like that in 15 years; we’ve forgotten what bonds are and the fact that they can yield some meaningful returns. I’m officially marking 2023, “The Year of the Yield.”

To add fuel to the fire, bonds have also been beaten up last year due to the strong interest rate hikes. By definition, bonds must return their principal at maturity, so as prices fall, the probability of a rebound continues to increase. With the Fed starting to signal a potential end to the rate hike cycle, what could that mean for bonds going forward? The phrase, “spring loaded” comes to mind.

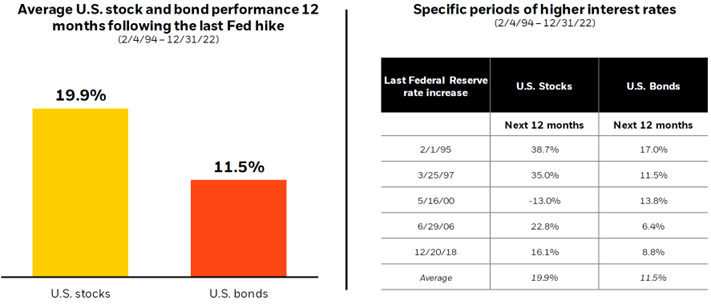

In the chart below, “Average U.S. Stock and Bond Performance 12 Months Following the Last Fed Hike,” a few things stand out:

- Stocks just can’t give up the spotlight, with an average return of almost 20% in the year following the last Fed hike. That said, the variability of returns, including one that’s negative, reminds us how volatile the stock market is.

- Bonds have double digit returns on average in the 12 months following the end of a hike cycle. The bond investments would have achieved their returns at significantly reduced levels of risk when compared to their stock market brethren.

- The 60/40 is not dead! While not listed, you can surmise the returns of a diversified portfolio of 60% stocks and 40% bonds which would achieve strong returns with lower volatility over the long-term.

Average U.S. Stock and Bond Performance

12 Months Following the Last Fed Hike

(2/4/94 – 12/31/22)

Source: BlackRock, with data from Morningstar as of 12/31/21. U.S. stocks are represented by the S&P 500 index. U.S. bonds are represented by the Bloomberg US Agg Bond TR Index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or investmentmanagement@dynamicadvisorsolutions.com.

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: lo lo, Unsplash