22

Q1 22 Dynamic Portfolio Services

Quarterly Briefing

Quarterly Briefing

Dynamic’s Unique Portfolio Solutions for Today’s Uncertain Markets

Market Update

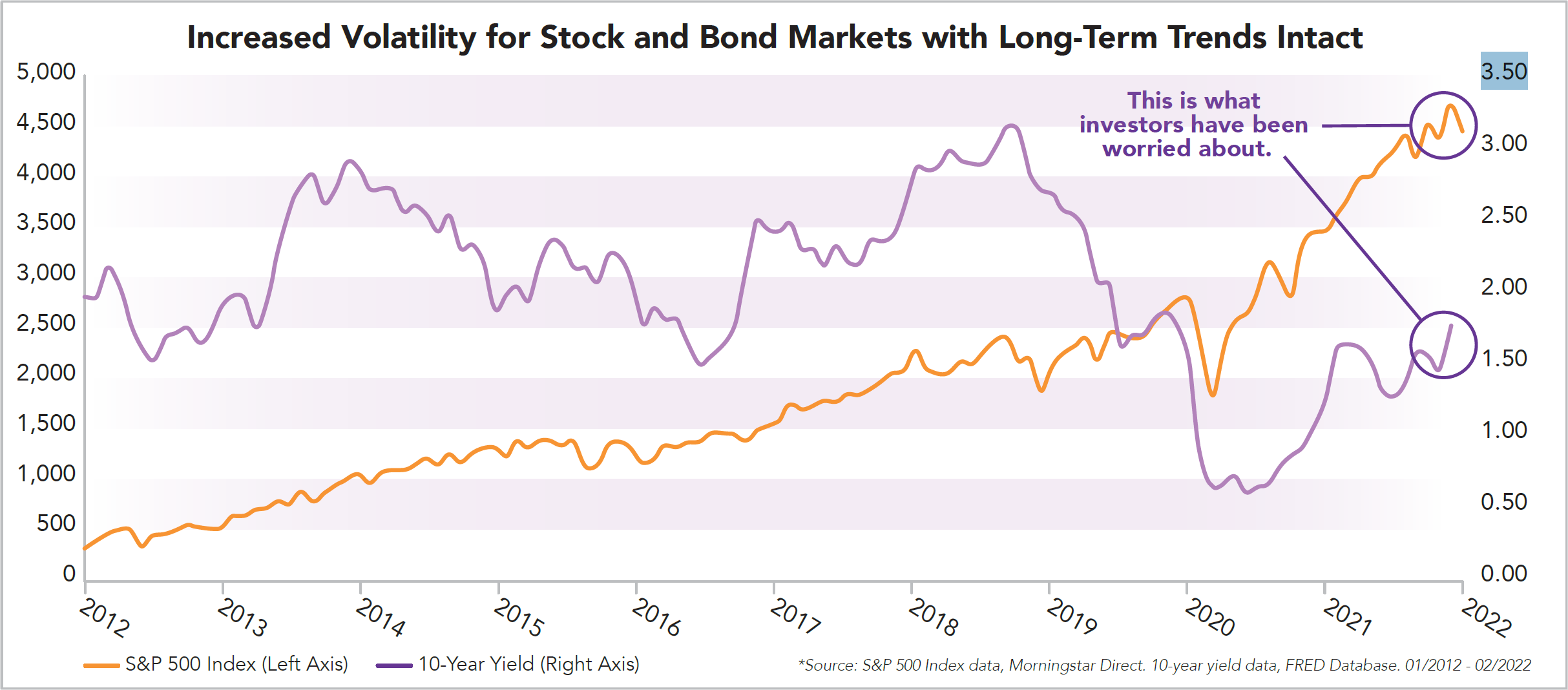

The U.S. stock market (as represented by the S&P 500 Index) has recently experienced some volatility and downward pressure ahead of expectations for rising interest rates. It’s always important to take a longer-term perspective on the market. The chart above shows the stock market and interest rate situations are not as dire as the shorter-term fluctuations would indicate.

NEW Alternatives Platform

The current low and potentially rising interest rate environment creates some headwinds for traditional fixed income. Diversify equity risk by utilizing uncorrelated alternative investments for a portion of the allocation (typically recommended not higher than 10-20%).

Dynamic announces CAIS, an alternatives platform, allowing advisors to access a variety of hedge funds and private investments. CAIS provides independent due diligence and research on specific investments provided by Mercer. CAIS offers simplicity and automation for the onboarding process through their website and generally offers lower minimum investments for accredited investors, some as low as $25,000.

Cryptocurrency Solutions

Dynamic’s Investment Management team believes that while cryptocurrencies may be a diversifying asset class, their volatility and lack of regulatory oversight make them inappropriate to utilize within our portfolios. Notwithstanding, there are products available to Dynamic advisors. Keep in mind, given the risk inherent in the asset class, Dynamic

doesn’t recommend allocating more than 5% of a portfolio to cryptocurrencies. Here are some available options:

- Publicly Available Trust Funds: Such as funds from Grayscale (GBTC – Bitcoin) and Bitwise (BITW — Crypto Index) which are available at the primary custodians.

- Exchange Traded Funds: Such as ETFs tracking crypto futures (BITO and BTF for Bitcoin exposure), offering a new way to invest in the crypto space.

- Private Placements: CAIS offers private placement in crypto investments from Galaxy (Bitcoin, Ethereum and Crypto Index) with a $25,000 minimum for accredited investors. This solution provides a more direct investment in the cryptocurrencies.

We encourage you to do thorough research as this asset class comes with risks that are unique and sometimes not apparent. The CAIS platform is a good source for educational resources.

Customized High-Net-Worth Solutions

Dynamic provides personalized investment management solutions and tailored services for high-net-worth individuals. Customized allocations could include direct indexing, separately managed accounts (SMAs) and alternative investments.

Dynamic offers innovative solutions to meet the needs of our advisors and their clients. Don’t hesitate to reach out to our team for help navigating today’s volatile markets, and we can come up with the right solutions together. (800) 257-3840, ext. 4; trading@dynamicwealthadvisors.com