22

Q2 22 Dynamic Portfolio Services

Quarterly Briefing

Quarterly Briefing

Innovative Investment Solutions Available for Today’s Uncertain Market

Market Brief

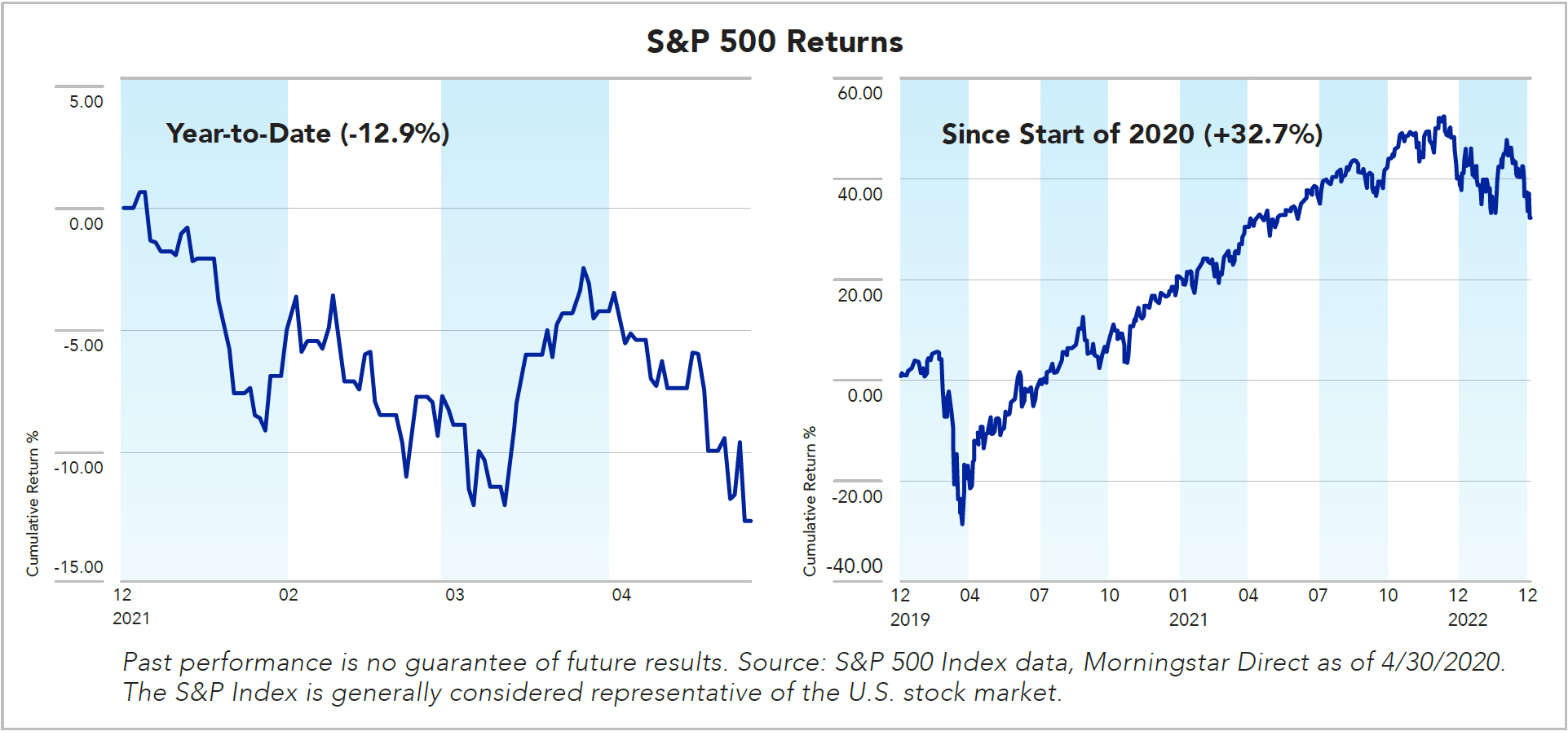

Rising interest rates, high inflation and conflict in Eastern Europe have roiled the U.S. stock market this year (as represented by the S&P 500 Index), but there may be clearer skies ahead. Please see the latest market update here for 10 bits of good news for the economy and market going forward. As the charts above show, while 2022 has not been great for the market, the previous two years have more than made up for it—and that includes the market drop during Covid.

Quarterly Rebalance Update

The second quarter rebalance is underway. Dynamic portfolios are generally selling higher quality U.S. stocks such as the SPDR S&P Dividend ETF (SDY), which has held up relatively well during the market selloff. Also, our portfolios are generally buying short and intermediate term higher quality bonds, such as the iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD), which has underperformed other less interest rate sensitive parts of the bond market.

Introducing ‘Constance’

As you may know, we currently partner with RetireOne to offer our advisors access to a variety of fee-based insurance and annuity solutions from highly rated companies through their easy-to-use independent platform. This service was designed with RIAs in mind and offers access to a fiduciary marketplace at no additional cost. Recently, RetireOne and Midland National Life Insurance Company have partnered to offer Constance, a unique, zero-commission portfolio

income insurance solution designed exclusively for RIAs. Constance is a Contingent Deferred Annuity (CDA) for RIAs to wrap client brokerage accounts, IRAs or Roth IRAs, with lifetime income protection. This allows advisors to continue to oversee client assets as they enter retirement and begin the decumulation phase.

Dynamic will offer this type of portfolio insurance on a couple of our popular DFA and ETF model product lines. Stay tuned for more information on this new and innovative investment solution.

Fund Spotlight: SPDR S&P Dividend ETF (SDY)

This unique income focused ETF can be found in Dynamic’s Defensive and Distribution strategies. It differs from more traditional high-yield stock funds by only holding companies which have increased their dividend for the past 20 consecutive years.

Of their starting universe of 1,500 stocks, only about 120 make the cut. These companies have withstood the test of time and tend to be higher quality with experienced managers to confidently weather market downturns. Case in point, through the end of April, SDY was down just over 3% in 2022, while the broader S&P 500 Index lost close to 13%.