21

Q3 21 Dynamic Portfolio Services

Quarterly Briefing

Quarterly Briefing

Combating Inflation with Dynamic Solutions

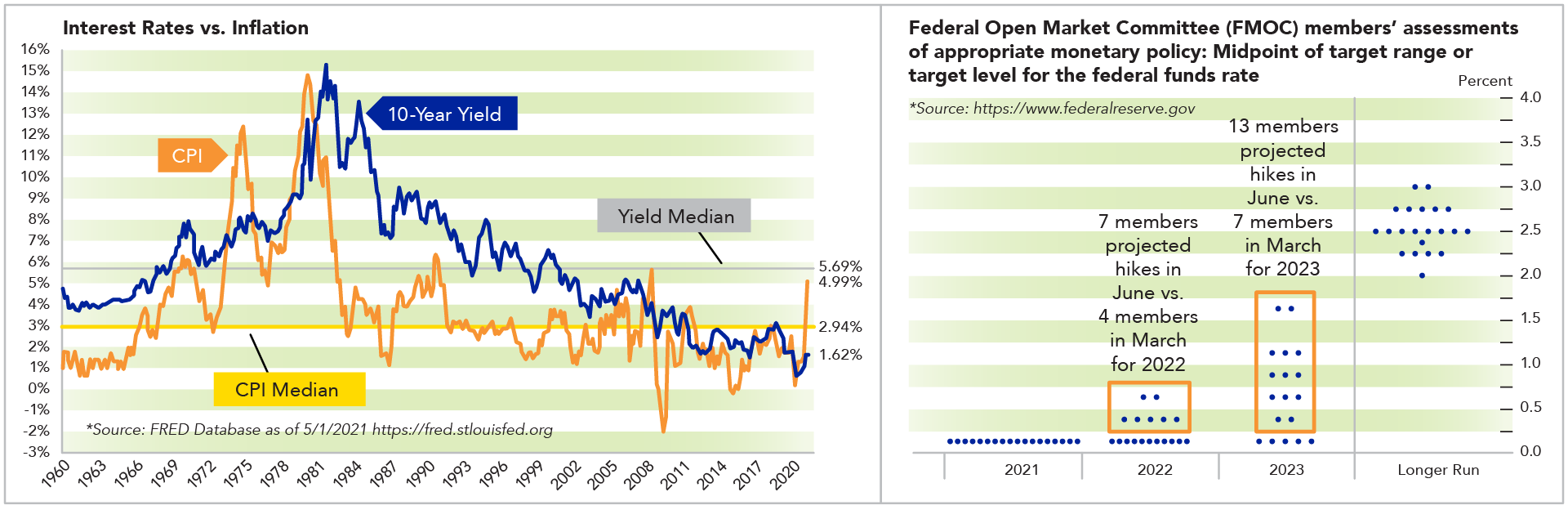

Inflation is here, but have no fear. Inflation has spiked recently to the highest levels in over a decade, as measured by the Consumer Price Index (CPI), primarily due to a post-COVID economic recovery. The Federal Reserve (Fed) believes these effects to be “transitory” and not a long-term concern, reassuring investors of a continued accommodative monetary policy (although updated dot plots would suggest higher rates ahead). While the Fed may have quelled a market overreaction, higher prices and inflation do erode wealth and investment returns. Just compare inflation to the 10-year treasury yield, which continues to decrease. Dynamic portfolios are generally positioned to combat inflation by allocating and tilting toward several asset classes that tend to do better in periods of higher inflation and a strengthening economy, including value stocks, small cap stocks and real assets. These asset classes have outperformed since the recovery began in November.

Introducing Goldman Sachs Asset Management (GSAM) ETF models. The global equity allocation will utilize an ActiveBeta suite of ETFs with a multi-factor approach, including four academically grounded performance factors: value, momentum, quality and low volatility. These factors are equally weighted to improve diversification and avoid factor timing to achieve more consistent outcomes over time, regardless of market environment. The ActiveBeta ETFs are among the lowest cost multi-factor ETFs and the largest in asset size on the market. The fixed income portion of the models is similarly well diversified with up to eight asset classes, primarily using GSAM ETFs and other issuers for asset classes. The result: a multi-factor, globally diversified and well vetted set of ETF models with an average underlying expense ratio of 0.16%.

Dynamic’s DFA tax-managed models become more tax efficient. After successfully entering the ETF market with three new actively managed ETFs last year, DFA made another splash in June as one of the first asset managers to convert mutual funds into ETFs by converting four tax-managed mutual funds. The ETF structure adds an additional layer of tax efficiency to these funds and is a welcome enhancement in taxable accounts. The conversion makes DFA one of the largest ETF issuers in the industry with more than $30 billion in combined ETF assets, placing them in the top 10% of all issuers*. DFA plans to convert two more tax-managed mutual funds in September. Ultimately, these updates will benefit Dynamic’s DFA tax-managed models given an enhanced focus on tax management through the use of ETFs.

*https://us.dimensional.com/about-us/media-center/dimensional-listsfour-new-etfs

Dynamic offers Direct Indexing solutions. Direct indexing, the next evolution of investment products, is the replication of an index by purchasing underlying securities. This concept isn’t new, but direct indexing has become available to a broader range of investors beyond those with ultra high net worth. Financial and technological enhancements have made possible frictionless trading, fractional shares and risk-based optimization, providing the ability to use in smaller accounts (with at least $500,000) at a lower cost. Another key benefit is tax efficiency. Tax loss harvesting at an individual account has more opportunities due to a larger amount of holdings. Also, there’s potential for customization by removing certain types of companies (e.g., ESG screening) or focusing on specific companies based on factors of returns (e.g., value and size). Contact Dynamic Portfolio Services for more information on Dynamic Direct Indexing.

https://www.fidelity.com/insights/investing-ideas/what-is-direct-indexing