22

Q3 22 Dynamic Portfolio Services

Quarterly Briefing

Quarterly Briefing

New, Custom Portfolio Solutions for Every Client

What Worked, What Didn’t In the Markets and In Dynamic Portfolios

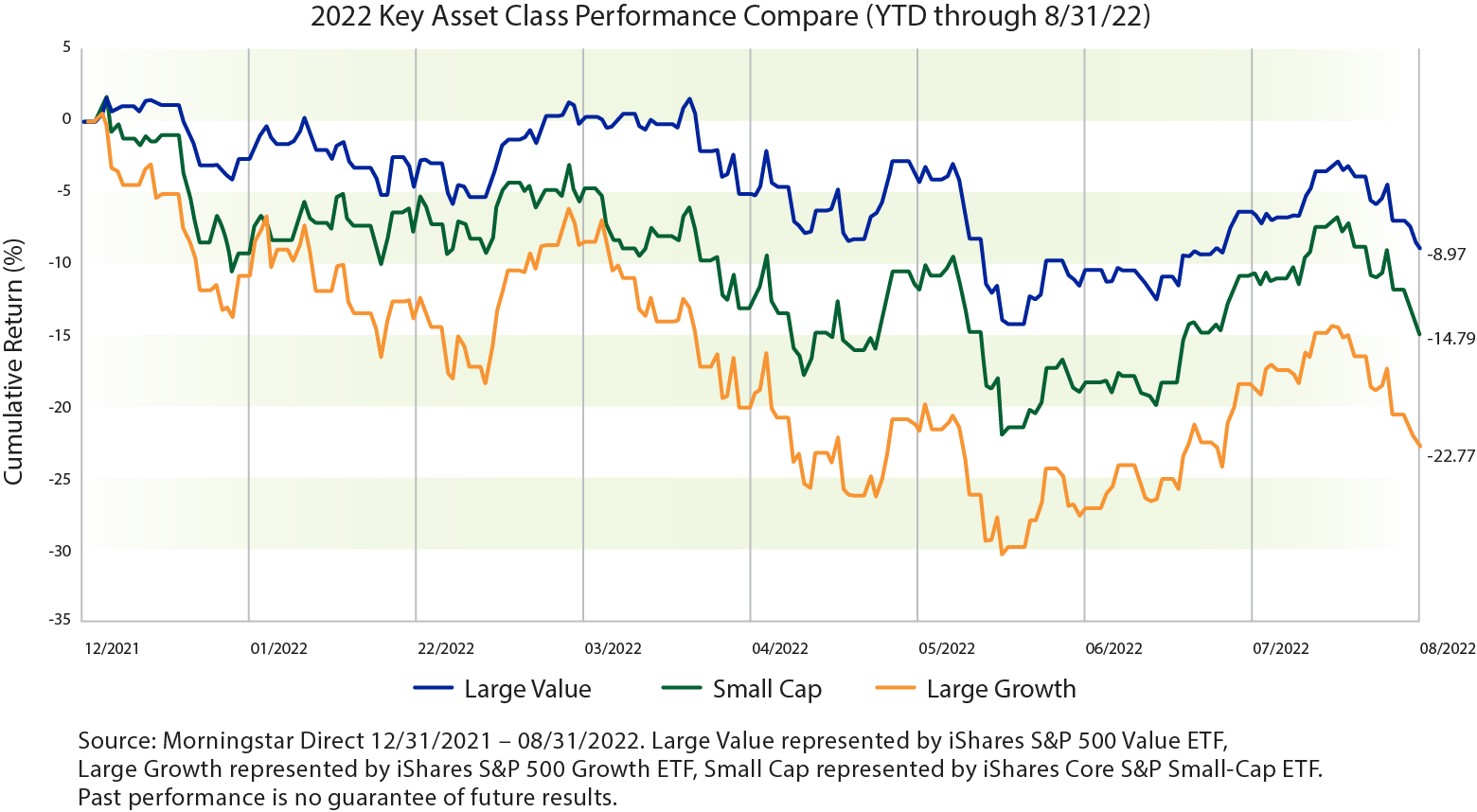

It’s been a volatile year in the markets and it feels like no asset class was safe from losses, but as the chart above indicates, there were some clear winners and losers in terms of relative performance:

- Small value vs. large growth: Larger growth companies have struggled this year in the face of rising interest rates and high inflation, while smaller and more value-oriented companies have held up better, particularly income-focused stocks. Dynamic portfolios generally have a tilt toward value and small and mid-size stocks.

- Short duration vs. long duration: Given the aggressive rising interest rate environment, bond funds saw historically heavy losses; shorter duration bonds and floating rate bonds have performed considerably better. Dynamic portfolios generally have lower duration relative to the broad bond market with allocations to floating rate bonds.

Introducing New ETF Models

We’re rolling out a series of new models using 100% ETFs, including total return strategies as well as those focused on specific objectives. The purpose of these strategies is to provide low cost, tax efficient, transparent models through the use of ETFs to meet a variety of client needs. A summary of each model:

- Dynamic Core ETF: Low-cost passive exposures with lighter portfolio tilts (7-12 holdings with 5-6 BPS underlying expense ratio)

- Dynamic Smart ETF: Multi-factor (Smart Beta) equity exposures combined with actively managed fixed income with higher conviction portfolio tilts (11-18 holdings with 32-41 BPS underlying expense ratio)

- Dynamic Income ETF: Higher yielding equities and fixed income to help clients with higher income needs

- Dynamic Defensive ETF: Buffered and lower risk holdings designed to hold up better in down markets for risk averse clients

- Dynamic Tax Aware ETF: Municipal bonds as part of fixed income to help lower the tax burden for tax sensitive clients

- Dynamic DFA ETF: Utilizes primarily DFA ETFs to represent a wide variety of asset classes

Dynamic Custom HNW Solutions

High net worth (HNW) clients often require an added level of customization and more personalized service based on their specific needs. Dynamic specializes in evaluating complex client situations and finding simple solutions for HNW clients with assets valued at a minimum of $2 million. In addition to building custom strategies which could include stocks, bonds, ETFs and alternative investments, we have a variety of unique products to meet specific client situations. A few examples:

Minimizing taxes: Direct indexing with daily tax loss harvesting, actively managed state-specific individual municipal bond separately managed accounts, 1031 exchanges, qualified opportunity zones, etc.

Concentrated stock positions: Exchange funds, custom option strategies, etc.

Capital preservation: Individual bond ladders, hedge funds, structured notes, etc.

Dynamic strives to be an industry thought leader when it comes to investment management. We regularly produce market commentary to 1) keep readers informed about relevant topics which may impact portfolios, but more importantly 2) to provide ideas and solutions for keeping clients calm and invested for the long-term, which is particularly important in volatile times. In addition to Quarterly Briefing, we produce two primary market pieces, both distributed via email and archived on the Dynamic Views blog:

Dynamic Market Update (bi-weekly): Distributed every two weeks, a timely commentary on recent developments in the markets and economy and how to best discuss with your clients. These updates also include a PDF version which can be co-branded for advisors in the Dynamic network to use with clients.

Dynamic Quarterly Market Review: A broadbased summary of investment topics typically related to the concepts of 1) helping investors stay disciplined 2) realizing the benefits of professional money management, and 3) understanding the value of global, diversified, balanced portfolios focused on the long-term. These reviews also include a PDF version which can be co-branded for advisors in the Dynamic network to use with clients.